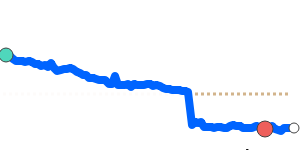

USD/TRY Outlook: Likely to increase, supported by the USD's strength against the TRY, which is elevated near recent highs.

Key drivers:

- Rate gap: The Federal Reserve is poised for rate cuts, while Turkey's central bank recently lowered its policy rate, creating a widening interest rate differential that favors the USD.

- Risk/commodities: Recent declines in oil prices could impact emerging market currencies like the TRY, adding pressure as import costs fluctuate.

- One macro factor: Fitch's recent upgrade of Turkey's outlook indicates improving economic conditions, which could benefit the lira but may not outweigh overall dollar strength.

Range: Expect USD/TRY to drift higher within its recent 3-month range, testing the upper extreme.

What could change it:

- Upside risk: A significant geopolitical event could strengthen the USD further.

- Downside risk: A swift recovery in oil prices coupled with further easing measures from Turkey’s central bank may weaken the TRY.