Outlook

The CAD sits buoyed by firmer oil prices, with the loonie likely to track crude moves in the near term as data remains limited. A sustained oil rally could push USD/CAD toward the upper end of recent ranges, while softer oil could pull it back. Overall, CAD direction will hinge on oil trends and broader risk appetite, with February 2026 data due to influence volatility.

Key drivers

- Oil price moves: Brent Crude OIL/USD is at 69.05, near 7-day highs and about 8.6% above its 3-month average (range 59.04 to 69.09). Higher oil supports the CAD, given Canada’s role as a major oil exporter.

- Monetary policy divergence: The Bank of Canada has kept policy cautious, with a 2.75% rate stance since July 2025 and inflation seen stabilizing near 2% in the medium term.

- Trade relations: U.S. tariffs on Canadian goods (and Canada’s retaliation) add a vulnerability channel for CAD, potentially limiting gains if trade tensions escalate.

- Market data flow: February 2026 will bring key employment, inflation, and central-bank communications that can heighten CAD volatility.

- USD and global risk sentiment: CAD often moves with broader risk sentiment and U.S. policy expectations, given Canada’s close trade ties with the U.S.

Range

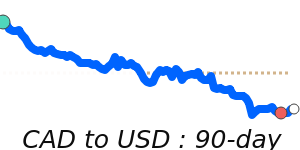

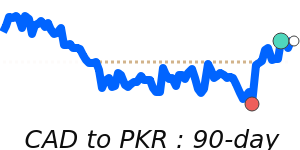

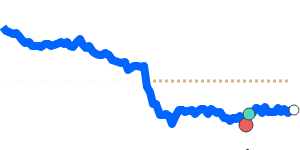

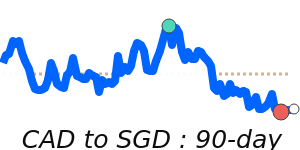

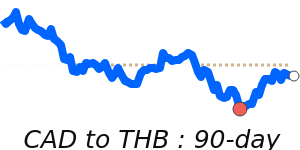

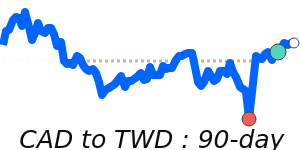

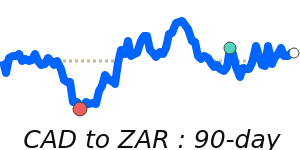

CAD to USD is at 7-day highs near 0.7378, 1.9% above its 3-month average of 0.7238, having traded in a stable 4.6% range from 0.7087 to 0.7413.

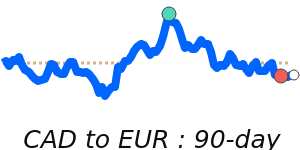

CAD to EUR is at 30-day highs near 0.6207, just above its 3-month average, within a 1.6% range from 0.6120 to 0.6217.

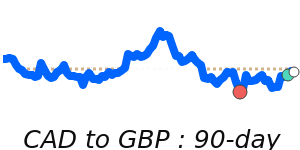

CAD to GBP is at 30-day highs near 0.5412, just above its 3-month average, within a 2.4% range from 0.5322 to 0.5451.

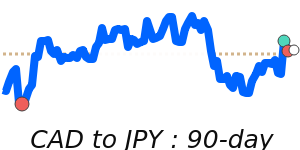

CAD to JPY is at 114.0, just 0.8% above its 3-month average of 113.1, having traded in a quite stable 4.7% range from 110.1 to 115.3.

Oil price/work price range: Brent Crude OIL/USD at 69.05, near 7-day highs and 8.6% above its 3-month average (range 59.04 to 69.09).

What could change it

- Oil price reversals: A sustained move lower or a sharp jump in oil could quickly shift CAD momentum.

- BoC policy surprises: Signals of sooner tightening or material changes to inflation/ growth outlook could strengthen or weaken CAD.

- U.S. policy and data: Strong U.S. data or a hawkish Fed stance could lift the USD, pressuring CAD; softer U.S. data or rate cuts could support CAD.

- Trade developments: Resolution or escalation of U.S.-Canada trade tensions could alter CAD risk positioning.

- Domestic indicators: Surprises in February 2026 employment, inflation, or other key indicators could shift near-term CAD volatility.