Outlook

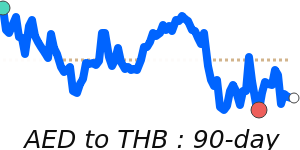

The UAE Dirham remains firmly pegged to the US dollar at 3.6725 AED per USD, supporting broad currency stability. The AED/USD rate sits near its 3-month average, with no clear breakout expected in the near term. Cross-rates show only modest momentum: AED/EUR around 0.2291 (1.5% below its 3-month average of 0.2326), AED/GBP about 0.1997 (1.6% below its 3-month average of 0.203), and AED/JPY near 42.07 (1.1% below its 3-month average of 42.54). The observed ranges—roughly 0.2263–0.2365 for EUR, 0.1968–0.2086 for GBP, and 41.47–43.32 for JPY—underscore a cautious, range-bound environment for non-dollar crosses. Underpinning this are the peg mechanics, oil revenue dynamics, and UAE policy alignment with global monetary conditions. Economic diversification and geopolitical stability further support a stable profile, while the recent remittance backdrop (weaker Asian currencies) adds a modest contextual nuance for expatriates.

Key drivers

- Fixed Exchange Rate Peg: the UAE Dirham is anchored to the USD at 3.6725 AED per USD, stabilizing the value.

- Oil Revenue Impact: fluctuations in oil prices influence UAE foreign reserves and the ability to maintain the peg.

- Monetary Policy Alignment: UAE Central Bank policy tends to track US Federal Reserve moves to preserve the peg, shaping domestic liquidity and investment flows.

- Economic Diversification: growth in tourism, real estate, and finance attracts capital and supports currency stability.

- Geopolitical Stability: broad regional stability reinforces investor confidence in the Dirham.

- Currency Symbol Introduction: the new Dirham symbol (unveiled March 2025) reinforces international recognition, with limited direct rate impact.

- Remittance Environment: depreciation in some Asian currencies has enhanced remittance value for expatriates, influencing transfer flows and demand contexts.

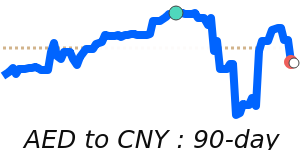

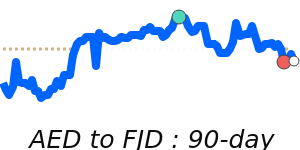

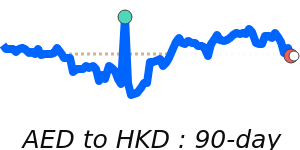

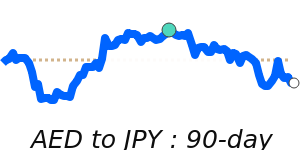

Range

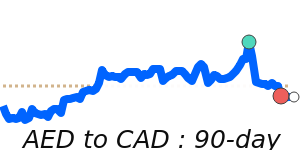

AED to USD is steady at its 3-month average of 0.2723.

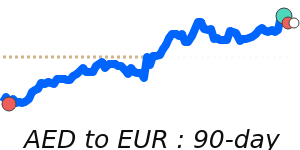

AED to EUR at 0.2291 is 1.5% below its 3-month average of 0.2326, having traded in a stable 4.5% range from 0.2263 to 0.2365.

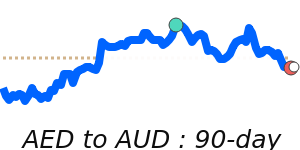

AED to GBP at 0.1997 is 1.6% below its 3-month average of 0.203, having traded in a stable 6.0% range from 0.1968 to 0.2086.

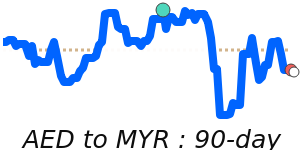

AED to JPY at 42.07 is 1.1% below its 3-month average of 42.54, having traded in a stable 4.5% range from 41.47 to 43.32.

What could change it

- A shift in US monetary policy or a change in the UAE’s policy stance that alters interest rate differentials or liquidity could prompt broader cross-rate moves.

- Significant oil-price swings that affect UAE foreign reserves and the ability to defend the peg could introduce volatility.

- Major geopolitical developments or unexpected macro shifts in the UAE economy or in key trading partners could alter demand for AED.

- Changes in remittance dynamics or regional risk sentiment that affect flows into and out of the UAE could influence near-term currency demand patterns.