Outlook

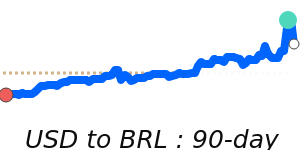

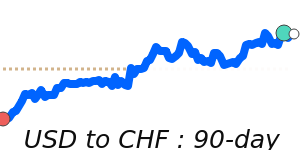

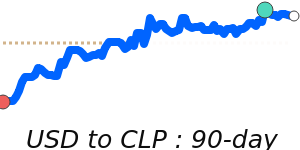

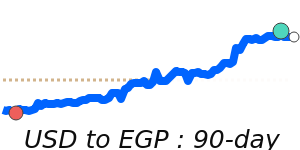

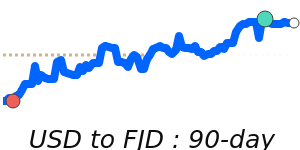

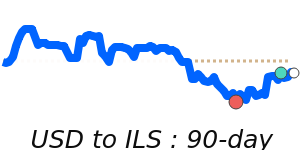

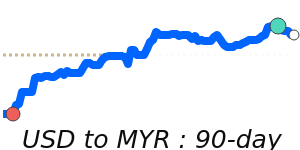

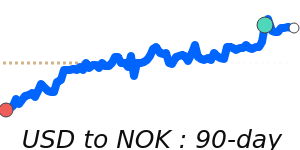

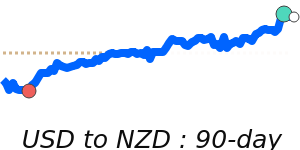

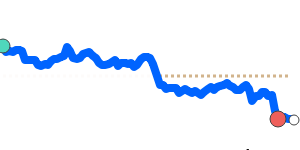

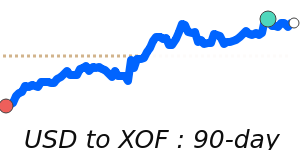

Outlook The US dollar remains rangebound amid a soft December retail sales print and a cautious stance from the Federal Reserve. A broader shift away from USD exposure, driven by de-dollarization and geopolitical tensions, supports the case for a contained dollar move unless upcoming data surprise. The Friday non-farm payrolls report will be a key catalyst: a weak print could push USD lower, while a stronger result could renew upside momentum.

Key drivers

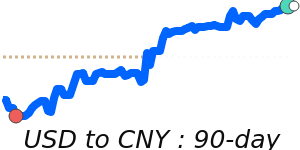

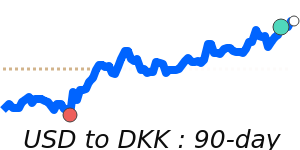

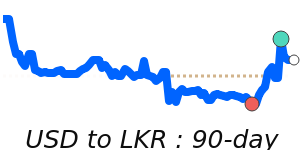

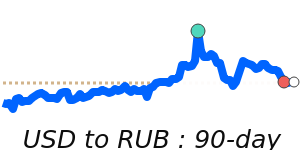

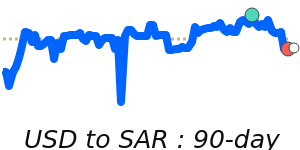

Key drivers The Federal Reserve held policy at 3.5%–3.75% on January 28, with inflation around 2.7% and a tight labor market, reinforcing a cautious path but limiting near-term USD rallies. In January, investor positioning shifted away from US assets as geopolitical tensions and policy concerns weighed on USD demand. Global de-dollarization continued, with BRICS plans to raise the share of internal trade settled in local currencies and central banks net selling dollars in January, dropping the dollar’s share to 58.2% (the lowest since 1995). Geopolitical tensions—such as tariff threats from the Trump administration—added to USD softness. Recent price data also reflects a still-tight USD narrative: markets note the USD’s range against major pairs amid evolving risk sentiment.

Range

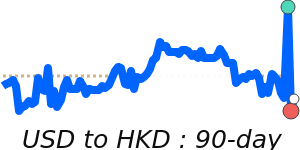

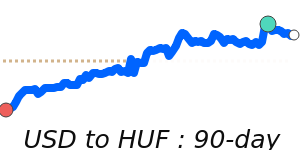

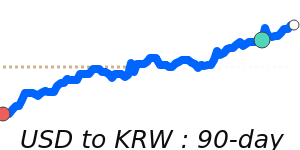

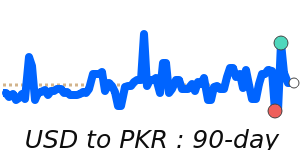

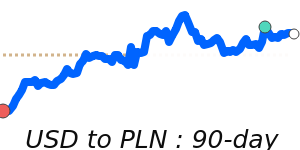

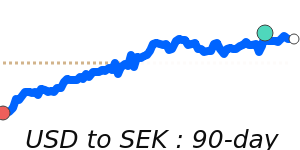

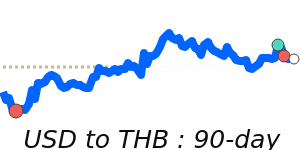

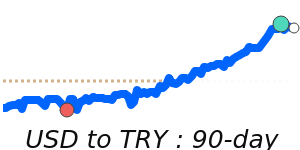

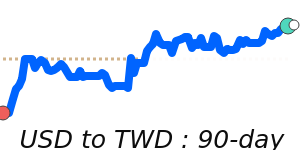

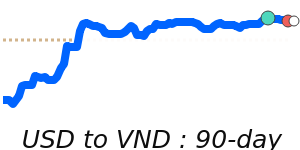

Range USD/EUR 0.8412; 1.5% below its 3-month average of 0.8541, within a 3-month range of 0.8312 to 0.8684.

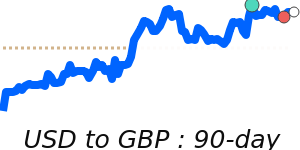

USD/GBP 0.7335; 1.6% below its 3-month average of 0.7454, within a 3-month range of 0.7227 to 0.7663.

USD/JPY 154.5; 1.1% below its 3-month average of 156.2, within a 3-month range of 152.3 to 159.1.

Brent Crude OIL/USD 69.05; 7-day highs, 8.6% above its 3-month average of 63.6, within a volatile 3-month range from 59.04 to 69.09.

What could change it

What could change it A stronger-than-expected January non-farm payrolls print would support the USD, while a weaker figure could weigh on it. Ongoing de-dollarization signals—if BRICS and other major economies push further toward local-currency settlements or central banks accelerate dollar diversification—would add downside pressure. Shifts in Federal Reserve messaging or policy expectations (any hawish tilt or new rate cuts) would drive USD moves. Oil price swings and related risk sentiment could also tilt currency directions, and geopolitical developments (new tariffs or sanctions) may inject volatility into the dollar.