Outlook

The yen is likely to remain in a broad range against the dollar in the near term, with volatility flaring around policy and intervention headlines. The BoJ’s December 2025 rate hike to 0.75% and its two-year quantitative tightening plan support domestic yields and can underpin the yen in risk-off sessions, but a strong USD backdrop and ongoing speculation of official intervention keep downside and intraday spikes possible. The U.S. Treasury’s FX monitoring addition to Japan adds a layer of scrutiny that could amplify sudden moves if authorities act.

Key drivers

• BoJ policy stance and QT: The BoJ raised its policy rate to 0.75% in December 2025 and announced a two-year QT plan, reducing government bond purchases by about 400 billion yen per quarter. Policy shifts and tighter balance-sheet dynamics remain key influences for the yen’s path.

• Intervention speculation and fiscal policy risk: Yen volatility surged on speculation of potential official intervention in January 2026, ahead of elections on February 8. Fiscal-policy chatter around that period can continue to spark knee-jerk moves.

• US policy backdrop and FX monitoring: The U.S. Treasury placed Japan on its FX monitoring list, underscoring cross-border sensitivities and the potential for spillovers if intervention is perceived as destabilizing.

• Market positioning and technicals: Recent action shows the yen oscillating within a broad range as markets price policy differentials and intervention risk, with eyes on how carry dynamics evolve as events unfold.

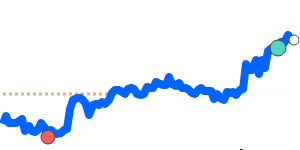

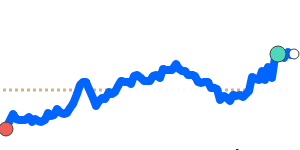

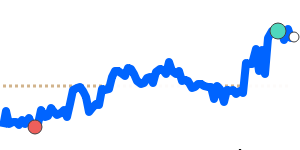

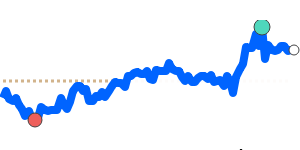

Range

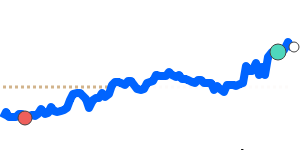

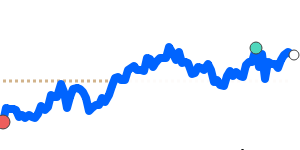

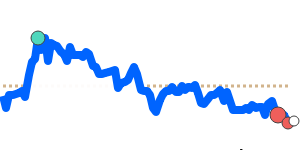

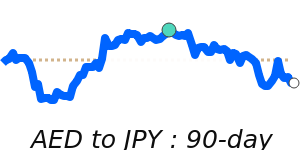

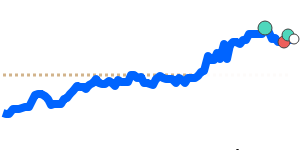

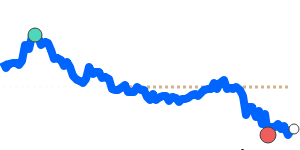

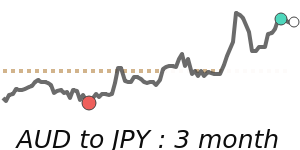

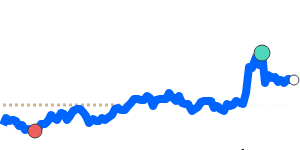

Current quotes for key JPY pairs are as follows: JPY to USD 0.006472, 1.1% above its 3-month average of 0.006401, trading in a 0.006284–0.006566 range (about a 4.5% band). JPY to EUR 0.005445, just below its 3-month average, within a 0.005370–0.005576 range (about a 3.8% band). JPY to GBP 0.004749, at 30-day highs near 0.004749 and just 0.5% below its 3-month average of 0.004771, within a 0.004666–0.004921 range (about a 5.5% band).

What could change it

• Surprise BoJ policy shift or communication: A hawkish or dovish turn, or clearer guidance on policy normalization, could move USD/JPY and other JPY pairs.

• Credible official intervention or FX stabilization plan: A clear, credible intervention or signals of readiness to act could generate sharp yen gains or reversals.

• Shifts in US-Japan rate differentials: A meaningful change in Fed path or U.S. yields versus Japanese yields would alter carry dynamics and the yen’s direction.

• Market sentiment and risk flows: Sudden shifts in global risk appetite or geopolitical developments can drive rapid, large moves in yen crosses.