Israeli new sheqel (ILS) Market Update

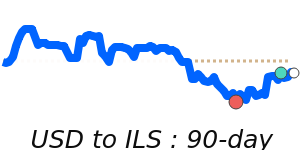

The USD to ILS exchange rate has recently been influenced by significant geopolitical and economic developments. Analysts have observed that the US dollar (USD) strengthened amidst renewed hopes for a US-China trade deal, which some view as a stabilizing factor for the dollar. However, concerns around President Trump's trade policies, including new tariffs and the shifting global trade landscape, have led to speculations that the dollar’s strength may not remain resilient.

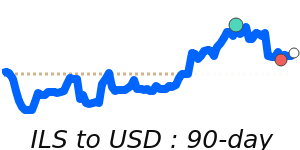

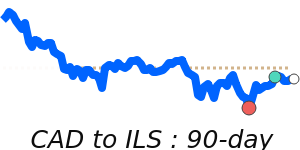

Recent market data shows the USD/ILS exchange rate is currently at a 60-day low near 3.5873, approximately 1.4% below its three-month average of 3.6393. This rate falls within a relatively stable range of 7.8%, having traded between 3.5434 and 3.8188. Analysts suggest that this stability could be at risk, depending on upcoming economic indicators, particularly April's non-farm payrolls data. A disappointing jobs report could prompt the dollar to weaken further.

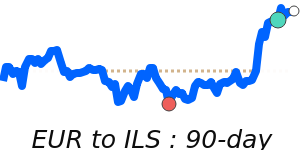

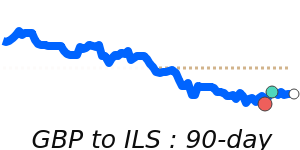

Meanwhile, the Israeli shekel (ILS) has experienced considerable pressure, dropping to its lowest level against the dollar in nearly eight years due to the ongoing conflict stemming from the Hamas attacks on October 7. The Bank of Israel’s intervention through foreign exchange sales reflects attempts to stabilize the shekel during heightened tensions that have increased market volatility. The US's reciprocal tariff of 17% on Israeli goods adds to the downward pressure on the shekel amidst the broader context of US-Israel trade relations influenced by the current administration's policies.

Looking ahead, experts indicate that the future trajectory of the USD/ILS exchange rate hinges on the interplay of US economic data, Federal Reserve policies, the ongoing geopolitical climate in the Middle East, and the financial stability measures implemented by the Bank of Israel. Investors and businesses involved in international transactions should remain vigilant, as fluctuations in this exchange rate can significantly impact costs and financial planning.