Outlook

The PLN is likely to stay in a cautious stance as inflation continues to ease and the NBP’s easing cycle has already delivered cuts in 2025. Growth prospects remain supported by EU funds and recovering exports, but political uncertainty under the Nawrocki administration and mixed trade signals keep the zloty range-bound.

Key drivers

- Inflation easing supports policy flexibility, with inflation at 2.8% in October 2025, helping the NBP’s stance to remain accommodative.

- The NBP has already cut rates in 2025 (50 basis points to 5.25% in May, then 25 basis points to 5.00% in July), aiming to spur growth as inflation slows.

- Growth outlook brightens for 2026, aided by EU funds, resilient domestic demand, and improving exports.

- Political developments under President Nawrocki (elected August 2025) add a layer of uncertainty and affect reform momentum and market sentiment.

- Trade dynamics remain mixed, with a swing from a €4.6 billion H1 2024 surplus to a February 2025 deficit, influencing near-term FX flows alongside GDP growth expectations.

Range

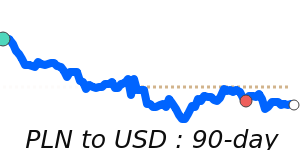

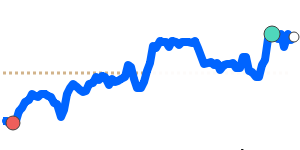

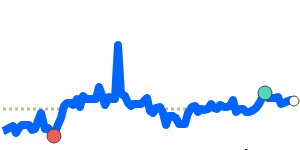

PLN/USD at 0.2817, 1.5% above its 3-month average of 0.2775, having traded in a 5.5% range from 0.2717 to 0.2867.

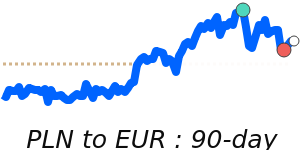

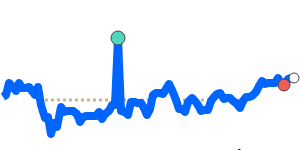

PLN/EUR at 0.2372, near its 3-month average, within a 1.1% range from 0.2358 to 0.2383.

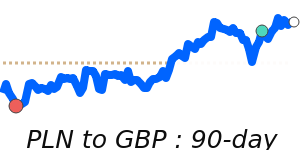

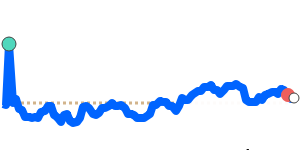

PLN/GBP at 0.2068, at 14-day highs near the 3-month average, within a 2.3% range from 0.2043 to 0.2089.

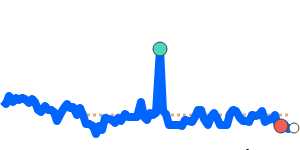

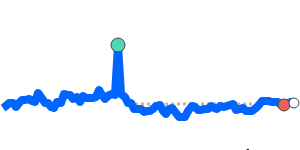

PLN/JPY at 43.14, a 60-day low, within a 4.3% range from 42.49 to 44.33.

What could change it

- A sharper-than-expected change in inflation (up or down) or a shift in NBP policy stance beyond current expectations.

- Improvements or setbacks in the political reform agenda affecting market confidence.

- a stronger or weaker external backdrop (e.g., commodity shocks, risk appetite) that alters risk sentiment and cross-border flows.