Swiss franc (CHF) Market Update

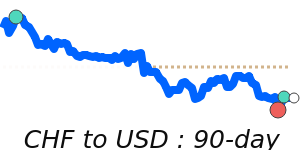

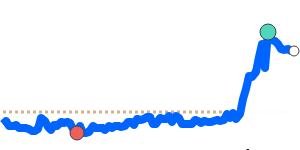

The Swiss franc (CHF) has recently demonstrated considerable strength, driven largely by increased demand for safe-haven currencies amid ongoing trade tensions and tariff negotiations. As traders seek refuge from market volatility, the CHF has climbed to a decade high, surpassing 1.22 against the US dollar (USD). This increase in value comes as US officials indicate that President Donald Trump remains firm on tariff policies, making it clear that trade disputes cannot be resolved quickly, according to Treasury Secretary Bessent. Such sentiments have further fueled the flight to safety in currency markets.

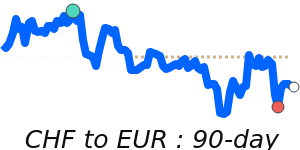

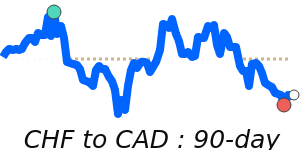

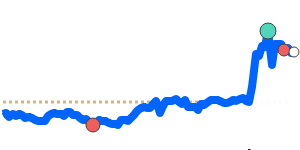

The current exchange rate of CHF to USD at 1.2098 is notably 5.3% higher than its three-month average of 1.1492, navigating through a volatile range of 1.0916 to 1.2358. Additionally, the CHF has shown strength against the euro (EUR), reaching near 1.0703, which is 1.0% above its three-month average of 1.0596. This movement comes after trading within a relatively stable range of 1.0352 to 1.0838 over the past weeks.

The relationship between the CHF and the euro remains crucial, as the Swiss economy is heavily intertwined with the Eurozone. Economic performance in the Eurozone can bolster the CHF, while instability might weaken it. Experts suggest that fluctuations in the CHF can be significantly influenced by the policies of the Swiss National Bank (SNB), which may intervene to mitigate excessive appreciation against the EUR in a bid to safeguard Swiss exports.

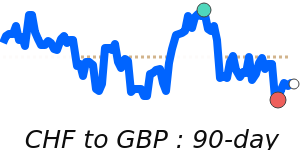

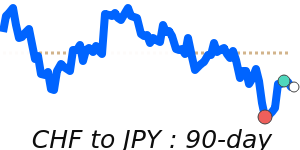

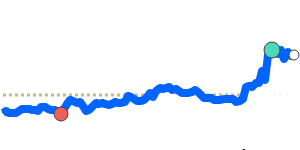

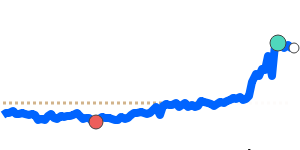

In relation to other major currencies, the CHF to British pound (GBP) is currently at 0.9115, which is 2.2% above its three-month average of 0.8919. This pair has also been relatively stable, trading within a range from 0.8703 to 0.9385. Similarly, the CHF to Japanese yen (JPY) stands at a 14-day high of 175.3, marking a 3.1% increase from its three-month average of 170.1. This pair has been trading within a narrower 6.0% range from 166.1 to 176.1.

As the currency market continues to evolve in response to geopolitical developments, the CHF is likely to remain an attractive option for investors seeking safety amid uncertainty. Observers will be watching closely for any signs from the SNB or shifts in Eurozone economic conditions that could further impact the CHF's value.