Currency in Japan: JPY Send & Spend FX Guide

Resources for Expats, Travelers and Entrepreneurs Navigating Life and Trade in Japan with the Japanese yen.

What's in this Japan currency guide?

What currency is used in Japan?

The official currency of Japan (country code: JP) is the Japanese yen, with symbol ¥ and currency code JPY.

What is a good Japanese yen exchange rate?

The BestExchangeRates.com currency comparison table below helps you see the total cost of your currency transaction by showing the exchange rates offered by different providers. It also makes it easy to spot potential savings from market-leading FX services compared to bank rates.

To see a full list of rates, enter your transaction type, currencies and amount then click ‘GET RATES’:

Loading rates...

|

|

|

Good things to know about the Japanese yen

The Japanese yen is a low value currency, against the US dollar it is normally quoted as USDJPY that is the number of yen per 1 US dollar.

According to the Bank for International Settlements, in 2016, trading in the Japanese yen (ISO: JPY) contributed to 22% of total foreign exchange market turnover, making the yen the world’s third most traded currency.

Like government bonds and gold, the Japanese yen is considered a safe haven asset – it is the premier safe haven of the currency world. This means that the yen is likely to increase in value against other currencies during periods of economic uncertainty or when global geopolitical risk is elevated, or during bouts of high market volatility.

Since 1995, against the US dollar, the yen’s lowest valuation came in August 1998 when USD/JPY reached 147.67 (¥100 cost a little less than $0.68). Its post-1995 high came in October 2011 when USD/JPY traded at just 75.56 (¥100 cost $1.32).

The Japanese yen is a crucial part of the ‘carry trade’ – a popular strategy among foreign exchange traders in which they borrow in a currency with a low interest rate and use those funds to invest in currencies paying a higher rate. In recent decades, the most popular way to fund the carry trade has been to borrow (sell) yen due to Japan’s consistently low interest rates (since 1996 Japanese rates have averaged less than 0.5%).

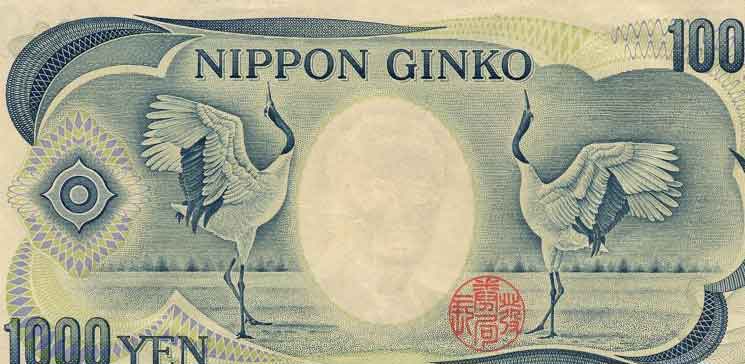

The Japanese yen banknotes and coins

The physical currency consists of coins and banknotes. The coins come in denominations of 1 yen, 5 yen, 10 yen, 50 yen, 100 yen, and 500 yen. The banknotes come in denominations of 1,000 yen, 5,000 yen, and 10,000 yen.

The banknotes feature images of famous Japanese historical figures, such as Hōkōsai Katsushika, Tōgai Kan, and Kōmei Emperor. The design of the currency is constantly being updated, so the physical appearance of the coins and banknotes may vary slightly over time.

For more JPY information check out our selection of Japanese yen news and guides.

Frequently Asked Questions

What currency should I use in Japan?

The domestic currency in Japan is the Japanese yen.

What is the Japanese yen currency code and symbol?

The three letter currency code for the Japanese yen is JPY — symbol is ¥.

What does the Japanese yen look like?

Here is an example Japanese yen banknote:

Which countries use the Japanese yen?

It is the domestic currency in Japan.

Is the Japanese yen a closed currency?

No, the Japanese yen is freely available and convertible. See guide: What is a closed currency?

What are equivalent amounts of USD and JPY?

Here are some popular conversion amounts for USD to JPY (US dollar to Japanese yen)*.

*Converted at the current USDJPY interbank exchange rate. Calculate actual payout amounts for Send Money and Travel Money exchange rates.

