Compare Best ExchangeFX Rates

GBP-USD Rate Calculator

Best Exchange Rates United Kingdom

For over a decade, BestExchangeRates.com has been a trusted resource for comparing foreign exchange rates in the United Kingdom and worldwide.

We make it easy to avoid hidden fees and inflated margins by comparing live rates from major banks and trusted money transfer specialists. Whether you’re sending money abroad or exchanging cash for travel, our tools highlight the cheapest and most convenient options in real time.

Our mission is simple: transparency. We break down complex FX fees so you can make informed decisions and keep more of your money where it belongs—in your pocket.

More than 3 million satisfied visitors have saved over $200M on foreign exchange.

We partner with only the largest, safest and most trusted foreign exchange brands.

Track AUD rates - transact when market in your favour. Follow FX forecasts & analysis.

Any marketing fees we receive from partners do not affect your exchange rate savings.

Save on International Money Transfers

Sending money abroad can be an expensive business, more so if you aren’t even aware of all the hidden fees. Money transfer companies and banks profit by charging you fees and a normally hidden margin on the exchange rate.

Using your Bank to make international wire transfers can be very expensive – often 5% to 6% worse than using a foreign exchange specialist to send money abroad or pay a foreign invoice.

Where do you want to Save Sending Money?

BER FX Rate Tracker

Follow exchange rates via your personal BER FX Tracker to keep track of trending currency pairs so that you can take advantage of opportunities and trends in the market.

Latest British pound Exchange Rates

We compare exchange rates from major financial institutions in the United Kingdom.

Save with our partners who are among the best & most trusted brands in the United Kingdom.

Get Better Currency Exchange Rates

We show you how to save by ordering foreign cash online or compare rates on multi-currency travel cards for better currency exchange rates, convenience and security for your next trip or overseas online purchase.

Smarter Currency Decisions Start Here

Read our Guides , Reviews , British pound News and Forecasts

News 2026-02-05

Currency Market Update - Week ending 2026-02-08

Weekly currency market update—practical actions for SMBs, expats and travellers across AUD, CAD, GBP, NZD, SGD, USD, EUR and JPY

News 2025-12-23

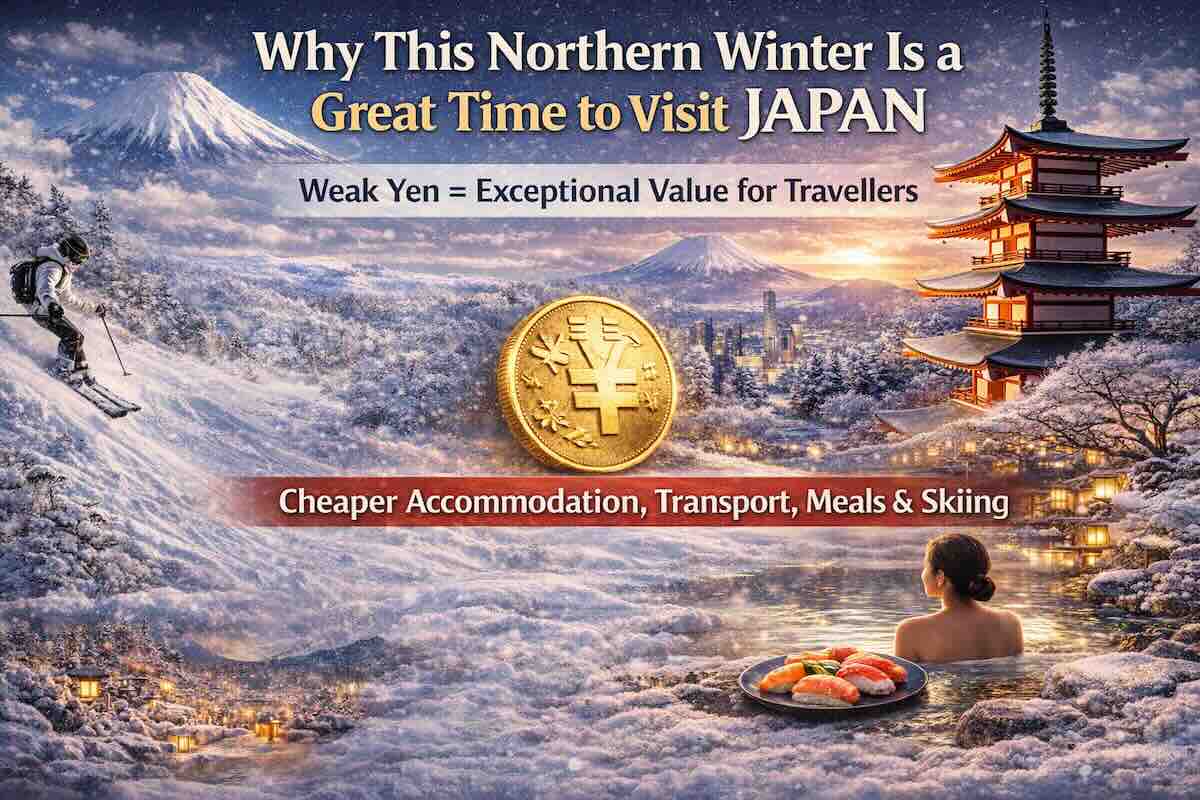

Japan Travel Boom: Weak Yen Makes Winter Trips Exceptional Value

With the yen down sharply against major currencies, winter in Japan offers rare value on hotels, food, transport, and skiing. A rare currency tailwind for travellers.

