Explore our latest JPY tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (172)

By Topic:

About Us (12)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Locations (10)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (77) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (49) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (114) FJD (6) FKP (1) GBP (75) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (31) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (31) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (4) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (13) MYR (23) MZN (1) NAD (1) NGN (6) NOK (8) NPR (2) NZD (39) OIL (1) OMR (4) PEN (1) PGK (1) PHP (13) PKR (12) PLN (8) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (9) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (8) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (11) ZWL (1)

Currency Market Update - Week ending 2026-02-08 2026-02-05

Weekly currency market update—practical actions for SMBs, expats and travellers across AUD, CAD, GBP, NZD, SGD, USD, EUR and JPY

Japan Travel Boom: Weak Yen Makes Winter Trips Exceptional Value 2025-12-23

With the yen down sharply against major currencies, winter in Japan offers rare value on hotels, food, transport, and skiing. A rare currency tailwind for travellers.

Global Central Banks Shift Policy: Key FX Impacts for August 2025 2025-08-28

Central banks are moving in different directions—Australia cuts, UK eases despite inflation, and the Fed faces political risks. Here’s what it means for exchange rates and transfer timing.

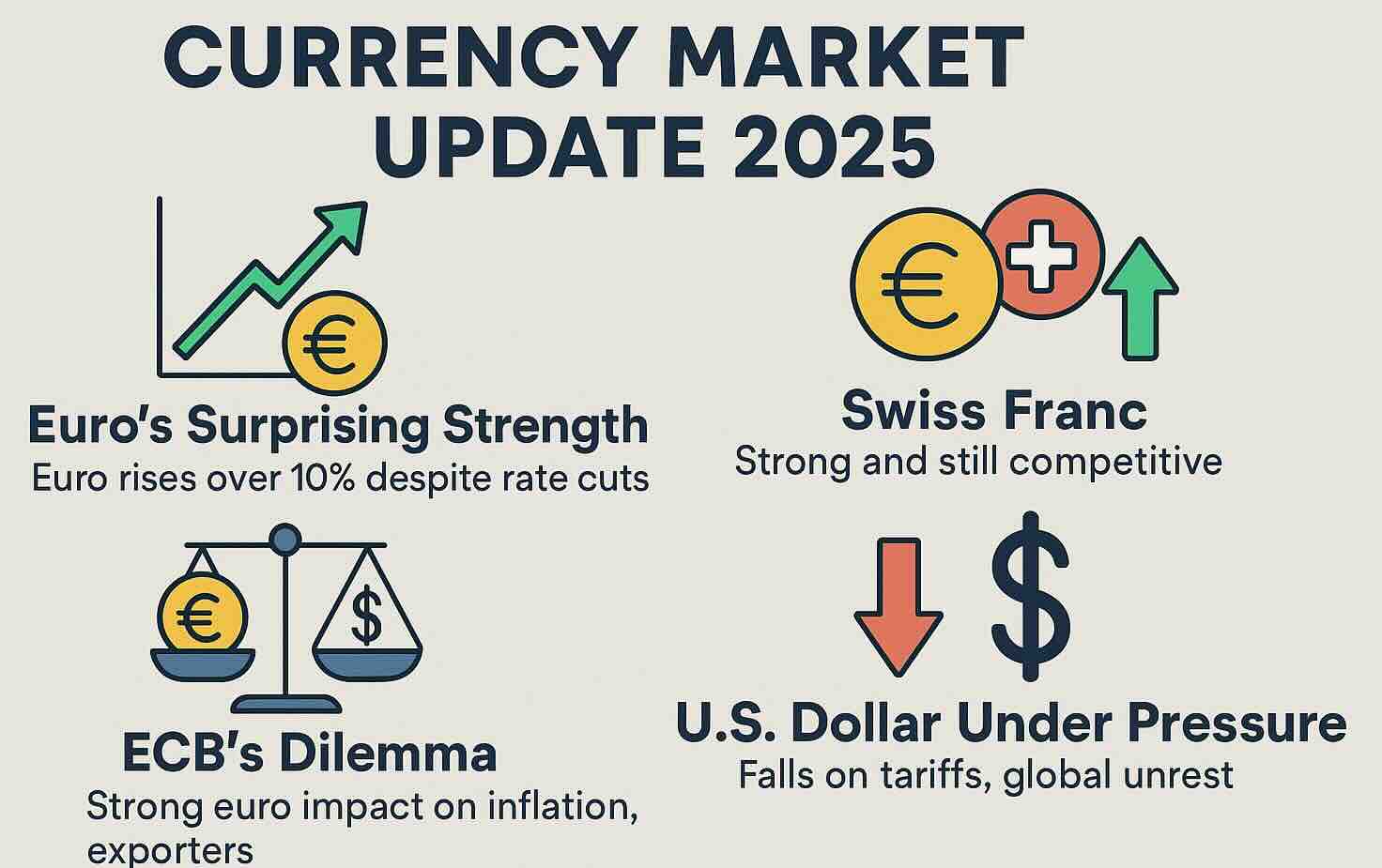

Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong 2025-06-03

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

Volatile May for Foreign Exchange Rates: EUR, GBP, JPY, AUD, NZD, RON 2025-05-16

In May 2025, currency markets experienced notable fluctuations influenced by geopolitical developments, economic policies, and trade relations. The pound (GBP) and euro (EUR) were strong while U.S. dollar (USD) exhibited a weakening trend, while several other currencies demonstrated strength.