Travel money for Japan

Using Wise for Japanese yen travel money is a smart choice for savvy travelers. With its competitive exchange rates and low fees, Wise allows you to convert and manage multiple currencies effortlessly.

Be careful when using your own bank's Debit/Credit Card, as your bank may also charge an extra 3% as an “Overseas Transaction Charge” plus “Overseas ATM” fees for withdrawing cash on top of the standard Visa/Mastercard 2.5% from market mid-rate.

For card purchases, if you are offered a choice of currencies always select to Pay in Japanese yen otherwise you will typically get much worst dynamic currency conversion (DCC) exchange rates.

If you really want Japanese yen cash before departure, you can save money by ordering online. You generally get better rates and can pick up the JPY cash locally or even on travel day at the airport.

Practical Travel Guide to Japan

Japan is a captivating destination that blends rich tradition with modern innovation. Here’s a streamlined guide to help you navigate your visit.

- Entry Requirements: Most travelers from Europe, the US, and many other countries can enter Japan visa-free for up to 90 days. Ensure your passport is valid for the duration of your stay, and check the latest entry requirements on the Japanese Ministry of Foreign Affairs website.

- Currency and Money: The Japanese yen (JPY) is the official currency. Cash is widely used, though credit cards and mobile payments like Suica or PayPay are gaining popularity. ATMs at post offices, 7-Eleven stores, and major banks accommodate international cards. Tipping is not customary in Japan.

- Transportation: The Japan Rail Pass offers unlimited travel on JR trains, including Shinkansen (bullet trains), and is ideal for tourists. Use prepaid IC cards like Suica or Pasmo for local buses and trains in cities. Taxis are reliable but costly. Renting a car is suitable for rural exploration but requires an International Driving Permit.

- Accommodation: Japan offers a variety of options, including luxury hotels, traditional ryokans with hot springs, budget capsule hotels, and hostels. Book accommodations early during peak seasons like cherry blossom season or major festivals.

- Food and Dining: Iconic dishes include sushi, ramen, tempura, and wagyu beef. Etiquette is important; avoid sticking chopsticks upright in rice and remember slurping noodles is polite. Cash is often preferred in small restaurants. Vegetarian and vegan options are growing but can still be limited.

- Cultural Tips: Bowing is a common form of greeting, and removing shoes is customary in homes, ryokans, and some temples. Keep public conversations quiet, especially on trains. Wash thoroughly before entering communal baths in onsen (hot springs).

- Top Attractions: Tokyo offers vibrant districts like Asakusa and Shibuya, while Kyoto is renowned for its temples and bamboo groves. Osaka is a hub for street food and entertainment, and Mount Fuji and Hiroshima’s Peace Memorial Park are must-visit landmarks.

- Festivals and Events: Cherry blossom season (March–April) is a major highlight. Kyoto’s Gion Matsuri in July and sumo tournaments in cities like Tokyo and Osaka provide cultural immersion.

- Packing Essentials: Bring comfortable walking shoes, layered clothing for varying climates, and a universal power adapter for Japan’s 100V Type A and B plugs. A compact umbrella is useful for sudden rain showers.

- Safety and Health: Japan is extremely safe, but basic precautions apply. Dial 110 for police and 119 for fire or medical emergencies. Comprehensive travel insurance is recommended.

- Practical Apps: Use Hyperdia or Japan Travel by NAVITIME for train schedules. Google Translate is helpful for language assistance, and LINE is the preferred messaging app. The Suica or Pasmo app simplifies managing your IC card for transport.

- Shopping Tips: Tax-free shopping is available at many stores for tourists; bring your passport. Popular souvenirs include traditional crafts, matcha products, sake, and Japanese snacks.

With proper preparation and respect for local customs, your visit to Japan will be smooth, enriching, and unforgettable. Safe travels!

Everyday Costs in in Japan

How much does it really cost to live, work, or travel in Japan? Here's what to expect for daily expenses and expat living.

