Norwegian krone (NOK) Market Update

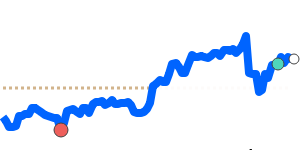

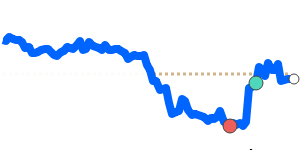

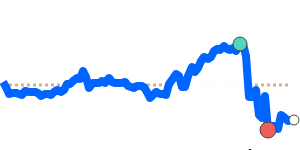

The USD to NOK exchange rate has been influenced by a complex interplay of economic factors and market sentiment. Currently, the USD is trading at 10.41, which is approximately 3.6% below its three-month average of 10.8, showcasing significant volatility in recent weeks. Analysts highlight that the pair has traded within a notable 11.2% range, fluctuating between 10.33 to 11.49, indicating market uncertainty.

The trajectory of the USD has recently been buoyed by hopes for improved US-China trade relations, as the market reacted positively to indications from China about openness to trade talks. This optimism momentarily strengthened the dollar, but caution prevails as focus shifts to upcoming economic indicators, particularly April's non-farm payroll figures. A potential slowdown in job creation could negatively impact the dollar's value. Moreover, concerns regarding US Treasury yields and President Trump’s tariff policies suggest that the dollar may face headwinds, as questions about its support as a safe-haven currency continue to emerge.

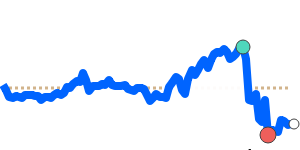

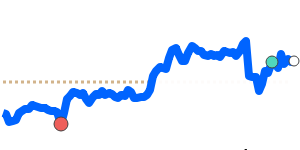

On the other hand, the Norwegian krone (NOK) has been on a remarkable upswing, gaining approximately 9% year-to-date against the dollar. This rise can be attributed to positive sentiment surrounding European economic prospects and an unexpected inflation increase within Norway. The markets appear to anticipate limited easing measures from the Norges Bank, with only slight adjustments likely in the coming months. However, experts from ABN-Amro caution that while there may be room for further gains in the NOK, risks remain, especially regarding the potential for a rebound in EUR/NOK to around 11.50 in the second quarter, largely influenced by shifting sentiment towards US tariffs on Europe.

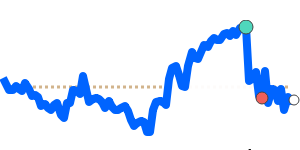

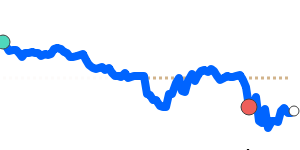

The NOK's strength is intrinsically linked to oil prices, as Norway is a major oil exporter. Presently, oil prices are at 90-day lows, around 61.29, which is significantly below the three-month average of 70.61. This decline, coupled with a volatile trading range of 25.6%, from 61.29 to 76.99, indicates that fluctuations in commodity prices will continue to play a crucial role in shaping the NOK's outlook against the USD.

In summary, forex experts indicate that the USD to NOK exchange rate is set against a backdrop of mixed economic signals, marked by strong performance in the krone driven by local inflation and broader European sentiment, while the dollar grapples with concerns of economic slowdown and geopolitical shifts. As such, businesses and individuals engaged in currency transactions should remain attuned to these developments to effectively manage their foreign exchange exposure.