![]()

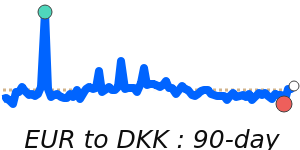

![]() The EUR to DKK exchange rate has been exhibiting some stability recently, currently trading near 7.4628. This value is close to its 14-day lows and aligns with its three-month average, indicating a relatively narrow trading range of 0.6% between 7.4569 and 7.5010. Analysts note that the fixed exchange rate policy of the Danish kroner provides predictability for businesses engaged in international transactions, although it limits the Danish central bank's ability to respond flexibly to economic changes.

The EUR to DKK exchange rate has been exhibiting some stability recently, currently trading near 7.4628. This value is close to its 14-day lows and aligns with its three-month average, indicating a relatively narrow trading range of 0.6% between 7.4569 and 7.5010. Analysts note that the fixed exchange rate policy of the Danish kroner provides predictability for businesses engaged in international transactions, although it limits the Danish central bank's ability to respond flexibly to economic changes.

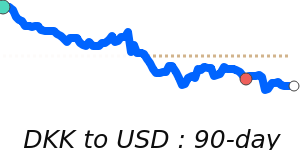

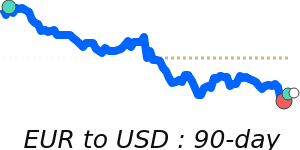

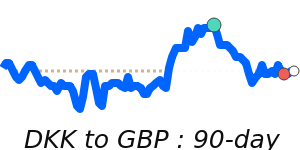

The euro (EUR) has faced downward pressure, particularly influenced by a strengthening US dollar (USD). Recent economic data showed a positive upward trend in US GDP, which contributed to the USD's gains and, correspondingly, the EUR's decline. Without supportive data for the euro, its ability to hold strength against the dollar has been challenged. The upcoming Eurozone CPI figures are anticipated to play a significant role; if inflation continues to cool, the euro could see further weakness, while stubbornly high prices may help support its value.

Global geopolitical tensions, including the ongoing conflict in Ukraine, remain a significant factor affecting the euro's performance. The EU's economic stability is continuously challenged by the repercussions of sanctions and energy supply disruptions, which have compounded inflationary pressures and hindered growth prospects. Analysts indicate that resolutions to such geopolitical tensions might enhance investor confidence in the euro, while the persistence of conflicts could further destabilize its value.

The recent fluctuation in oil prices, with crude trading at 90-day lows around 61.29 and significantly lower than its three-month average, indicates additional economic stress. As oil prices affect transportation costs and overall economic sentiment in the Eurozone, such trends could indirectly influence the euro's stability against the DKK.

Moving forward, the euro's trajectory will hinge on several crucial factors, including the European Central Bank's monetary policy interventions, inflation control, and the overall economic health of major Eurozone nations. Despite the DKK's relative stability due to its pegged nature, softening pressures on the EUR could translate into minor fluctuations in the EUR/DKK exchange rate, depending on macroeconomic developments and market sentiment.

Loading rates...

|

|

|

DKK to EUR Market Data

Danish krone (DKK) to Euro (EUR) market data - latest interbank exchange rate, trend, chart & historic rates.

Compare & Save - Danish krone to Euro

Exchange rates can vary significantly between different currency exchange providers, so it's important to compare Danish krone (DKK) to Euro (EUR) rates from different sources before making a conversion.

Use our DKK to EUR calculator to see how much you could save on your international money transfers. makes it easy to compare the Total Cost you are being charged on Krone to Euro currency rates and the possible savings of using various providers.

| Date | DKK/EUR | Period |

|---|---|---|

19 Apr 2025 | 0.1339 | 2 Week |

02 Feb 2025 | 0.1340 | 3 Month |

03 May 2024 | 0.1340 | 1 Year |

04 May 2020 | 0.1340 | 5 Year |

06 May 2015 | 0.1335 | 10 Year |

08 May 2005 | 0.1346 | 20 Year |

Will the Danish krone rise against the Euro?

It is almost impossible to predict what an exchange rate will do in the future, the best approach is to monitor the currency markets and transact when an exchange rate moves in your favour.

To help with this you can add DKK/EUR to your personalised Rate Tracker to track and benefit from currency movements.

Rather than requiring you to set a target rate, our Rate Alerts keep you informed of recent trends and movements of currency pairs.

Add rates to your Rate Tracker and select to receive an daily email (mon-fri) or when a rate is trending

Related exchange rate forecasts

BER articles that mention the Euro (EUR):

The U.S. Dollar Is Losing Ground to the Euro — And the World Is Watching

Deutsche Bank forecasts a significant weakening of the US dollar in the coming years, potentially reaching its lowest level against the euro in over a decade.

US Dollar Hits Three-Year Low On Jerome Powell Dismissal Threat

The US dollar has fallen to a three-year low, influenced by Trump policy back flips plus concerns over the Federal Reserve's independence. Analysts suggest a long-overdue correction due to overvaluation and trade tensions.

Further reading on the Euro (EUR) - Guides, Reviews & News from our research team.

Forecasts disclaimer: Please be advised that the forecasts and analysis of market data presented on BestExchangeRates.com are solely a review and compilation of forecasts from various market experts and economists. These forecasts are not meant to reflect the opinions or views of BestExchangeRates.com or its affiliates, nor should they be construed as a recommendation or advice to engage in any financial transactions. Read more