Currency Guide for Japan (JPY)

For a traveler planning a mid-range stay in Japan for one week, it's wise to budget approximately ¥100,000 to ¥150,000 (around $680 to $1,020 USD) for a comfortable experience. This amount can cover a range of activities, from enjoyable dining to sightseeing and accommodation. Typical daily expenses that travelers can expect include a meal at a local restaurant for about ¥1,200-¥2,500 (🍱), a cup of coffee for around ¥400 (☕), public transport fares averaging ¥200 (🚄), a prepaid SIM card for ¥3,000-¥5,000 (📱), and budget hotel or Airbnb stays costing ¥7,000-¥15,000 per night (🏨). Overall, Japan is considered to be on the expensive side, particularly when compared to the United States, where daily costs can be a bit lower for food and accommodation. In comparison to the UK, Japan can feel relatively similar, given that both countries tend to have a high cost of living, especially in their respective major cities.

Expat Living in Japan

For expatriates settling in Japan, typical monthly living costs can range from ¥250,000 to ¥400,000, depending on lifestyle and location. Rent for a one-bedroom apartment in a city center averages around ¥150,000, while groceries, utilities, and transportation can contribute significantly to overall expenses. When it comes to banking, Japan is heavily reliant on cash, and while credit cards are accepted in many places, some shops may only take cash. Therefore, it’s recommended to maintain a healthy balance of cash and a card. Online transfer services like Wise or OFX can be beneficial for managing international money transfers and are often better than local exchange rates. However, for day-to-day spending, using an ATM might provide more convenience. It's essential to check with your bank regarding international withdrawal fees and limits to ensure smooth financial operations in your new home.

USD/JPY Market Data

The below interactive chart displays the USD/JPY change and UP📈 DOWN📉 trends over the past 1 Year.

Recent Japanese yen Market News

February 14, 2026

Key Developments Affecting the Japanese Yen (JPY):

1. Bank of Japan's Interest Rate Hike: On December 19, 2025, the Bank of Japan raised its benchmark short-term interest rate by 0.25 percentage points to 0.75%, marking a 30-year high. This move aims to curb inflation, which stood at 3% in November, remaining above the BOJ's 2% target for an extended period. (apnews.com)

2. Fiscal Concerns and Political Risks: In January 2026, Prime Minister Sanae Takaichi proposed tax cuts ahead of upcoming elections, raising fears of growing fiscal deficits and reducing investor confidence in Japan's debt sustainability. (axios.com)

3. Bank of Japan's Policy Normalization: The BOJ has been gradually normalizing its monetary policy, ending negative rates and executing several rate hikes, bringing the benchmark rate to 0.5%, its highest level in over a decade. (ebc.com)

4. Global Oil Price Surge: In 2025, a surge in global oil prices, driven by geopolitical tensions in the Middle East, increased Japan's import costs, contributing to a weaker yen. (ebc.com)

These developments have collectively influenced the Japanese Yen's performance in recent months.

For more JPY information read our News and guides to the Japanese yen.

Send Money to Japan - Best Rates

To get a good (and fair) exchange rate when sending money to Japan you need to find and compare exchange rates for International Money Transfers (IMTs).

The available FX rates for sending money abroad can be very different to the mid-market (wholesale) rate which you see reported online and in the News.

You should especially compare your own bank's exchange rates to those available from Money Transfer specialists to see how much you can save - we make that calculation easy in the below table.

Get a better deal for foreign transfers to Japan

When sending money to Japan it’s important to compare your bank’s rates & fees with those we have negotiated with our partner money transfer providers. To get a better deal you should follow these 4 simple steps :

- Open an account with a BER reviewed FX provider (id docs may be required)

- You specify the local or Japanese yen amount you want to transfer

- Make a local currency domestic transfer for the requested amount to the provider's bank account in your country

- Once your funds are received by the provider the converted JPY amount will be transfered to the recipient account you specify in Japan.

Use the above calculator to compare the exchange rates of FX specialist providers rates versus your bank's standard rates you can hopefully save around 5% and maybe more - end result is more Japanese yen deposited into the recipient bank account and less margins and fees kept by the banks!

Managing money while living and working in Japan

Managing your money effectively while living and working abroad can be challenging, but there are several steps you can take to ensure that your finances are in order.

Understand Japanese yen currency exchange rates: Exchange rates can have a big impact on your finances, so it is important to keep an eye on the JPY exchange rate and consider using a money transfer specialist or a credit card that does not charge foreign transaction fees to get the best exchange rate.

