Polish zloty (PLN) Market Update

The Polish zloty (PLN) has experienced significant turbulence recently, primarily influenced by changes in monetary policy and external economic pressures. Following the National Bank of Poland's surprise interest rate cut in September, the zloty has depreciated nearly 3% against the Euro. Central Bank Governor Adam Glapiński pointed to a "radically changed" economic landscape, with the looming threat of a recession in Germany raising concerns about Polish exports, given the close economic ties between the two nations. Germany's economy is grappling with persistent stagflation, exacerbated by a sharper-than-expected decline in industrial production.

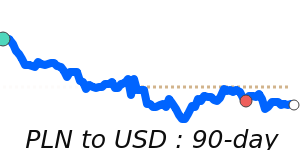

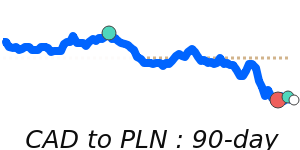

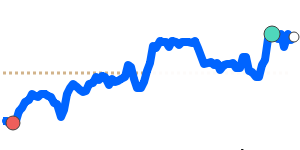

The ongoing War in Ukraine continues to cast uncertainty over both the Polish economy and the zloty, which was trading around 4.0 to the USD prior to the conflict's onset. Currently, the zloty is quoted at 0.2642 to the USD, which is 2.6% above its three-month average of 0.2575. This pair has demonstrated notable volatility, with a wide trading range of 16.4% spanning from 0.2425 to 0.2823.

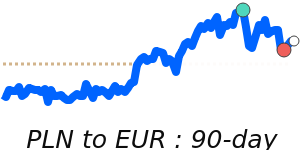

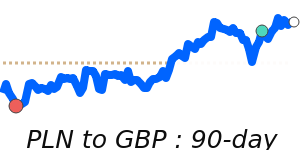

In relation to the euro, the zloty is trading at 0.2337, reflecting a 1.6% decline from its three-month average of 0.2375. This currency pair has shown a relatively stable trading range of 6.7%, oscillating between 0.2328 and 0.2483. Meanwhile, the GBP/PLN exchange rate stands at 0.1990, just shy of its three-month average, exhibiting a volatile range of 8.2%.

For the PLN to JPY exchange rate, the zloty is currently at 38.28, slightly above its three-month average. This pair has fluctuated within a 9.0% range, from 37.20 to 40.54, reflecting similar volatility observed in other PLN pairs.

Analysts suggest that continued instability in regional markets, compounded by geopolitical tensions and economic conditions in Germany, will likely impact the zloty going forward. Businesses and individuals engaging in international transactions should closely monitor these developments, as foreign exchange rates may experience further shifts in the coming weeks.