How much does it really cost to live, work, or travel in ? Here's what to expect for daily expenses and expat living.

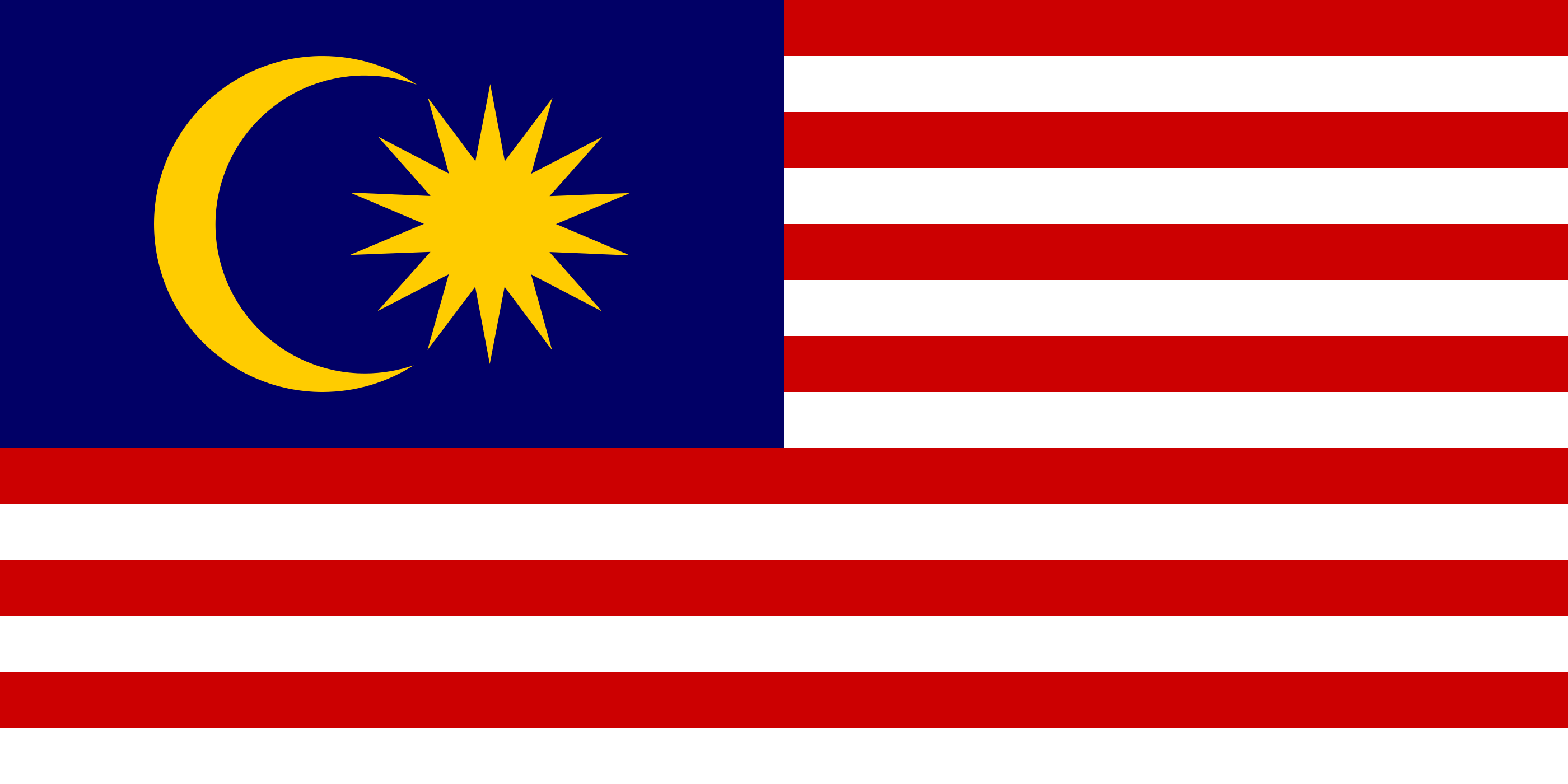

Currency Guide: Malaysia (MY)

When planning a mid-range stay in Malaysia for one week, a traveler should budget approximately MYR 3,500 to MYR 5,000 (around USD 750 to USD 1,100). This should cover your accommodation, meals, transport, and activities while allowing for some leisure spending. Typical daily expenses can help paint a clearer picture: a meal at a local restaurant (MYR 15-25 🍜), a cup of coffee (MYR 8-15 ☕), a public transport fare (MYR 1-3 🚆), a prepaid SIM card (MYR 30-50 📱), and a budget hotel or Airbnb (MYR 100-200 🛏️). Overall, Malaysia is considered quite affordable compared to many countries, especially the United States and the UK, where similar expenses could easily be 50-100% higher. In comparison, your travel experience could be cheaper here than in Australia, where food and accommodation are generally pricier.

Living in Malaysia: Tips for Expats

Expats settling in Malaysia should anticipate typical monthly living costs around MYR 4,500 to MYR 8,000, depending on lifestyle choices and location within the country. To maintain a smooth financial routine, it’s advisable to use a mix of local banking services and online solutions. While local banks facilitate daily transactions, using international cards from well-known providers (Visa, Mastercard) is usually supported, but be cautious of foreign transaction fees. When it comes to sending and receiving money internationally, services like Wise or OFX often provide better rates and lower fees than exchanging cash at local banks or exchange centers. Therefore, for day-to-day expenses, using local currency strategically will help you save, while leveraging online services can be advantageous for larger transfers and international payments to keep your finances streamlined.