The Mexican Peso (MXN) has faced notable pressures in recent weeks due to a combination of domestic and international factors. Analysts highlight the significant impact of U.S. tariffs, with the implementation of a 25% tariff on Mexican imports announced on February 1, 2025, causing an immediate depreciation of the peso. Although the full implementation has been delayed, the ongoing threat of these tariffs continues to introduce volatility in the MXN.

In light of the Bank of Mexico’s (Banxico) recent stance, where interest rates were maintained at 11.00% in June 2025, forecasters have signaled potential easing in the future. This dovish approach has contributed to the peso's weakening against the U.S. dollar, further exacerbated by uncertainties arising from an upcoming early review of the United States-Mexico-Canada Agreement (USMCA). Such uncertainties could ultimately reshape trade conditions, increasing economic risk.

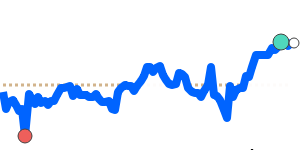

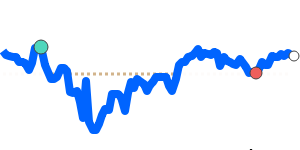

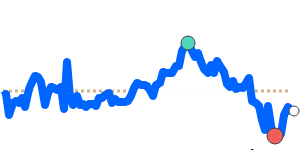

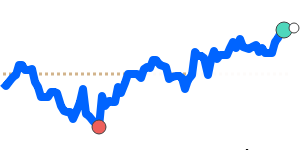

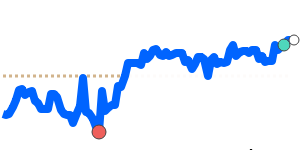

Global market trends present a mixed picture for the MXN. Improved sentiment linked to renewed U.S.-China trade talks led to a temporary strengthening of the peso, which approached the 19-mark against the dollar in June. However, current exchange rates indicate a more stable condition, with the MXN to USD trading at 0.053873, near its 3-month average and within a narrow range. The MXN to EUR has declined to 14-day lows at 0.046446, slightly above its 3-month average, reflecting a stable trade range. Meanwhile, the MXN to GBP is trading 2.0% above its average, and the MXN to JPY is also 3.2% above its average, indicating relative strength against these currencies.

Overall, the peso's performance amid tariff concerns, interest rate policies, and trade agreement uncertainties suggests a cautious outlook. As the economic landscape evolves, it will be crucial for individuals and businesses to monitor these developments closely to optimize their international transactions.