Outlook

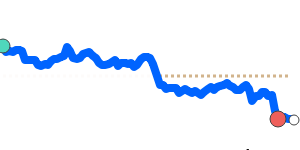

The US dollar has moved higher after January payrolls surprised to the upside, but the longer-term path remains mixed. A paused path for U.S. rate cuts leaves the dollar vulnerable to shifts in global risk sentiment and the growing trend of de-dollarization, which could cap sustained USD strength even as domestic data stay solid. Markets will keep a close eye on US initial jobless claims next, as a fresh signal on the health of the labor market could swing near-term USD moves.

Global headwinds include the shift by BRICS and other central banks toward more local-currency settlements, plus ongoing geopolitical tensions that can spur risk-off flows. A higher oil price reinforces inflation concerns and can influence rate expectations, adding another layer of complexity for USD direction. In short, near-term moves for the USD may be choppy, with the direction tied to data surprises and policy signaling.

Key drivers

- January payrolls beat forecasts (130,000 vs 70,000) with unemployment easing to 4.3%, supporting some near-term USD strength.

- The Federal Reserve paused rate cuts in late January, keeping the range at 3.5%–3.75% and keeping policy expectations sensitive to inflation signals.

- Global de-dollarization pressures persist: BRICS planning more trade in local currencies and central banks net selling USD reserves, shrinking the dollar’s share of global reserves.

- Geopolitical tensions and tariff threats add to risk-off considerations that can weigh on USD during periods of heightened uncertainty.

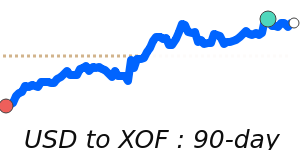

- Oil remains upbeat: at 70.26, a 90-day high, oil prices can influence inflation expectations and risk sentiment, with mixed implications for the dollar depending on broader market tone.

Current price context shows the dollar holding below recent ranges against major peers, with notable structural headwinds from de-dollarization and policy uncertainty.

Range

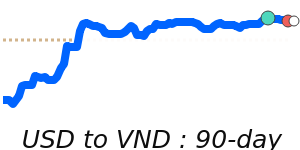

USD to EUR is 0.8421, about 1.4% below its 3-month average of 0.8539, having traded within a 0.8312–0.8684 range over the past 3 months.

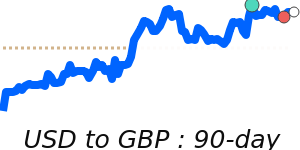

USD to GBP is 0.7340, about 1.5% below its 3-month average of 0.7451, with a 0.7227–0.7663 range.

USD to JPY is around 153.2 (7-day low), about 1.9% below its 3-month average of 156.2, trading in a 152.3–159.1 range.

Oil is 70.26, a 90-day high, about 10.3% above its 3-month average of 63.72, with a wide price range from 59.04 to 70.26 over the period (roughly a 19% intraday range).

What could change it

- A surprise in US initial jobless claims or payroll data that shifts the view on the health of the labor market.

- A shift in Fed communications or policy expectations (hawkish or dovish guidance) that alters rate-path expectations.

- Renewed de-dollarization momentum (e.g., BRICS actions or central-bank reserve shifts) or new collateral implications for dollar liquidity.

- Escalation or easing of geopolitical tensions that impact risk sentiment and safe-haven demand.

- Sharp moves in oil prices that feed through to inflation expectations and Fed pricing.