USD/NOK Outlook:

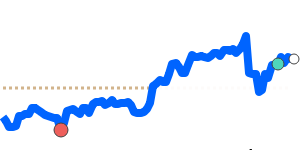

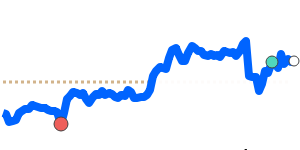

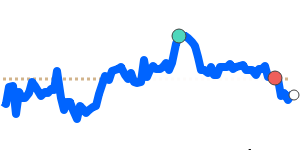

The USD/NOK rate is likely to decrease as it is currently below its recent average and trading near recent lows. This decline is influenced by weak demand for the USD amidst cautious risk appetite in the market.

Key drivers:

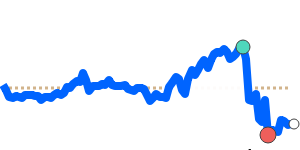

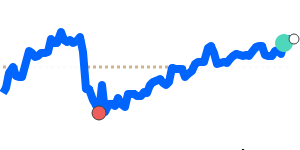

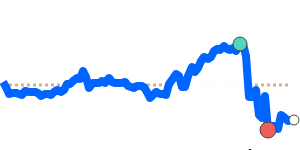

• Rate gap: The Federal Reserve's positioning on interest rates remains uncertain, creating a challenge for the USD compared to Norges Bank's steady monetary policies.

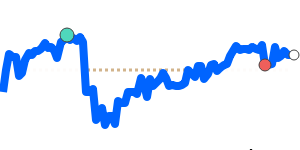

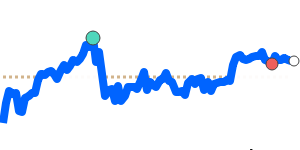

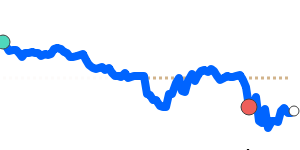

• Risk/commodities: With oil prices currently above their average, the NOK is benefitting from Norway's strong oil sector, enhancing its appeal against the USD.

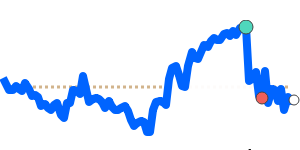

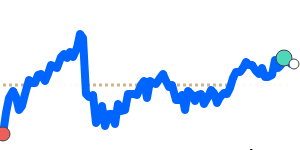

• One macro factor: The upcoming release of the New York Empire State manufacturing index could reveal weaknesses in the USD if it shows a significant decline.

Range:

The USD/NOK is expected to drift lower within recent three-month extremes, as it continues under pressure.

What could change it:

• Upside risk: Stronger-than-expected data from the U.S. could shift the outlook for the USD positively.

• Downside risk: A significant drop in oil prices would exert pressure on the NOK and potentially lead to further USD/NOK declines.