The Singapore dollar (SGD) has recently been influenced by a combination of monetary policy adjustments, trade relations, and economic growth outlook. The Monetary Authority of Singapore (MAS) took a significant step in April by easing its monetary policy, marking the second instance this year. This decision involved reducing the rate of appreciation of the nominal effective exchange rate (S$NEER) policy band, reflecting concerns over global trade uncertainties and a downgraded GDP growth forecast of 0%-2% for 2025.

Trade dynamics have also been critical, especially with the United States imposing a 10% tariff on all goods from Singapore in April. The impact of these tariffs has prompted the Singaporean government to set up a task force to support affected businesses and workers. Despite facing these headwinds, the economy demonstrated resilience with a better-than-expected growth rate of 1.4% in Q2 2025. Nonetheless, the MAS decided to maintain its current policy settings, anticipating a moderation in growth for the latter half of the year.

Inflation rates are another essential component of the SGD's landscape. Recent trends indicate a decline in core inflation in Singapore, dropping to 0.6% in June from a peak of 5.5% in early 2023. This decrease has provided the MAS with the flexibility to keep its monetary policy unchanged, suggesting that inflationary pressures remain subdued.

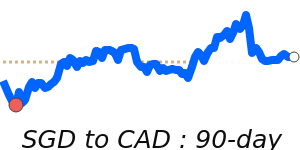

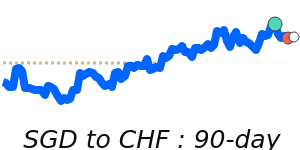

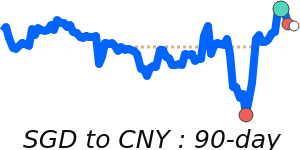

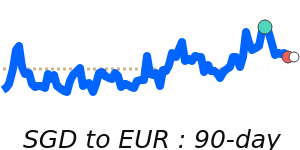

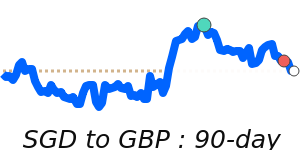

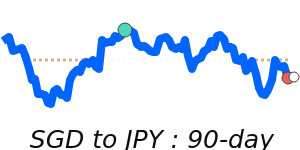

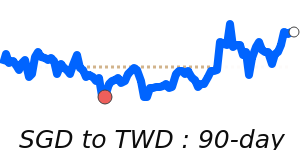

In currency market movements, the SGD to USD has recently reached 14-day highs near 0.7795, aligning closely with its 3-month average and exhibiting a stable range of 2.4%. In contrast, the SGD to EUR is at 14-day lows near 0.6673, which is 1.0% below its 3-month average and within a consistent trading range. Similarly, the SGD to GBP has hit 14-day lows near 0.5771, hovering near its 3-month average after remaining stable. Conversely, the SGD to JPY has risen to 7-day highs near 115.2, marking a 1.5% increase over its 3-month average, indicating some strength against the yen.

Analysts suggest that ongoing developments in trade relations and inflationary trends will play a crucial role in determining the future trajectory of the SGD. For individuals and businesses engaging in international transactions, these factors are essential to consider for optimizing exchange rates and minimizing costs.