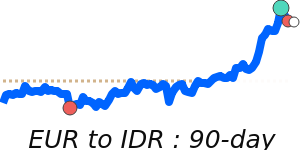

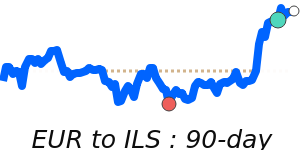

The euro (EUR) has experienced some upward movement recently, buoyed partly by its negative correlation with the US dollar (USD). However, gains have been limited by disappointing data, including weaker-than-expected industrial production reports from Germany and retail sales figures from the Eurozone. Analysts suggest that the upcoming German trade figures may provide further direction for the euro. A potential narrowing of the trade surplus expected in September could be offset by a recovery in exports, potentially supporting the currency as the week concludes.

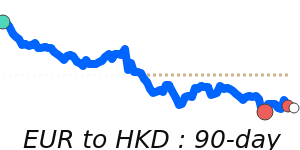

Several key factors are influencing the euro's value. Actions taken by the European Central Bank (ECB) regarding interest rates and monetary policies have a significant impact. Currently, the ECB’s more dovish stance is likely exerting downward pressure on the euro, especially in light of economic growth slowdowns in the Eurozone, with the Composite Purchasing Managers' Index (PMI) recently dipping to 49.7, indicating a contraction in business activity.

Alongside these indicators, the euro's performance is susceptible to fluctuations in the trade balance. A positive trade balance generally supports the euro, while a deficit may weaken it. Recent geopolitical tensions, such as the ongoing war in Ukraine and its impact on energy supply and inflation, add further volatility to the euro market. Political uncertainty within member states can similarly lead to depreciation of the currency, as was observed during previous electoral instabilities.

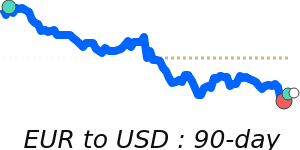

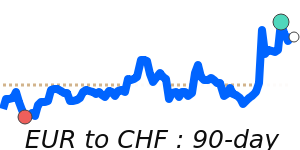

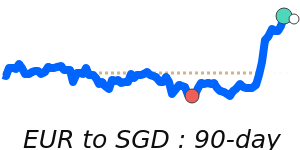

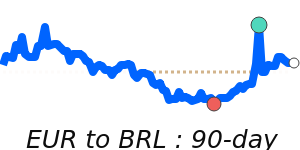

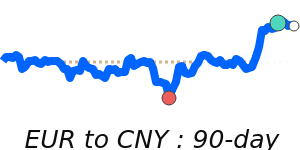

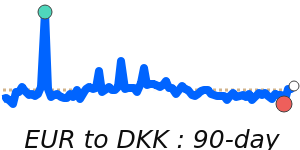

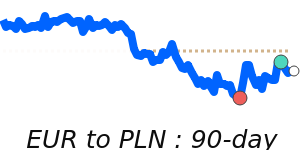

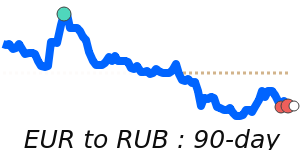

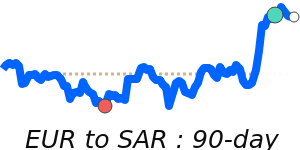

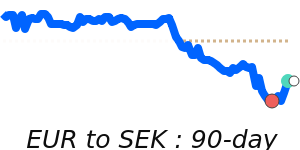

Looking at recent market data, the EUR/USD pair is currently trading at 1.1569, which is only 0.9% below its three-month average of 1.1669. The pair has remained within a narrow stable range of 1.1480 to 1.1868, suggesting limited volatility. In comparison, the EUR/GBP is at 0.8792, reflecting a stronger position, trading 1.1% above its three-month average, with stability seen at a 2.4% range. The EUR/JPY stands at 177.6, notably 1.8% above its average and within a stable range of 4.0%.

In the context of oil prices, current data shows WTI crude trading at 63.63, which is 3.4% below its three-month average. The volatility in oil prices can impact the euro indirectly, given the Eurozone’s reliance on energy imports. Consequently, further fluctuations in oil may introduce additional volatility for the euro.

As the Eurozone navigates these complex economic and geopolitical landscapes, the future trajectory for the euro will heavily depend on forthcoming economic indicators, ECB policy decisions, and the resolution of ongoing political uncertainties within the region. Investors would do well to remain vigilant, considering these factors as they relate to the euro's performance in the currency markets.