Outlook

The Australian dollar faces a mix of support and risk in the near term. A 25 basis point RBA hike to 3.85% on February 3 and firmer inflation signals support a higher-yielding AUD, while a weaker domestic consumer sentiment reading keeps upside constrained. External factors remain supportive on commodity demand and a softer USD, but caution ahead of key US data could cap gains. Overall, the AUD is likely to drift higher with upsides tempered by domestic confidence weakness and global risk sentiment.

Key drivers

• RBA’s February rate hike to 3.85% and ongoing inflation concerns reinforce the case for a higher policy stance.

• Inflation data surprised on the upside, strengthening expectations of further tightening.

• The Trade-Weighted Index (TWI) for the AUD has appreciated, reflecting stronger demand for Australian exports and a softer US dollar.

• China’s policy stance remains supportive for commodity demand, aiding AUD sentiment.

• Australia’s commodity exposure means iron ore, coal, and gas prices underpin cross-rates and the AUD’s overall direction.

• Market risk sentiment and moves in the USD continue to drive short‑term volatility in AUD pairs.

Range

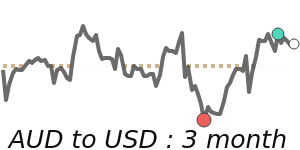

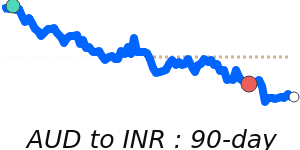

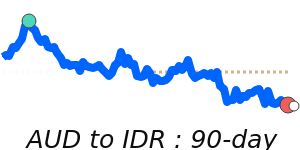

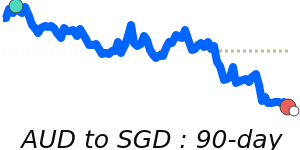

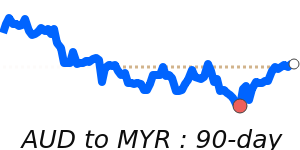

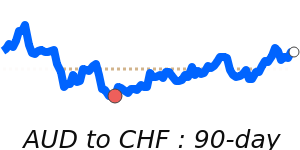

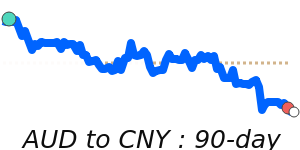

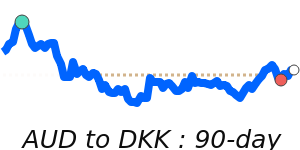

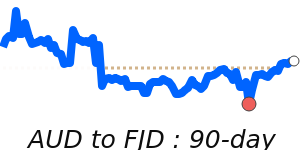

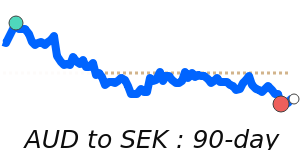

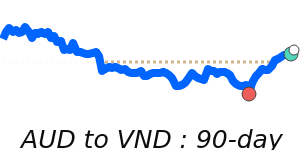

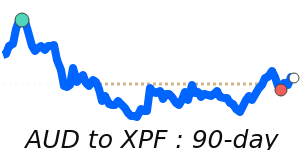

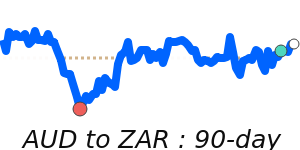

AUD/USD 0.7075, 5.4% above its 3-month average of 0.671, having traded in a volatile 10.1% range from 0.6444 to 0.7093.

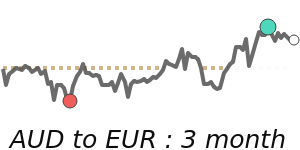

AUD/EUR 0.5953, 3.9% above its 3-month average of 0.573, with a 6.5% range from 0.5591 to 0.5953.

AUD/GBP 0.5189, 3.8% above its 3-month average of 0.5, trading in a 5.6% range from 0.4913 to 0.5189.

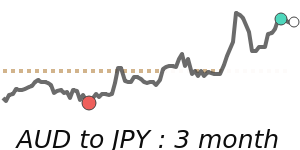

AUD/JPY 109.3, 4.3% above its 3-month average of 104.8, within a 9.7% range from 100.8 to 110.6.

What could change it

• A surprise in US inflation or payrolls data that alters rate expectations or risk sentiment.

• A shift in RBA policy guidance or additional rate moves beyond the February hike.

• A sustained move in commodity prices (iron ore, coal, LNG) that strengthens or weakens export demand.

• A further shift in China policy or data that changes demand for Australian commodities.

• A broad change in global risk appetite or USD strength that reroutes capital flows.