Guide to the Euro: Understanding Europe's Common Currency for Travelers, Expats and Business

Understanding the Euro is not only crucial for navigating the financial landscapes of these countries but also for appreciating the broader economic and cultural contexts that shape Europe today.

How to Choose the Best Money Transfer Provider

A comprehensive guide to choosing the best money transfer provider, covering key factors like fees, speed, exchange rates, and customer support, with comparisons of top providers.

Compare the Best Multi-Currency Accounts for Travel, Business & Transfers

We compare the features, exchange rates and security of the three best multi-currency accounts available today — the Wise Account, the WorldFirst World Account, and the OFX Global Currency Account.

How Currency Fluctuations Impact Your Profit Margins (and How to Protect Them)

Currency shifts can quietly shrink your margins if you’re doing business internationally. Learn how to manage FX exposure, protect your profits, and use smart tools to stay ahead.

OFX vs Wise: Which Money Transfer Service Is Best For You in 2026

Looking to transfer money internationally? We compare OFX and Wise side by side, covering costs, exchange rates, speed, and features to help you choose the best service for your needs in 2026.

Wise Review: Is It the Best Way to Transfer Money Internationally?

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

Guide to the Canadian Dollar (CAD): Travel, Transfers & FX Tips

The Canadian dollar (CAD) is a major global currency closely linked to commodities and US trade. This guide explains how it works and how to manage CAD FX costs.

Understanding the US Dollar: A Guide to America's Currency for Travelers and Investors

The United States dollar is the official currency of the United States of America but also is the world’s dominant reserve currency, and it accounts for roughly 62% of global foreign exchange reserves, double that of the Euro and Yen. In fact, the US Dollar has been the world’s reserve currency for over 100 years.

OFX Money Transfer Review: Fees, Rates & Features Explained (2025)

OFX is a reputable international money transfer service that caters to both individuals and businesses, offering a range of features designed to facilitate global transactions.

Currency Exchange & Travel Money: Compare Rates Worldwide

Compare global currency exchange rates for travel money & online purchases. Get the best rates, low fees & top multi-currency cards. Save money worldwide.

Best Exchange Rates United Kingdom Compare & Save on Foreign Exchange

British pound market update

British pound market update

Outlook

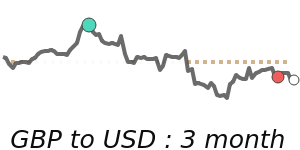

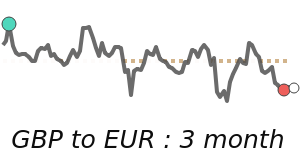

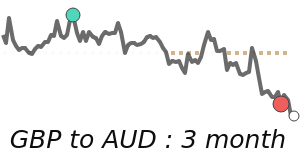

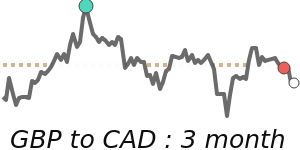

The pound remains under pressure from political jitters and a cautious Bank of England stance. Markets are pricing in a slower policy normalization path, with a 25 basis point rate cut by June 2026 widely anticipated. Thursday’s GDP data could set the near-term direction: stronger growth might lift the pound, while softer figures could cap any upside. GBPUSD is around 1.3633, GBP/EUR near 1.1468, and GBPJPY near 210.6, all trading within recent ranges. The three-month GBPUSD range sits roughly 1.3050 to 1.3837, with 1.3633 about 1.6% above the 3-month average of 1.3418. UK retail sales rose 2.5% in December and inflation ran at 3.4%, highlighting a mixed policy environment. Political developments continue to be a key risk to sentiment.

Key drivers

- Bank of England policy: 3.75% hold with a 5–4 vote and a dovish tilt; markets price a 25bp cut by June 2026.

- UK data backdrop: December retail sales +2.5% YoY and inflation at 3.4%; unemployment at 5.1%.

- Currency positioning: GBPUSD around 1.3633 (within a 1.3050–1.3837 3-month range); GBP/EUR about 1.1468 (within roughly 1.1322–1.1590 over 3 months); GBP/JPY near 210.6 (30-day range 203.2–214.3).

- Political landscape: ongoing Labour leadership uncertainty contributing to caution in flows and positioning.

BestExchangeRates.com keeps you up-to-date on British pound forecasts by collating the views of reliable FX forecasters and economists together with recent GBP price trends. This analysis covers a wide range of factors including economic indicators, geopolitical events, central bank policies, and technical analysis to provide a thorough and current outlook on currency trends.