Recent developments point to a complex outlook for the UAE Dirham (AED) as geopolitical tensions, economic forecasts, and trade negotiations interplay to influence its value. Following Israel's military actions against Iran, markets across the UAE and the broader Middle East faced declines, leading to increased volatility and rising oil prices. Such geopolitical instability typically fosters a risk-averse market environment, which can impact currency strength.

Economically, a positive projection from the Arab Monetary Fund anticipates a growth rate of 6.2% for the UAE in 2025. This expected growth is largely driven by sectors such as tourism, real estate, and international trade. However, concerns over the performance of the non-oil private sector have emerged, with May data showing a slowdown to its lowest growth rate in almost four years. This juxtaposition of growth forecasts alongside challenges in diversification may create fluctuations in the AED's value.

Conversely, ongoing trade negotiations with the U.S. aimed at reducing tariffs on steel and aluminum exports could significantly impact trade balances and currency dynamics. Positive outcomes from such negotiations may strengthen the AED, particularly if they enhance the UAE's trade relationships.

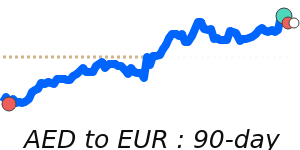

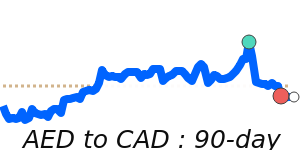

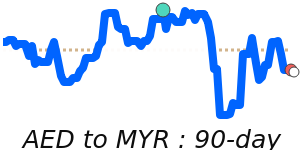

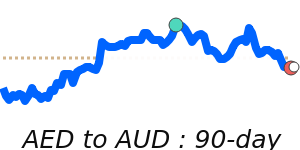

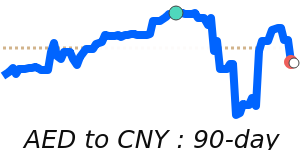

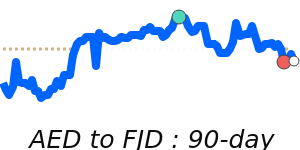

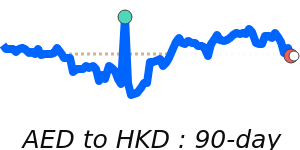

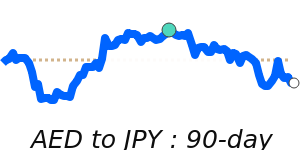

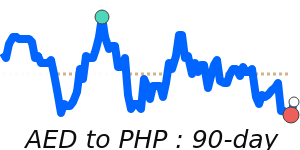

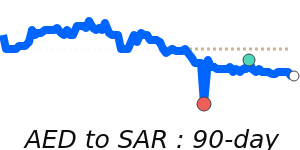

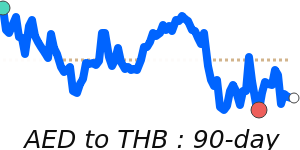

From a market perspective, the AED has shown stability against major currencies over the past weeks. The exchange rate for AED to USD remains steady at its three-month average of 0.2723. The AED to EUR is trading at 0.2341, which is 1.5% below its three-month average, demonstrating relatively stable trading ranges. In contrast, the AED to GBP is slightly above its average, while the AED to JPY is at 90-day highs, trading 2.7% above its three-month average.

As the currency market continues to respond to both domestic developments and international events, businesses and individuals engaging in international transactions should remain vigilant and informed about the factors influencing the AED.