Czech Republic horuna (CZK) Market Update

Recent forecasts and updates regarding the USD to CZK exchange rate highlight several key factors influencing the currency landscape. The US dollar (USD) has shown resilience recently, bolstered by renewed hopes for a US-China trade agreement. Analysts note that optimism surrounding potential negotiations has contributed to a stronger USD. However, upcoming non-farm payrolls data is expected to play a crucial role in shaping investor sentiment, with a significant slowdown in job creation potentially leading to declines in the dollar's value.

Concerns regarding US Treasury bonds have emerged as their rising yields coincide with a weaker dollar amidst President Trump's trade policies, including new tariffs on exports. These developments have sparked speculation that the current administration may be intentionally trying to devalue the dollar to enhance competitiveness in global trade. Financial markets are increasingly discussing the so-called "Mar-a-Lago Accord," which could reshape international trade norms in favor of the United States.

The Czech koruna (CZK) has experienced some volatility as well, largely affected by regional economic dynamics and external factors. The Czech economy, closely linked to Germany’s, is currently facing challenges as Germany grapples with stagflation and declining industrial production. Although the Czech National Bank has maintained interest rates at 7 percent since June, expectations for further adjustments remain cautious. The latest inflation figures show a decline to 8.8 percent, which provides some breathing room for the central bank but also indicates an environment of uncertainty.

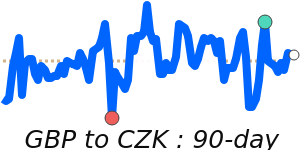

In terms of the USD to CZK exchange rate, it is currently trading at 22.05, which is notably 4.6% below its three-month average of 23.12. This volatility is evidenced by a wide trading range of 13.3%, between 21.74 and 24.63. Experts suggest that while the USD's strength is influenced by domestic factors, the external pressures from global trade relations and regional economic health, particularly with Poland’s recent rate cut, contribute to the fluctuations observed in the koruna.

Overall, analysts recommend keeping a close watch on forthcoming economic data, U.S. monetary policy shifts, and ongoing geopolitical developments, as these factors are likely to continue shaping the USD to CZK exchange rate in the near term.