Use a local Japanese yen bank account: A local JPY bank account can make it easier for you to manage your finances and pay bills while you are in Japan. It may also be more convenient to use a local JPY bank account to make purchases and withdraw cash.

Research local laws and regulations: It is important to understand the local laws and regulations that apply to financial transactions in Japan. This can help you avoid legal issues and ensure that you are complying with local requirements.

Consider the tax implications: It is important to understand the tax implications of living or doing business in Japan. This can help you plan your finances and ensure that you are paying the correct amount of tax.

Seek financial advice: If you are unsure of how to manage your finances in Japan, it is a good idea to seek the advice of a financial professional who is familiar with the local financial system. This can help you make informed decisions and avoid financial pitfalls.

We have put together some key points to help managing your money effectively, you can reduce financial stress and enjoy your experience living or doing business in Japan.

Expat and Business Guide to Japan

Japan offers a unique blend of tradition, modernity, and economic opportunity, making it an attractive destination for expatriates and business professionals. Here’s a practical guide to help you navigate life and work in Japan.

- Visa Requirements: Expatriates generally need a work visa, such as the Highly Skilled Professional Visa, Engineer Visa, or Specialist in Humanities Visa. Consult the Japanese Ministry of Foreign Affairs for details and documentation requirements.

- Language: Japanese is the official language, and while English is commonly used in business settings, learning basic Japanese is essential for everyday interactions and professional networking.

- Cultural Etiquette: Bowing is customary for greetings, and business cards (meishi) are exchanged with both hands as a sign of respect. Punctuality is highly valued in both personal and professional settings.

- Work Culture: Japan’s work culture emphasizes teamwork, hierarchy, and long working hours. Understanding cultural nuances like "nemawashi" (informal consensus-building) is crucial for business success.

- Housing: Options range from urban apartments to traditional houses. Renting often requires a guarantor and additional costs such as a security deposit and key money. Websites like Suumo or GaijinPot are helpful for finding accommodations.

- Healthcare: Japan has a high-quality healthcare system. Expats are required to enroll in the National Health Insurance (NHI) program or their employer’s health insurance plan. Private insurance is an option for additional coverage.

- Cost of Living: Japan’s cost of living varies widely. Tokyo is among the most expensive cities, while rural areas are more affordable. Budget for housing, transportation, and food, as these can be significant expenses.

- Transportation: Japan has an extensive public transport system, including trains, subways, and buses. The Japan Rail Pass is useful for travel between cities. Owning a car is more practical in rural areas than in cities.

- Business Environment: Japan is a global leader in technology, automotive, and finance industries. Building long-term relationships and respecting decision-making processes are key to successful business dealings.

- Taxation: Expats staying longer than one year are subject to Japanese tax on global income. Consult a tax advisor to understand local tax obligations and possible treaties between Japan and your home country.

- Banking: Major banks like MUFG and SMBC cater to expatriates. ATMs are widely available, though some may not accept foreign cards. Online banking is accessible but often limited in English.

- Networking: Join organizations like the Tokyo American Club or the Chamber of Commerce for networking opportunities. Language exchange meetups and professional events are also valuable for making connections.

- Childcare and Education: Options include international schools, public schools, and private Japanese schools. International schools are ideal for expat families, offering familiar curriculums in English.

- Leisure and Recreation: Japan offers diverse recreational activities, from skiing in Hokkaido to visiting traditional hot springs (onsen) and exploring cultural festivals. Public parks and museums are abundant in cities.

- Safety and Security: Japan is one of the safest countries in the world, with low crime rates. Emergency numbers are 110 for police and 119 for medical and fire services.

- Practical Apps: Use Google Maps for navigation, Suica or Pasmo apps for public transport, and LINE for communication, as it is Japan’s most popular messaging platform.

- Documentation and Legal Matters: Carry your residence card (zairyu card) at all times, as it serves as your primary ID. Register your address at the local municipal office within 14 days of moving.

Japan’s unique cultural and professional landscape offers immense opportunities for expatriates and business professionals. Understanding its traditions and practices will help you integrate and succeed in this dynamic country.

You can read about the best providers and compare the latest deals for international money transfers to Japan in our Send Money to Japan guide.