Bank of America at a glance

Bank of America (BOA) is the second-largest consumer bank in the USA after Chase Bank and serves about millions of consumers and small business clients worldwide from its headquarters in Charlotte, North Carolina.

Bank of America is one of the Big Four US banks and holds over 10% of all American bank deposits, in direct competition with JPMorgan Chase Bank, Citigroup, and Wells Fargo.

Cross-border wires with Bank of America

BOA offers international money transfer services that allow customers to send and receive funds from abroad. Customers can initiate a money transfer online or in person at a branch. BOA provides fast and secure international money transfer services however the exchange rates offered for international money transfer services are not the best on the market.

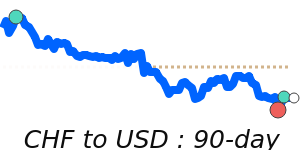

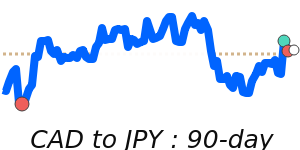

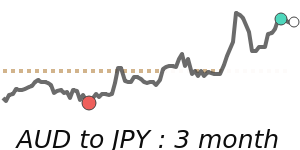

Sending or receiving international transfers to or from your Bank of America bank account will include a margin rate of between 4% to 8% – this is much higher than most money transfer broker rates (which are normally 0.5 to 1.5%).

The BOA app and website allow you to check the FX rate prior to scheduling an international wire. So you can check the rate and compare to the best rates from our BER partner brokers to check for a better deal.

Pay by Bank

Bank of America participates in Pay by Bank, a product that allows mobile uses to buy products online and pay directly from their bank account service in a foreign currency, Pay by Bank does not require a card or card data.

CashPro for Corporates

For businesses making international payments BOA provide the CashPro Platform.

BOA is improving the CashPro API to allow merchants to process payments in an increasing number of different countries. It will connect to seven real-time payment schemes; transfer apps including Zelle in the U.S. and Pix in Brazil; and cross-border wires.