Recent developments in the Hong Kong Dollar (HKD) have been shaped by notable monetary policy adjustments and market interventions by the Hong Kong Monetary Authority (HKMA). On September 18, 2025, the HKMA cut its base interest rate by 25 basis points to 4.50%, marking its first reduction since December 2024. This decision reflects ongoing alignment with activities from the U.S. Federal Reserve as markets adapt to global economic conditions.

Moreover, in response to market pressures, the HKMA has actively intervened in the foreign exchange market. On July 30, the authority purchased nearly HK$4 billion to support the HKD, emphasizing its commitment to defending the currency peg. Earlier in June, the HKMA sold US dollars in a weak-side Convertibility Undertaking, purchasing HK$9.42 billion, indicating the challenges faced by the currency as it approached the lower end of its permitted trading band.

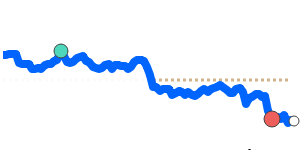

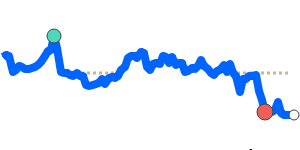

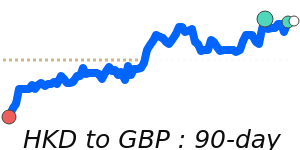

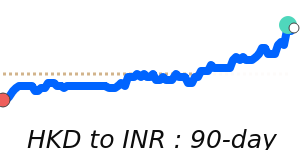

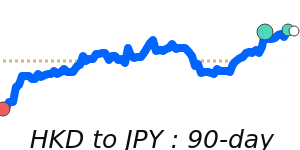

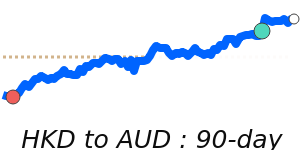

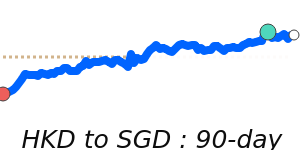

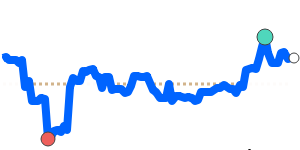

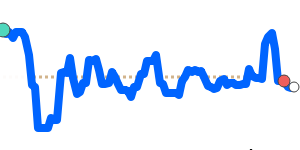

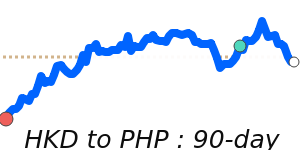

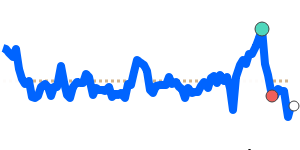

Currently, HKD is experiencing fluctuations against major currencies. The exchange rate against the US dollar is at 90-day highs near 0.1287, slightly above its 3-month average, indicating stability within a 1.0% range. Conversely, against the Euro, the HKD has recently dropped to 7-day lows at 0.1104, yet remains close to its 3-month average within a stable 3.1% range. against the British pound, the HKD trades at 90-day highs of 0.096977, showing a 1.6% increase above its 3-month average and stability within a 3.4% range. In contrast, the HKD to Japanese yen has hit 7-day lows at 19.52, slightly above the 3-month average yet reflecting a stable 5.0% trading range.

These recent movements in the HKD underscore an ongoing dynamic in currency stabilization efforts and market reactions. Analysts suggest that the HKMA's interventions and interest rate adjustments will continue to play a pivotal role in shaping the HKD's value moving forward, particularly as economic conditions evolve both locally and globally.