Forecasts for BTC to EUR

![]()

![]() ### BTC to EUR Outlook

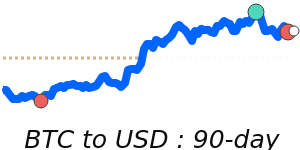

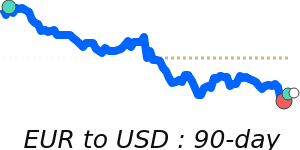

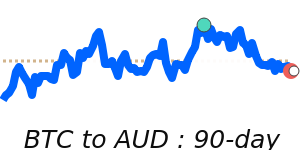

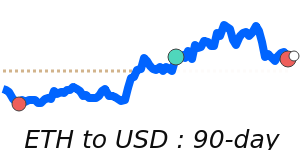

In the near term, BTC/EUR is trading close to the lower end of its recent range, holding near 58630. The dominant driver from structured analysis is risk sentiment, which remains risk-off. EUR is pressured amid geopolitical tensions and energy costs, supporting a weaker Bitcoin relative to the Euro. Near-term conditions suggest Bitcoin may face further pressure if risk aversion continues.

### BTC to EUR Outlook

In the near term, BTC/EUR is trading close to the lower end of its recent range, holding near 58630. The dominant driver from structured analysis is risk sentiment, which remains risk-off. EUR is pressured amid geopolitical tensions and energy costs, supporting a weaker Bitcoin relative to the Euro. Near-term conditions suggest Bitcoin may face further pressure if risk aversion continues.

### Transfer implications

- **Expats:** sending Bitcoin to Euro may find conditions less favourable than recent levels.

- **Travellers:** buying Euro cash or loading cards might see increased costs or less favourable exchange rates.

- **Businesses:** paying Euro invoices with Bitcoin could experience less advantageous conversion rates.

### Key drivers

- **Rate gap:** Bitcoin's rate gap reflects heightened risk-off sentiment, with the pair trading below its 3-month average.

- **Risk/commodities:** EUR faces downside pressure amid geopolitical tensions and rising energy costs.

- **Global factors:** European growth remains mixed despite resilient employment data, influencing overall risk appetite.

### What could change it

- **Upside risk:** A shift towards risk-on sentiment and easing geopolitical tensions could support BTC/EUR.

- **Downside risk:** Escalation of energy issues or geopolitical conflicts might deepen the decline in Bitcoin relative to Euro.