MYR Market Update

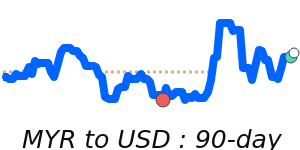

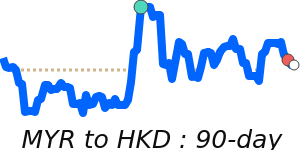

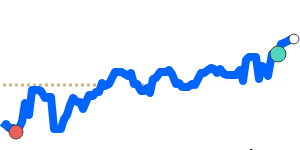

The Malaysian Ringgit has been holding steady, with some signs of slight strength against major currencies. Recently, MYR reached its highest point in a month against the US dollar, trading near 0.2534, which is about 1.4% above its 3-month average. This reflects Malaysia’s solid economic outlook, buoyed by ongoing fiscal efforts and stable monetary policy.

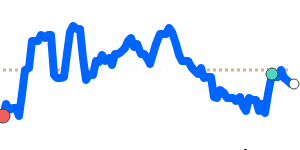

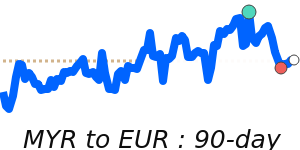

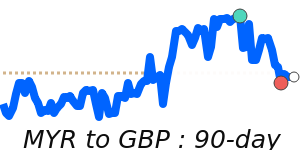

against the Euro and British pound, the MYR is also somewhat stronger, trading about 2.5% and 2.1% above its three-month averages respectively. These moves show a consistent trend of the ringgit gaining ground, supported by Malaysia’s resilient domestic demand and cautious optimism about the economy in 2026.

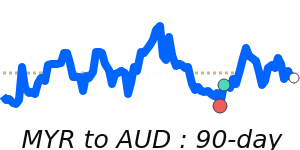

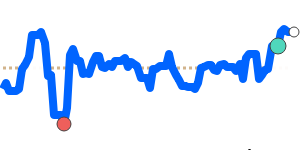

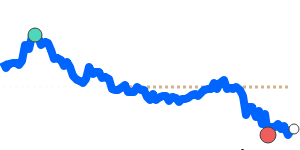

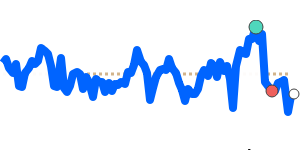

Compared to the Japanese yen and Australian dollar, the ringgit remains above average but with less volatility, trading around 39.99 and 0.3601 respectively. This stability indicates a cautious but positive sentiment, with no major shocks in recent weeks.

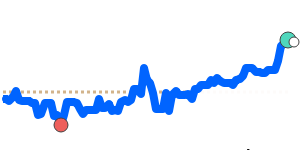

Overall, the MYR's recent performance suggests steady positioning supported by Malaysia's economic resilience and fiscal discipline, with a bias toward continued strength in the near term.