Outlook

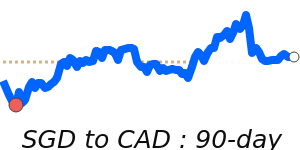

The SGD is likely to stay in a modest range near current levels in the near term. USD/SGD is testing the upper end of the recent range, with SGD/USD near 7-day highs around 0.7904, about 1.7% above the 3-month average of 0.7771, and the pair trading within a stable 3.8% range (0.7644–0.7934). SGD remains broadly supported by Singapore’s resilient growth and contained inflation, but policy accommodation from the MAS and external trade headwinds can cap gains.

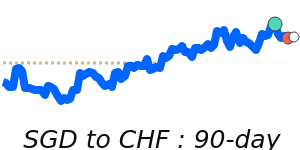

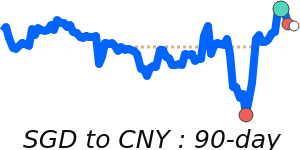

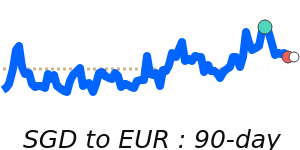

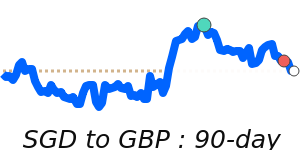

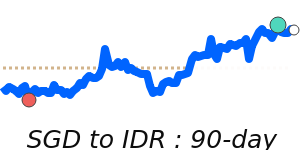

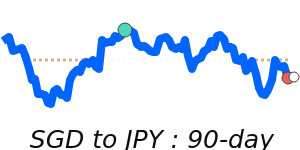

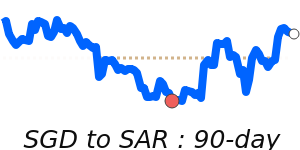

Dollar- and euro-based pairings show the SGD holding within well-defined bands: SGD/EUR around 0.6647 (near its 3-month average; range 0.6593–0.6696), SGD/GBP around 0.5796 (near its 3-month average; range 0.5730–0.5863), and SGD/JPY around 122.1 (0.6% above its 3-month average of 121.4; range 118.8–123.8). Domestic momentum remains positive on growth (Q4 2024 GDP up 5%), while inflation stayed subdued (core inflation 0.8% year-on-year in January 2025), allowing MAS to maintain an accommodative stance. External risks persist, notably trade policy developments affecting Singapore’s export-led economy.

These factors together imply the SGD could drift with shifts in domestic momentum, inflation signals, and external trade dynamics, rather than break decisively from the current ranges.

Key drivers

- MAS policy stance remains accommodative after the slope reduction in January 2025, supporting growth but weighing on SGD vs the USD.

- Singapore’s economy showed resilience with 5% growth in Q4 2024, underpinning SGD with fundamentals.

- External trade headwinds persist from US trade measures (tariffs on Singapore imports) that can temper SGD strength.

- Inflation stayed subdued (core inflation 0.8% YoY in January 2025), giving MAS room to stay accommodative.

Range

SGD/USD: 0.7644–0.7934; current near 0.7904 (7-day high)

SGD/EUR: 0.6593–0.6696; current near 0.6647

SGD/GBP: 0.5730–0.5863; current near 0.5796

SGD/JPY: 118.8–123.8; current near 122.1

What could change it

- A material shift in MAS policy in response to inflation or growth surprises (more tightening or more easing).

- A substantial change in Singapore’s external trade environment (e.g., resolution or escalation of US-Singapore trade tensions).

- A surprise inflation uptick or slowdown that alters the MAS inflation outlook.

- A shift in global rate expectations or risk sentiment that strengthens or weakens USD broadly.

- Significant new economic data from Singapore influencing domestic growth expectations.