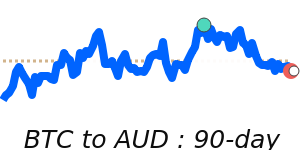

Forecasts for BTC to USD

![]()

![]() ### BTC/USD Outlook:

Likely to decrease, as the rate is significantly below its recent average and facing pressure from multiple factors.

### BTC/USD Outlook:

Likely to decrease, as the rate is significantly below its recent average and facing pressure from multiple factors.

#### Key drivers:

• Rate gap: The U.S. Federal Reserve's decision to hold interest rates steady contrasts with the growing interest in Bitcoin, which may not support its value against the USD.

• Risk/commodities: With oil prices experiencing volatility, the appetite for riskier assets, including cryptocurrencies like Bitcoin, has been affected negatively.

• One macro factor: The ongoing trend of global de-dollarization is reducing demand for the USD, potentially pressuring Bitcoin as an alternative asset.

#### Range:

The BTC/USD pair is likely to drift further below its recent average within the highly volatile range it has experienced.

#### What could change it:

• Upside risk: A shift in U.S. economic data that shows stronger consumer spending could provide renewed support for the USD, affecting Bitcoin.

• Downside risk: Continued geopolitical tensions and monetary policy changes could further diminish demand for both the USD and Bitcoin.