Currency in Afghanistan: AFN Send & Spend FX Guide

Resources for Expats, Travelers and Entrepreneurs Navigating Life and Trade in Afghanistan with the Afghan Afghani.

What's in this Afghanistan currency guide?

What currency is used in Afghanistan?

The official currency of Afghanistan (country code: AF) is the Afghan Afghani, with symbol and currency code AFN.

What is a good Afghan Afghani exchange rate?

The BestExchangeRates.com currency comparison table below helps you see the total cost of your currency transaction by showing the exchange rates offered by different providers. It also makes it easy to spot potential savings from market-leading FX services compared to bank rates.

To see a full list of rates, enter your transaction type, currencies and amount then click ‘GET RATES’:

Loading rates...

|

|

|

Good things to know about the Afghan Afghani

As of June 16, 2025, the Afghan Afghani (AFN) has experienced notable fluctuations:

- Currency Depreciation: Between January and March 2025, the AFN weakened by nearly 5% against the US dollar, from approximately AFN 68.20 to AFN 71.70 per USD. (amu.tv)

- Central Bank Interventions: In response to currency volatility, Da Afghanistan Bank (DAB) injected between $15 million and $100 million into the local market to stabilize the AFN. (tolonews.com)

- Currency Redenomination: DAB destroyed over 500 million AFN worth of deteriorated currency notes in the western region to maintain currency quality. (bakhtarnews.af)

Travelers, expats, and business owners should monitor these developments, as currency fluctuations can impact transaction costs and financial planning.

For more AFN information check out our selection of Afghan Afghani news and guides.

Frequently Asked Questions

What currency should I use in Afghanistan?

The domestic currency in Afghanistan is the Afghan Afghani.

What is the Afghan Afghani currency code and symbol?

The three letter currency code for the Afghan Afghani is AFN.

What does the Afghan Afghani look like?

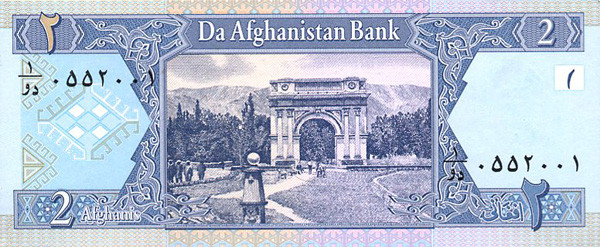

Here is an example Afghan Afghani banknote:

Which countries use the Afghan Afghani?

It is the domestic currency in Afghanistan.

Is the Afghan Afghani a closed currency?

No, the Afghan Afghani is freely available and convertible. See guide: What is a closed currency?

What are equivalent amounts of GBP and AFN?

Here are some popular conversion amounts for GBP to AFN (British pound to Afghan Afghani)*.

*Converted at the current GBPAFN interbank exchange rate. Calculate actual payout amounts for Send Money and Travel Money exchange rates.

Travel money for Afghanistan

Using Wise for Afghan Afghani travel money is a smart choice for savvy travelers. With its competitive exchange rates and low fees, Wise allows you to convert and manage multiple currencies effortlessly.

Be careful when using your own bank's Debit/Credit Card, as your bank may also charge an extra 3% as an “Overseas Transaction Charge” plus “Overseas ATM” fees for withdrawing cash on top of the standard Visa/Mastercard 2.5% from market mid-rate.

For card purchases, if you are offered a choice of currencies always select to Pay in Afghan Afghani otherwise you will typically get much worst dynamic currency conversion (DCC) exchange rates.

If you really want Afghan Afghani cash before departure, you can save money by ordering online. You generally get better rates and can pick up the AFN cash locally or even on travel day at the airport.

Afghanistan: Travel Guide

Traveling to Afghanistan requires careful financial planning to ensure a smooth and cost-effective experience. Here's a comprehensive guide to help you navigate currency considerations and manage your money effectively during your visit.

Afghanistan is a country located in Central and South Asia. It is a landlocked country with a population of around 35 million people, and the official language is Dari. The country has a rich cultural heritage and a long history, but it has been facing a number of challenges in recent years, including ongoing conflict and political instability.

Visiting Afghanistan can be a challenging and potentially dangerous experience. The country has a high level of crime and a high threat of terrorism, and visitors are advised to exercise caution and follow the advice of local authorities. In addition, the infrastructure in Afghanistan is not well developed, and the country has limited access to modern amenities and facilities.

Despite these challenges, Afghanistan is home to a number of interesting sights and attractions. These include the ancient city of Bamiyan, which was once a center of Buddhist learning and is home to the famous Buddhas of Bamiyan, and the Minaret of Jam, a UNESCO World Heritage Site. The country is also home to a number of museums, such as the National Museum of Afghanistan in Kabul, which houses a collection of ancient artifacts and manuscripts.

It is important to carefully research the security situation and to follow the advice of the local authorities before visiting Afghanistan. It is also recommended to have a reliable and experienced guide to help navigate the country.

Everyday Costs in in Afghanistan

How much does it really cost to live, work, or travel in Afghanistan? Here's what to expect for daily expenses and expat living.

