Danish krone (DKK) Market Update

The recent predictions and trends regarding the USD to DKK exchange rate indicate a complex interplay of factors influencing the value of the US dollar against the Danish kroner. Analysts note that the US dollar has shown resilience, largely supported by renewed hopes for improved US-China trade relations after positive signals from both sides. However, this momentum could be disrupted as attention shifts to upcoming economic data, particularly the non-farm payroll figures. Any signs of a slowdown in job creation might lead to a decline in the dollar's strength as it could undermine confidence in the US economy.

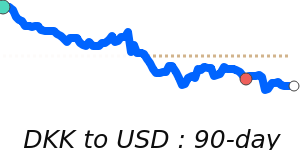

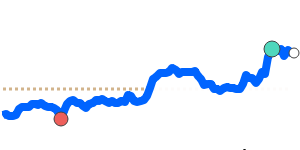

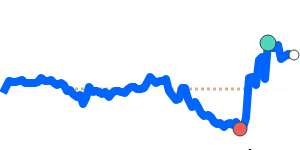

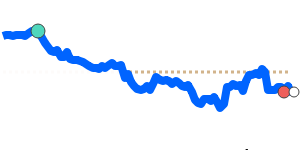

The dollar currently trades at 6.6043 DKK, which is significantly below its three-month average of 6.8903 DKK, reflecting a 4.2% depreciation. This volatility, with a broad trading range of 12.5% from as low as 6.4849 to a high of 7.2934, highlights ongoing uncertainties in the currency markets. Economic analysts suggest that fluctuations in USD demand are influenced by various factors, including US Treasury yields, which have been under scrutiny as market participants reassess their safe-haven status amid geopolitical tensions and evolving fiscal policies.

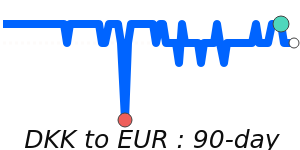

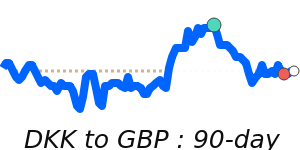

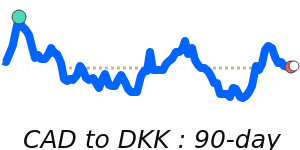

The Danish kroner, while stable due to its peg to the Euro, faces challenges in maintaining this fixed exchange rate policy against the backdrop of changing interest rates and other currencies' fluctuations. The Danish central bank has frequently intervened in currency markets to uphold this stability, but such actions can limit its ability to respond flexibly to domestic economic conditions. Experts suggest that any significant changes in the Eurozone's economic outlook will also impact the DKK's performance against the USD.

In summary, the future trajectory of the USD to DKK exchange rate is uncertain and hinges on critical economic indicators and evolving trade dynamics. Investors and businesses should closely monitor these factors, especially the potential effects of US employment data and international trade developments, as they navigate their currency-related transactions. The overall market sentiment remains cautious, reflecting both the dollar’s flexible dynamics and the fixed nature of the Danish economy.