USD/TRY Outlook:

The USD/TRY rate is likely to increase as it is currently trading above its recent average and near recent highs, supported by strong US economic data.

Key drivers:

• Rate gap: The US Federal Reserve's interest rate policy remains focused on maintaining higher rates, while the Central Bank of Turkey has recently cut its benchmark rate.

• Risk/commodities: Ongoing geopolitical tensions, particularly regarding the possibility of US military action in the Middle East, are bolstering demand for the safe-haven USD.

• One macro factor: The latest US GDP growth print is anticipated to show slower growth, which may create uncertainty in the USD's sustained strength.

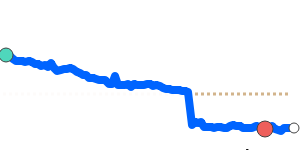

Range:

Expect USD/TRY to test extremes within its recent 3-month range, moving between established levels.

What could change it:

• Upside risk: A surprising increase in US economic growth data might further strengthen the USD.

• Downside risk: A significant improvement in Turkey's inflation outlook or a more aggressive monetary policy shift could support the TRY.