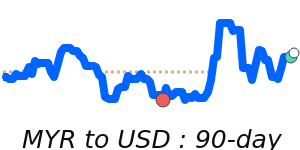

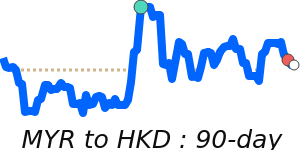

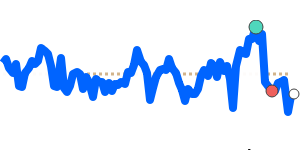

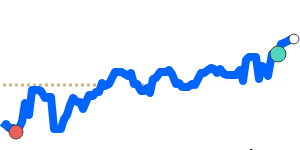

Recent developments have positioned the Malaysian Ringgit (MYR) favorably against major currencies, notably the U.S. dollar (USD). Following the U.S. Federal Reserve's commencement of a rate-cutting cycle in September 2025, the USD has weakened, providing a supportive backdrop for the MYR. Analysts have noted this trend as a key factor in the MYR's strengthened performance, with the exchange rate to USD currently at 90-day highs near 0.2395, slightly above its 3-month average of 0.2373.

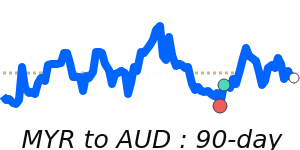

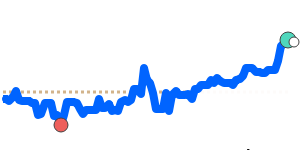

Malaysia's robust economic fundamentals continue to inspire confidence among investors. Steady GDP growth and inflows of foreign direct investment have been highlighted as critical elements contributing to the MYR's resilience. Furthermore, the nation recorded a trade surplus of MYR 16.1 billion in August 2025, bolstered by increased exports and diversification into emerging markets, which has further supported the MYR's upward trajectory.

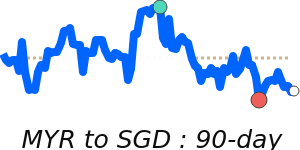

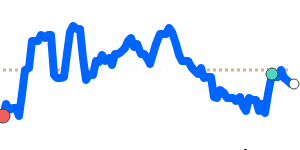

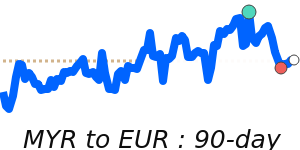

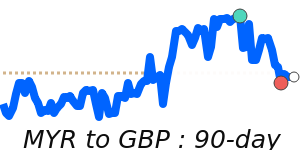

Bank Negara Malaysia's decision to maintain the Overnight Policy Rate at 3.00% during this period signals a cautious stance amid ongoing external uncertainties. This policy approach has contributed to the stability of the MYR against other currencies, such as the euro (EUR), where the exchange rate stands at 0.2070, 1.8% above its 3-month average, and the British pound (GBP), currently at 0.1820, 2.9% higher than its 3-month average.

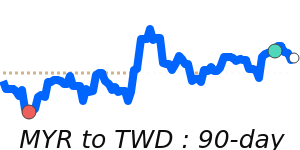

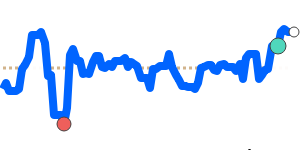

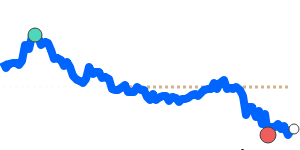

The MYR has shown resilience against the Japanese yen (JPY) as well, with the rate nearing 36.77—3.7% above its recent average. However, the oil market has remained somewhat volatile, with oil prices currently at $63.63, which is 3.4% below the 3-month average. This can impact the MYR, given Malaysia's status as a significant oil exporter.

In summary, the combination of favorable monetary policy in the U.S., strong economic fundamentals in Malaysia, and the nation's positive trade balance contributes to a buoyant outlook for the MYR, while external variables such as oil prices remain a crucial factor to monitor.