Swedish krona (SEK) Market Update

The recent trend for the USD to SEK exchange rate suggests a complex interplay of factors affecting both currencies. Analysts indicate that the U.S. dollar (USD) has been buoyed by renewed optimism around U.S.-China trade discussions, particularly after China signaled a willingness to engage in trade talks. However, concerns remain about potential economic impacts, including the impending release of April’s non-farm payrolls figures, which could signal a slowdown in job creation and temper investor confidence in the dollar.

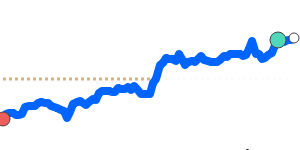

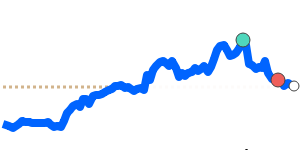

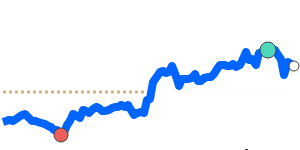

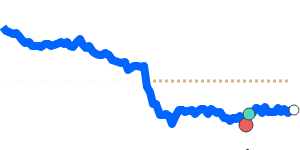

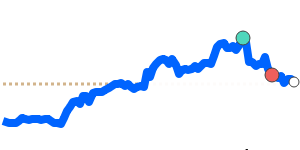

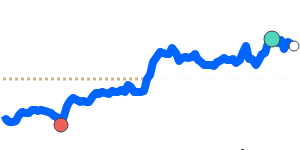

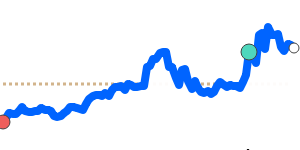

Currently, the USD is trading at 9.6547 SEK, which is significantly lower than its three-month average of 10.22 SEK. This positions the dollar about 5.5% below the average, having displayed a striking 18.1% volatility range between 9.5267 and 11.25 SEK. The dollar's performance appears to be at a crossroads, with increasing speculation that U.S. monetary policy and geopolitical strategies could be influencing its value.

In the Swedish market, the Riksbank is closely monitoring inflation data and has left open the possibility of a rate cut as early as May if the data continues to improve. Market sentiment indicates that investors are anticipating a shift to more accommodative monetary policy in Sweden, particularly when compared to the European Central Bank's expected timeline for cuts. This perspective reinforces the idea that external influences, such as global economic conditions and trade dynamics, will play a critical role in shaping the SEK's trajectory.

The current pricing dynamics suggest a heightened sensitivity to economic indicators and geopolitical developments. Experts note that the reliability of the USD as a safe-haven currency could impact demand and exchange rates, particularly amid market fluctuations related to international trade policies. As developments unfold, investors and businesses should stay vigilant, as shifts in monetary policy and trade relations will likely continue to influence the USD/SEK exchange rate in the near future.