The GBP remains uncertain as markets digest the latest UK services PMI data, which shows persistent inflation pressures alongside signs of job cuts. This mixed picture leaves the Bank of England (BoE) in a delicate spot, balancing inflation concerns with economic growth challenges.

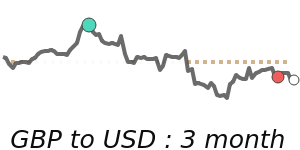

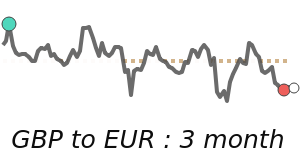

against the US dollar, GBP has edged lower, trading around 1.3393, slightly below its 3-month average, with risk-off sentiment and US dollar safe-haven demand contributing to its softening. The euro has also seen modest weakness against the pound, with GBP/EUR trading just above 1.15, reflecting cautious market risk appetite.

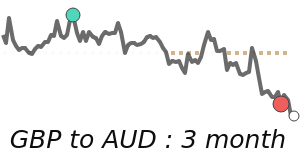

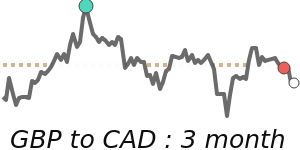

Meanwhile, GBP has strengthened a bit against the Australian dollar to around 1.9033, but remains well below its recent 3-month average due to risk concerns and energy sensitivities. The yen has climbed near 211.5, close to 7-day highs, driven by safe-haven flows stemming from geopolitical tensions. Overall, the pound's moves are influenced by global risks, energy prices, and the UK’s economic data, with a cautious bias in the near term as markets remain fragile.