US-China Trade Truce Boosts Dollar, Euro and Yen React 2025-05-13

The US dollar surged following a 90-day tariff pause between the US and China, while the euro and yen weakened in response.

The U.S. Dollar Is Losing Ground to the Euro — And the World Is Watching 2025-04-25

Deutsche Bank forecasts a significant weakening of the US dollar in the coming years, potentially reaching its lowest level against the euro in over a decade.

Swiss Franc Surges Amid U.S. Tariff Escalation 2025-04-11

The Swiss franc has experienced a significant surge, reaching a decade-high against the U.S. dollar, following President Donald Trump's announcement of increased tariffs on Chinese imports. This development has intensified market volatility and heightened demand for safe-haven assets.

Yuan's Volatility Surges Amid U.S. Tariff Escalation 2025-04-10

The Chinese yuan has weakened following the United States' decision to impose a 125% tariff on Chinese imports, prompting the People's Bank of China to intervene to stabilize the currency.

Global Currency Markets React to U.S. Tariffs and Economic Policies 2025-03-27

Recent U.S. trade policies, including aggressive tariffs on auto imports, have introduced significant volatility in global currency markets, affecting major currencies such as the euro, British pound, and Japanese yen.

Currency Markets in Flux: Euro's Ascent Amidst Global Economic Shifts 2025-03-19

The global currency landscape is experiencing notable shifts as the euro strengthens against major currencies, influenced by economic policies, geopolitical events, and fluctuating oil prices.

How the Weak US Dollar Can Impact International Business in 2025

Markets have shifted focus to the interest rate policies of other major central banks rather than the Federal Reserve.

Strong Singapore Dollar Sparks Travel Boom and Economic Shifts

The Singapore dollar has reached its highest level in over a decade, boosting outbound travel and curbing inflation, but also putting pressure on exporters and local businesses. While sectors like logistics and finance benefit, retail, hospitality, and exports face challenges from the strong currency.

Will the US dollar remain strong?

The dollar has risen by nearly 20% against most currencies compared to this time last year.

US Dollar Hits 14-Month Low on Cooling US Inflation 2023-07-17

USD sinks as global currency markets react to slowing US inflation, prompting a surge in other major currencies and a potential end to the Federal Reserve's tightening cycle.

Ski vacations and exchange rates

How can exchange rates affect the cost of a ski holiday? We look at tips for finding the best value locations for skiing, there are countries where skiing may be more affordable due to favourable exchange rates or lower costs of living.

Fears of US Recession Shifts Currencies & Commodities 2022-06-23

As we approach mid-year a shift has taken place in currency markets with the narrative less about interest rates hikes and more risk-off worries about a possible coming recession.

War and Inflation Powers US Dollar Strength 2022-05-10

During periods of rising inflation a stronger currency benefits a country's economics as this makes imports cheaper.

Japan Allows Fintech Payments Specialists to Compete with Banks 2019-02-21

The Japanese FSA has announced it will finally remove a ¥1 million (US$9,000) cap on cross-border money transfers handled by non-banking entities, paving the way for a major overhaul of Japan’s remittance industry.

CAD to JPY 2026 Forecasts

CAD/JPY Outlook: Slightly positive, but likely to move sideways as the rate is above its recent average and lacks a clear driver.

AUD to JPY 2026 Forecasts

AUD/JPY Outlook: Slightly positive, but likely to move sideways as the rate is above its recent average and trading near recent highs without a clear driver.

EUR to JPY 2026 Forecasts

EUR/JPY Outlook: Slightly positive, but likely to move sideways as the rate remains just above its recent average and lacks a clear driver.

GBP to JPY 2026 Forecasts

GBP/JPY Outlook: Slightly weaker, but likely to move sideways, as the rate is below its recent average and near recent lows with limited driving forces.

USD to JPY 2026 Forecasts

USD/JPY Outlook: Bearish, as the rate is below its recent average and approaching recent lows, pressured by weak US economic signals.

CHF to JPY 2026 Forecasts

CHF/JPY Outlook: Bullish, as the rate is above its recent average and near recent highs, supported by strong demand for CHF.

AED to JPY 2026 Forecasts

AED/JPY Outlook: The AED/JPY outlook is slightly positive, but likely to move sideways as it trades just above its recent average with limited clear drivers.

NZD to JPY 2026 Forecasts

NZD/JPY Outlook: The outlook is likely to increase as the rate is significantly above its 90-day average and near recent highs, boosted by commodity...

MYR to JPY 2026 Forecasts

MYR/JPY Outlook: Slightly positive, but likely to move sideways as the rate is above its recent average but lacks a clear driver.

INR to JPY 2026 Forecasts

INR/JPY Outlook: Slightly positive, but likely to move sideways as the rate is near its recent average and lacks a clear driver.

SGD to JPY 2026 Forecasts

SGD/JPY Outlook: Slightly positive, but likely to move sideways, as the rate is above its recent average but lacks a strong driver.