Outlook

The HKMA continues to defend the HKD peg to the USD, with policy actions expected to remain active as needed. Peg stability remains the baseline given ongoing interventions and solid offshore demand from Mainland investors. Near-term moves are likely to stay range-bound around current levels, unless a larger shift in US policy, global risk sentiment, or cross-border capital flows pressures the peg.

Key drivers

• HKMA FX interventions to defend the peg, including past large-scale HKD purchases and balance sheet actions.

• Prior peg pressure in mid-2025 followed by intervention-driven stabilization, with the peg framework still tested by external shocks.

• Interest rate dynamics tied to interventions and capital flows, notably increased local interbank rates when demand from Mainland investors rose.

• Global factors such as US tariff announcements and capital-flow volatility that can test HKD stability and prompt corrective HKMA action.

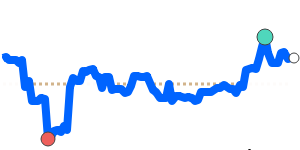

Range

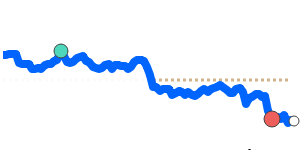

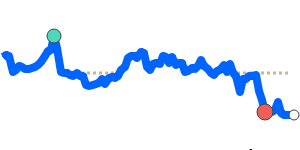

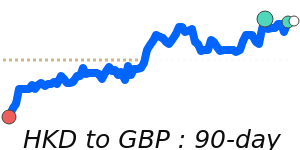

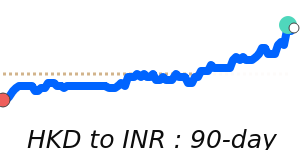

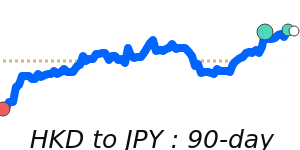

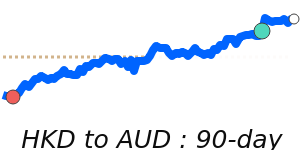

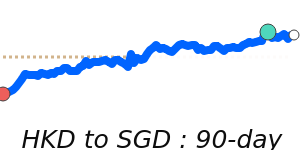

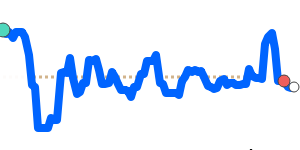

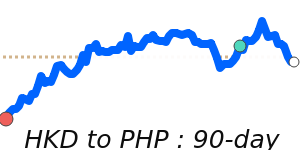

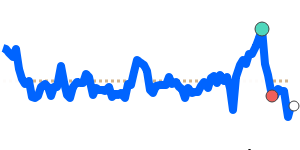

HKD/USD is at 0.1279, near 90-day lows and just below its 3-month average, having traded in a stable 0.6% range from 0.1279 to 0.1287. HKD/EUR at 0.1078 is 1.6% below its 3-month average of 0.1095, with a range of 0.1065 to 0.1116 (a 4.8% range). HKD/GBP at 0.093704 is 1.9% below its 3-month average of 0.095556, trading within 0.092640 to 0.098365 (a 6.2% range). HKD/JPY at 19.53 is 2.5% below its 3-month average of 20.04, within 19.52 to 20.40 (a 4.5% range).

What could change it

• Further HKMA intervention or changes to balance-sheet stance that alter currency liquidity.

• Shifts in US monetary policy or a stronger USD that widen the USD/HKD differential.

• Changes in Mainland demand or cross-border capital flows affecting HKD demand.

• Global risk sentiment, tariff developments, or other shocks impacting HK financial markets.

• Domestic financial stability developments or property-market dynamics influencing carry and capital flows.