![]()

![]() The exchange rate forecasts for the Hong Kong dollar (HKD) to Philippine peso (PHP) reflect a mixed outlook amidst various economic factors affecting both currencies. The HKD has remained stable against the US dollar, despite facing some downward pressure due to the ongoing uncertainties in the US Federal Reserve's interest rate policy. Analysts have noted that while the Hong Kong government has initiated measures to boost the economy and restore its status as a financial hub, the anticipated recovery in the property market may be slow, further impacting domestic demand.

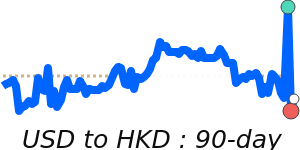

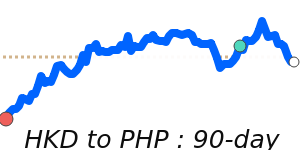

The exchange rate forecasts for the Hong Kong dollar (HKD) to Philippine peso (PHP) reflect a mixed outlook amidst various economic factors affecting both currencies. The HKD has remained stable against the US dollar, despite facing some downward pressure due to the ongoing uncertainties in the US Federal Reserve's interest rate policy. Analysts have noted that while the Hong Kong government has initiated measures to boost the economy and restore its status as a financial hub, the anticipated recovery in the property market may be slow, further impacting domestic demand.

Recent policy announcements by Hong Kong's Chief Executive aim to revitalize the local economy, but experts caution that significant improvement will depend on broader economic recovery and a potential reduction in interest rates. With current inflation rates easing to sub-2% levels and muted labor market recovery, the HKD's strength might be constrained unless these economic challenges are effectively addressed.

On the other hand, the Philippine peso is facing headwinds partly due to external factors such as tariffs and overall weaker external balances, leading some economists to forecast depreciation against the USD and by extension, could impact the HKD to PHP rate. The peso's performance has also been marred by political uncertainties related to upcoming mid-term elections and its struggle to gain from global supply chain shifts, unlike other Asian economies.

As per recent data, the HKD to PHP exchange rate has recently dipped to 90-day lows at 7.1823, which is about 2.6% below its 3-month average of 7.3777. This indicates a potential bearish sentiment in the market for the HKD against the PHP, reflecting a trading range stability within a relatively narrow band of 4.6%. Market analysts are closely monitoring these trends, suggesting that while the Hong Kong dollar might hold its ground against potential depreciation pressures from the peso, the overall outlook remains uncertain. Future movements will likely depend on the efficacy of Hong Kong's economic policies, interest rate decisions from the Fed, and ongoing global economic dynamics.

Loading rates...

|

|

|

PHP to HKD Market Data

Philippine peso (PHP) to Hong Kong dollar (HKD) market data - latest interbank exchange rate, trend, chart & historic rates.

Compare & Save - Philippine peso to Hong Kong dollar

Exchange rates can vary significantly between different currency exchange providers, so it's important to compare Philippine peso (PHP) to Hong Kong dollar (HKD) rates from different sources before making a conversion.

Use our PHP to HKD calculator to see how much you could save on your international money transfers. makes it easy to compare the Total Cost you are being charged on Peso to Hong Kong dollar currency rates and the possible savings of using various providers.

| Date | PHP/HKD | Period |

|---|---|---|

12 Apr 2025 | 0.1356 | 2 Week |

26 Jan 2025 | 0.1337 | 3 Month |

26 Apr 2024 | 0.1358 | 1 Year |

27 Apr 2020 | 0.1531 | 5 Year |

29 Apr 2015 | 0.1751 | 10 Year |

01 May 2005 | 0.1441 | 20 Year |

Will the Philippine peso rise against the Hong Kong dollar?

It is almost impossible to predict what an exchange rate will do in the future, the best approach is to monitor the currency markets and transact when an exchange rate moves in your favour.

To help with this you can add PHP/HKD to your personalised Rate Tracker to track and benefit from currency movements.

Rather than requiring you to set a target rate, our Rate Alerts keep you informed of recent trends and movements of currency pairs.

Add rates to your Rate Tracker and select to receive an daily email (mon-fri) or when a rate is trending

Related exchange rate forecasts

BER articles that mention the Hong Kong dollar (HKD):

How the Weak US Dollar Can Impact International Business in 2025

Markets have shifted focus to the interest rate policies of other major central banks rather than the Federal Reserve.

Hong Kong Reverts to More Lenient Travel Restrictions

Recognising the impact of Covid-19 on its financial status, Hong Kong has reverted back to more lenient travel restrictions to improve life for both residents and travelers.

Further reading on the Hong Kong dollar (HKD) - Guides, Reviews & News from our research team.

Forecasts disclaimer: Please be advised that the forecasts and analysis of market data presented on BestExchangeRates.com are solely a review and compilation of forecasts from various market experts and economists. These forecasts are not meant to reflect the opinions or views of BestExchangeRates.com or its affiliates, nor should they be construed as a recommendation or advice to engage in any financial transactions. Read more