Outlook

The HKD is likely to remain anchored to the USD peg, supported by ongoing HKMA interventions and resilient domestic demand from the Mainland. Near-term volatility remains possible as external factors such as US policy moves and tariff-related news influence markets. In the immediate horizon, USD/HKD could drift within a tight band around the equivalent of roughly 7.77–7.81 per USD, with the HKMA prepared to act to defend the peg if weakness on the weak side re-emerges.

Key drivers

- HKMA interventions to defend the peg, including notable actions such as the August 2025 purchase of about HK$6.4 billion to support HKD. These steps illustrate the central bank’s readiness to drain or add liquidity to maintain stability.

- The peg’s sensitivity to interest-rate differentials, where intra-bank rates and flows from mainland investors have previously tightened USD/HKD gaps, supporting the HKD when demand is strong.

- Market volatility from US policy signals and tariff announcements, which can test the peg and prompt corrective actions by the HKMA.

- Ongoing pressure episodes in mid-2025 that tested the weak side of the peg and prompted balance-sheet adjustments, underscoring the peg’s dynamic risk environment.

Range

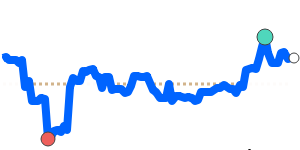

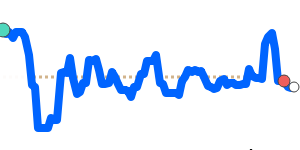

HKD to USD is at 0.1280, near its 90-day lows and just below the 3-month average, having traded in a stable 0.5% range from 0.1280 to 0.1287.

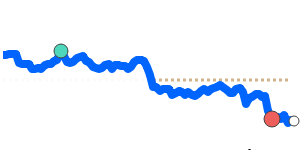

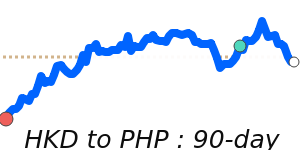

HKD to EUR is at 0.1083, 1.4% below its 3-month average of 0.1098, having traded in a stable 4.8% range from 0.1065 to 0.1116.

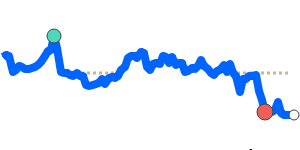

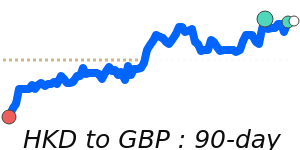

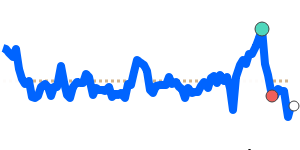

HKD to GBP is at 0.093994, 1.9% below its 3-month average of 0.095856, having traded in a stable 6.2% range from 0.092640 to 0.098365.

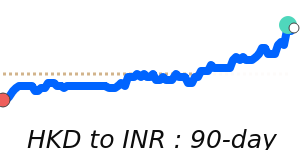

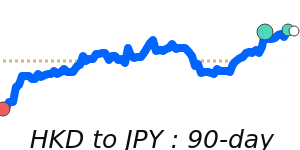

HKD to JPY is at 20.12, near 14-day highs and just above its 3-month average, having traded in a stable 4.5% range from 19.52 to 20.40.

What could change it

- A material shift in US monetary policy or a renewed round of US dollar strength could compel larger HKMA interventions and potentially widen the band pressure.

- A significant change in domestic liquidity conditions or aggregate balance due to HKMA actions could alter HKD stability and drag on or support the peg.

- Sudden shifts in Mainland capital flows or demand for HKD-denominated assets could move the HKD cross rates, testing the peg again.

- New trade developments or tariff surprises that alter risk sentiment and capital flows could drive short-term volatility in HKD crosses.