Outlook

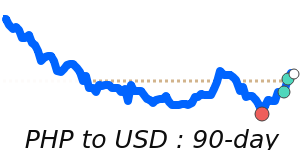

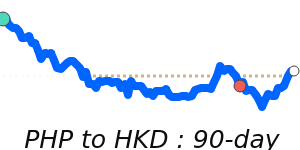

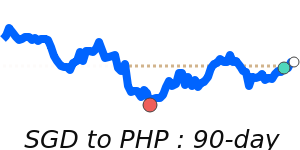

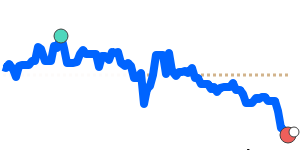

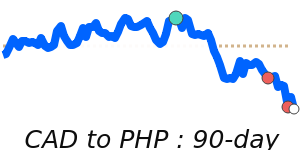

The Philippine peso faces near-term pressure from expectations of BSP rate cuts and ongoing growth/governance concerns. Markets have priced in a 25 basis-point cut, following a January 15 move that saw the peso slip to a fresh low around PHP59.46 per USD. BSP Governor Remolona Jr. has signaled that the central bank will not defend a specific level, suggesting the currency could drift toward PHP60 per USD if moves remain orderly. MUFG Bank Ltd. now forecasts a weaker peso toward PHP60 per USD, citing weaker growth and corruption-related spending risks. A sharp rise in derivatives activity in January points to stronger policy transmission and potentially higher volatility. Spot price action shows PHP/USD around 60-day highs, with the pair near 0.017095 USD per PHP (about 0.7% above the 3-month average), trading within a tight range recently.

Key drivers

- MUFG Bank Ltd. forecast the peso weakening toward PHP60 per USD due to concerns over economic performance and corruption-related spending risks.

- BSP stance that it does not automatically defend any specific level, allowing drift toward PHP60 if orderly.

- January 15 move to a new low around PHP59.46 per USD amid rate-cut expectations.

- Derivatives trading in the PHP interest rate swap market surged about 60x to PHP43.5 billion in January, signaling a structural shift in monetary policy transmission.

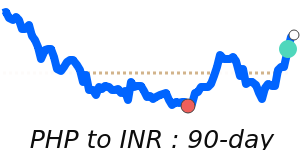

Range

PHP/USD is at 0.017095, a 60-day high and about 0.7% above the 3-month average of 0.016968, having traded in a stable 60-day range from 0.016796 to 0.017101 (roughly 1.8% range).

PHP/EUR is at 0.014378, about 0.8% below the 3-month average of 0.014493, with a stable 4.8% range from 0.014088 to 0.014771.

PHP/GBP is at 0.012537, about 0.9% below the 3-month average of 0.012648, trading in a relatively stable 6.1% range from 0.012249 to 0.012995.

PHP/JPY is at 2.6409, just below the 3-month average, with a quiet 4.4% range from 2.5814 to 2.6939.

What could change it

- Unexpected BSP policy shift, such as delaying or accelerating rate cuts, or changes to the inflation/fiscal policy outlook.

- A material change in domestic data (growth, inflation, remittances) or governance issues that alter risk premiums.

- A shift in global risk appetite or U.S. dollar dynamics that broadens or compresses EMFX flows.

- Resolution or escalation of corruption-related concerns that affect government spending credibility and fiscal outlook.