The euro (EUR) remains mixed today, largely impacted by recent geopolitical tensions and energy prices. Despite unemployment in the Eurozone reaching a record low, the EUR has shown signs of weakness against some major currencies.

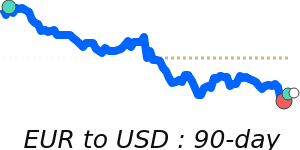

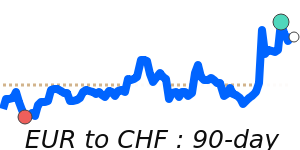

EUR/USD currently sits around 1.1623, about 1.1% below its three-month average, reflecting cautious investor sentiment as the US dollar maintains safe-haven appeal amid ongoing tensions. Similarly, EUR/CHF has slipped to 0.9034, just below its recent averages, indicating a modest move away from the franc’s usual stability during uncertain times.

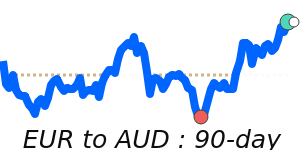

The euro is also weaker against the Australian dollar, trading at 1.6516, roughly 3.8% below its recent average, consistent with risk-off flows driven by concerns over rising energy costs and Middle East geopolitical risks. These factors tend to weigh on EUR more than some other currencies, as Europe is more sensitive to energy price shocks.

While some data suggests retail activity might support the euro, the outlook remains cautious. Investors will be watching for further developments in energy markets and ECB policy signals to gauge the currency’s next move.