Outlook

The Mexican peso is expected to remain relatively stable in 2026, with forecasts pointing to a range of roughly 18 to 20 pesos per U.S. dollar. This outlook reflects Mexico’s ongoing economic performance, Banxico’s commitment to inflation control, and the trajectory of U.S. monetary policy. The nearshoring trend and higher foreign direct investment in Mexico’s manufacturing sector are supportive for peso demand. In the near term, MXN exchange rates sit near the upper end of recent ranges against major peers, signaling modest strength but limited upside without a shift in policy or risk appetite.

Current price data show MXN/USD around 0.0581 USD per MXN (roughly 1 USD ≈ 17.2 MXN), MXN/EUR around 0.0490 USD per MXN (1 EUR ≈ 20.4 MXN), MXN/GBP around 0.0427 USD per MXN (1 GBP ≈ 23.4 MXN), and MXN/JPY near 8.91 JPY per MXN (7-day view). These levels are each trading within multi-month ranges, with MXN/USD, MXN/EUR and MXN/GBP hovering near the upper ends of their ranges and MXN/JPY showing modest strength despite recent volatility.

Key drivers

- Stable exchange rate outlook supported by Banxico’s anti-inflation stance and a predictable U.S. rate path.

- Interest-rate differentials: Banxico’s 2025 easing (about 150 basis points to 7.50%) versus the U.S. Federal Reserve’s rate trajectory influence the peso’s yield appeal.

- Trade relations and tariffs: U.S. tariffs on Mexican imports create uncertainty; Mexico is negotiating delays to mitigate potential peso volatility.

- Nearshoring and foreign investment: Rising manufacturing investment in Mexico strengthens demand for Mexican assets.

- Valuation signals: current MXN levels are modestly above their 3-month averages against the USD and other major currencies, indicating slight firmness but limited upside without new catalysts.

Range

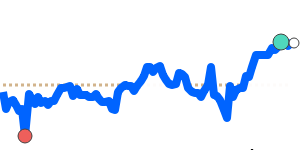

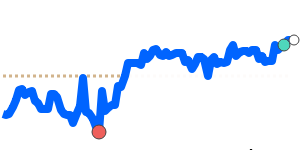

MXN/USD is at 0.058146, which is 3.9% above its 3-month average of 0.055952, after trading in a relatively stable 7.8% range from 0.054040 to 0.058279.

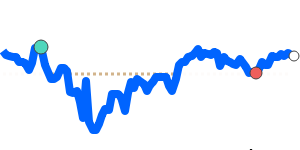

MXN/EUR is at 0.048967, which is 2.5% above its 3-month average of 0.047771, after trading in a stable 4.9% range from 0.046825 to 0.049108.

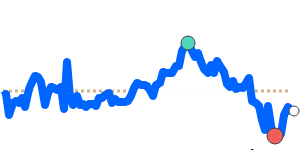

MXN/GBP is at 0.042683, which is 2.4% above its 3-month average of 0.041679, after trading in a stable 4.2% range from 0.040994 to 0.042716.

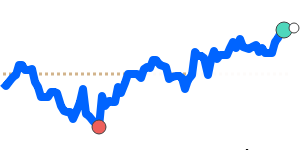

MXN/JPY is near 7-day lows at 8.9087, which is 1.9% above its 3-month average of 8.7385, after trading in a fairly volatile 8.5% range from 8.4232 to 9.1351.

What could change it

- A shift in U.S. monetary policy (accelerated or delayed Fed rate cuts) could alter carry and overall risk appetite for EM currencies.

- Banxico policy surprises (inflation surprises, faster or slower tightening) would shift Mexico’s rate dynamics and attractiveness.

- Changes in U.S.-Mexico trade policy (reinstatement or escalation of tariffs) could impact near-term peso volatility.

- A shift in nearshoring momentum or foreign investment flows (positive or negative) would affect demand for MXN assets.

- Global risk sentiment and commodity price moves can drive broad EM risk appetite, influencing MXN performance.