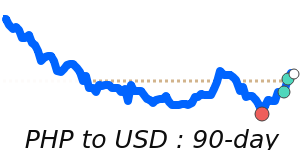

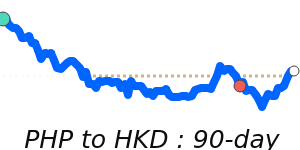

The Philippine Peso remains relatively stable against major currencies, trading close to recent averages. against the US dollar, PHP has dipped slightly below the 3-month average, with the rate at around 0.01694 USD, just 0.5% below its typical level. This reflects a period of subdued movement amid ongoing domestic challenges and cautious investor sentiment due to protests and economic uncertainties.

The peso is also holding near its average against the Euro, with a rate of approximately 0.01457 EUR, just 0.6% above the three-month average. The currency's performance against the pound and yen is similarly stable, hovering close to their respective averages, indicating a lack of sharp fluctuations despite the challenging environment.

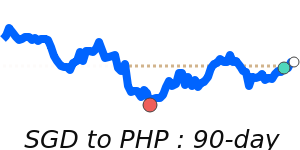

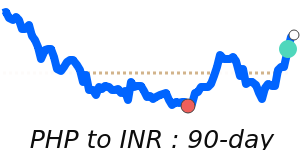

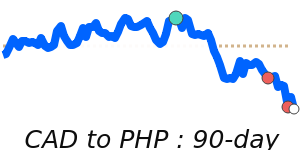

Notably, the peso has weakened slightly relative to the Australian dollar and Canadian dollar, trading around 0.02407 AUD and 0.02300 CAD, both below their recent averages by about 3%. Meanwhile, against the Indian rupee, PHP remains close to its three-month average, at approximately 1.5571.

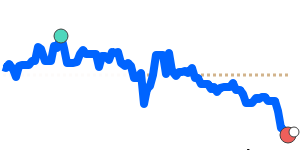

Overall, while global and domestic factors continue to exert pressure on the peso, recent data shows a period of relative stability within narrow trading ranges. Importers and exporters should remain attentive to potential volatility stemming from ongoing protests and monetary policy outlooks.