South African rand (ZAR) Market Update

The South African Rand (ZAR) is experiencing notable movements in the currency market amid a challenging external environment. Recent forecasts and analysis suggest that the ongoing trade tensions, particularly the 30% reciprocal tariff imposed by the US on South African goods, are significantly influencing investor sentiment toward the ZAR. As South Africa heavily relies on foreign investment to bridge its budget and current account deficits, fluctuations in global market conditions are acutely felt.

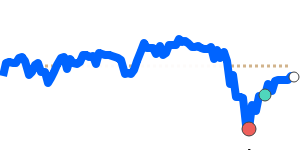

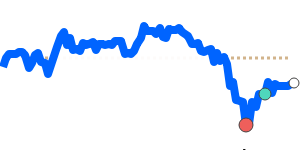

Currently, the ZAR to USD exchange rate is at a 30-day high of approximately 0.054373, representing a modest rise of 0.9% above its 3-month average of 0.053871. In recent trading, the pair has demonstrated volatility, oscillating within a 9.3% range from a low of 0.050563 to a high of 0.055274. Analysts indicate that any shifts in global risk appetite could further sway the ZAR's performance against the dollar.

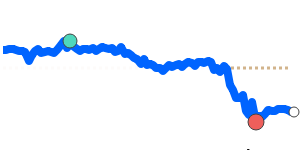

In the ZAR to EUR pairing, the currency is trading at 14-day highs near 0.048119, but remains 3.3% below its 3-month average of 0.049744. The volatility in this pair has been particularly pronounced, with fluctuations within a 14.4% range from 0.045978 to 0.052601. Economists suggest that the euro's strength relative to other currencies continues to place pressure on the ZAR.

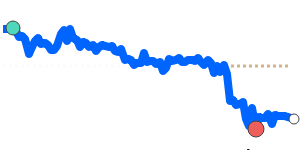

The GBP/ZAR exchange rate also shows recent strengths, with the ZAR currently at 0.040973, marking a 30-day high yet remaining 2.1% below its 3-month average of 0.041844. This pair has traded within a notably volatile range of 10.7%, with values fluctuating between 0.039609 and 0.043842. Forecasters note that geopolitical uncertainties could keep this volatility alive as market participants react to new developments.

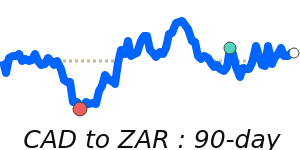

Lastly, the ZAR to JPY exchange rate stands at 7.8776, which is 1.3% under its 3-month average of 7.9843. This pair has seen fluctuations within a 12.7% range from 7.3967 to 8.3356, underscoring the currency's exposure to global market dynamics.

Overall, the ZAR remains sensitive to international economic conditions and trade conflicts. Markets are advised to monitor developments closely, as shifts in sentiment could lead to further volatility in the upcoming weeks.