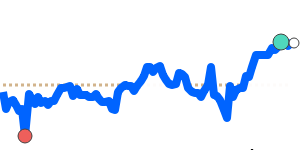

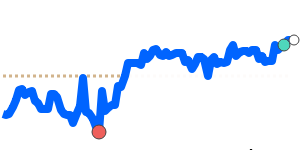

The Mexican peso has been relatively stable recently, trading very close to its 3-month average against the US dollar at around 0.0562. Despite some fluctuations, the peso remains within a narrow range, just 1% below its average, reflecting cautious market sentiment.

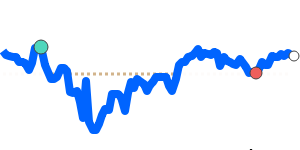

The peso has seen slight dips against the Euro and British pound, reaching near 30-day lows at approximately 0.0483 and 0.0419 respectively. These declines align with broader market concerns over U.S. import tariffs, which came into effect earlier this month, and ongoing inflation pressures in Mexico.

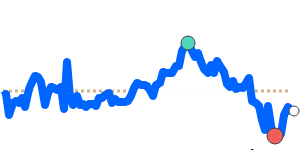

against the Japanese yen, the peso touched a 14-day low of around 8.87, but traded within a stable range overall. Similarly, the peso’s value against the Australian dollar and Canadian dollar remains near its recent lows, at about 0.0798 and 0.0763 respectively, influenced by trade tensions and shifts in global investment flows.

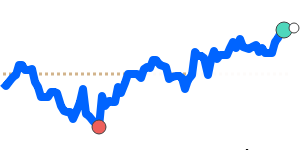

Overall, the peso's movements reflect a cautious picture, with external trade concerns, slight inflation issues, and steady foreign investment supporting its stable outlook. The currency continues to tread within its recent ranges, signaling a period of relative resilience amid global uncertainties.