Traveling to Afghanistan: A Cost Overview

For a mid-range traveler planning a one-week stay in Afghanistan, a budget of approximately 800–1,000 AFN (around $9 to $11 USD) per day is a good estimate for a comfortable experience. This totals about 5,600–7,000 AFN (approximately $65 to $84 USD) for the week. Here’s a glimpse of typical daily expenses in Afghan Afghani (AFN):

- 🌮 Meal at a local restaurant: 400 AFN

- ☕ Coffee: 100 AFN

- 🚍 Public transport fare: 20 AFN

- 📶 Prepaid SIM card: 400 AFN

- 🏨 Budget hotel or Airbnb: 2,000–3,000 AFN

Overall, Afghanistan is considered to be a cheap destination compared to Western countries. In comparison, a similar stay in the United States might cost upwards of $1,500, while in the UK, you might be looking at about £1,200 for a mid-range experience. The cost of living in Afghanistan is significantly lower, making it an appealing option for budget-conscious travelers.

Expat Life in Afghanistan: What to Expect

For expatriates living in Afghanistan, the typical monthly living costs can vary significantly, but you should expect to spend around 30,000–50,000 AFN (approximately $350 to $600 USD) depending on your lifestyle and location. Essentials such as rent, groceries, and utilities contribute to this budget; however, options vary widely based on urban versus rural settings.

When it comes to banking, using local banks can be beneficial, but be mindful of the limited services they may offer. Credit and debit cards are increasingly accepted in major cities, but always have some cash on hand, especially in rural areas. Sending and receiving money might be easier through online transfer services like Wise or OFX, which often provide better currency exchange rates and lower fees compared to exchanging cash at local banks. However, for day-to-day transactions, carrying cash in AFN is the most convenient option. Always compare fees and exchange rates to maximize your money’s value.

USD/AFN Market Data

The below interactive chart displays the USD/AFN change and UP📈 DOWN📉 trends over the past 1 Year.

Recent Afghan Afghani Market News

Recent developments influencing the Afghan Afghani (AFN) include:

- Central Bank Interventions: Da Afghanistan Bank has conducted multiple auctions, injecting millions of USD to stabilize the AFN. Notably, on February 5, 2025, it auctioned $25 million, and on February 22, 2025, another $20 million. (english.news.cn)

- Currency Appreciation: In early 2024, the AFN appreciated by 15.42% against the USD, indicating strengthening of the local currency. (english.news.cn)

- Commodity Price Fluctuations: In May 2025, gold prices surged, contributing to the AFN's strengthening against the USD and Pakistani rupee. (pajhwok.com)

- Regional Economic Policies: In January 2025, the World Food Program reported a sharp rise in commodity prices, primarily due to the AFN's depreciation against the USD. (anewz.tv)

These factors collectively impact the AFN's exchange rate and economic stability.

For more AFN information read our News and guides to the Afghan Afghani.

Send Money to Afghanistan - Best Rates

To get a good (and fair) exchange rate when sending money to Afghanistan you need to find and compare exchange rates for International Money Transfers (IMTs).

The available FX rates for sending money abroad can be very different to the mid-market (wholesale) rate which you see reported online and in the News.

You should especially compare your own bank's exchange rates to those available from Money Transfer specialists to see how much you can save - we make that calculation easy in the below table.

Get a better deal for foreign transfers to Afghanistan

When sending money to Afghanistan it’s important to compare your bank’s rates & fees with those we have negotiated with our partner money transfer providers. To get a better deal you should follow these 4 simple steps :

- Open an account with a BER reviewed FX provider (id docs may be required)

- You specify the local or Afghan Afghani amount you want to transfer

- Make a local currency domestic transfer for the requested amount to the provider's bank account in your country

- Once your funds are received by the provider the converted AFN amount will be transfered to the recipient account you specify in Afghanistan.

Use the above calculator to compare the exchange rates of FX specialist providers rates versus your bank's standard rates you can hopefully save around 5% and maybe more - end result is more Afghan Afghani deposited into the recipient bank account and less margins and fees kept by the banks!

Managing money while living and working in Afghanistan

Managing your money effectively while living and working abroad can be challenging, but there are several steps you can take to ensure that your finances are in order.

Understand Afghan Afghani currency exchange rates: Exchange rates can have a big impact on your finances, so it is important to keep an eye on the AFN exchange rate and consider using a money transfer specialist or a credit card that does not charge foreign transaction fees to get the best exchange rate.

Use a local Afghan Afghani bank account: A local AFN bank account can make it easier for you to manage your finances and pay bills while you are in Afghanistan. It may also be more convenient to use a local AFN bank account to make purchases and withdraw cash.

Research local laws and regulations: It is important to understand the local laws and regulations that apply to financial transactions in Afghanistan. This can help you avoid legal issues and ensure that you are complying with local requirements.

Consider the tax implications: It is important to understand the tax implications of living or doing business in Afghanistan. This can help you plan your finances and ensure that you are paying the correct amount of tax.

Seek financial advice: If you are unsure of how to manage your finances in Afghanistan, it is a good idea to seek the advice of a financial professional who is familiar with the local financial system. This can help you make informed decisions and avoid financial pitfalls.

We have put together some key points to help managing your money effectively, you can reduce financial stress and enjoy your experience living or doing business in Afghanistan.

Doing business in Afghanistan

Doing business in Afghanistan can be challenging due to the country's political instability and ongoing conflict. The country has a high level of corruption, and businesses may face difficulties navigating the complex regulatory environment. In addition, the infrastructure in Afghanistan is not well developed, and access to electricity, water, and other basic amenities can be limited.

Despite these challenges, there are opportunities for businesses in Afghanistan, particularly in sectors such as agriculture, mining, and construction. The country has a large and young population, and there is potential for businesses that can tap into this market.

To succeed in Afghanistan, it is important to have a clear understanding of the local market and the business environment. It is also important to be patient and to be prepared for setbacks and delays. It is recommended to seek legal and financial advice, and to work with local partners who have a strong understanding of the local market.