Danish krone (DKK) Market Update

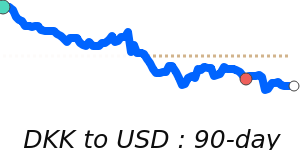

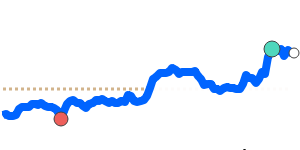

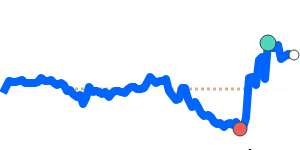

Recent forecasts regarding the USD to DKK exchange rate indicate a period of volatility for the US dollar, which is currently trading at 7-day lows near 6.6680. This value is 1.9% lower than its 3-month average of 6.7978, reflecting a significant fluctuation, with the exchange rate moving within a 10.8% range from 6.4849 to 7.1884. Analysts suggest that the downward pressure on the dollar can be attributed to a combination of weaker than expected consumer sentiment and growing investor concerns surrounding the potential for a US recession.

The recent announcement of a trade agreement between the US and the UK has not substantially bolstered the dollar, as the specifics of the agreement remained vague, particularly around tariff structures. Furthermore, US Treasury bonds are losing their traditional appeal as safe-haven assets due to rising yields and concerns over the effects of President Trump's tariff policies, including a controversial 10% tariff on numerous exporters.

Markets are increasingly speculating that Trump's economic strategies may intentionally aim to weaken the dollar, further complicating the dollar's outlook. This idea, dubbed the "Mar-a-Lago Accord," suggests a reshaping of global trade relations that could prioritize US interests, thereby impacting the dollar's stability in the face of fluctuating international market conditions.

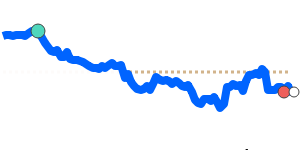

While the USD's value is generally supported by its role as a global reserve currency, the current economic sentiment is underpinned by uncertainties regarding US fiscal policies and trade relations, particularly with key partners such as China. The combination of these factors indicates a challenging environment for USD investors.

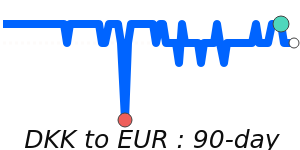

On the other hand, the Danish kroner (DKK) maintains a fixed exchange rate policy linked to the Euro, providing a stable financial environment that is particularly advantageous for Denmark's export-oriented economy. However, this policy also limits the central bank's ability to adjust monetary measures effectively in response to changes in global economic conditions or inflections in currency values.

As such, for those managing transactions involving USD and DKK, current market conditions reflect a need for careful monitoring of US economic indicators and trade developments that may influence the dollar's strength in the future. As always, maintaining awareness of geopolitical developments and the Federal Reserve's monetary policy decisions will be crucial for forecasting potential movements in the USD to DKK exchange rate.