Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong

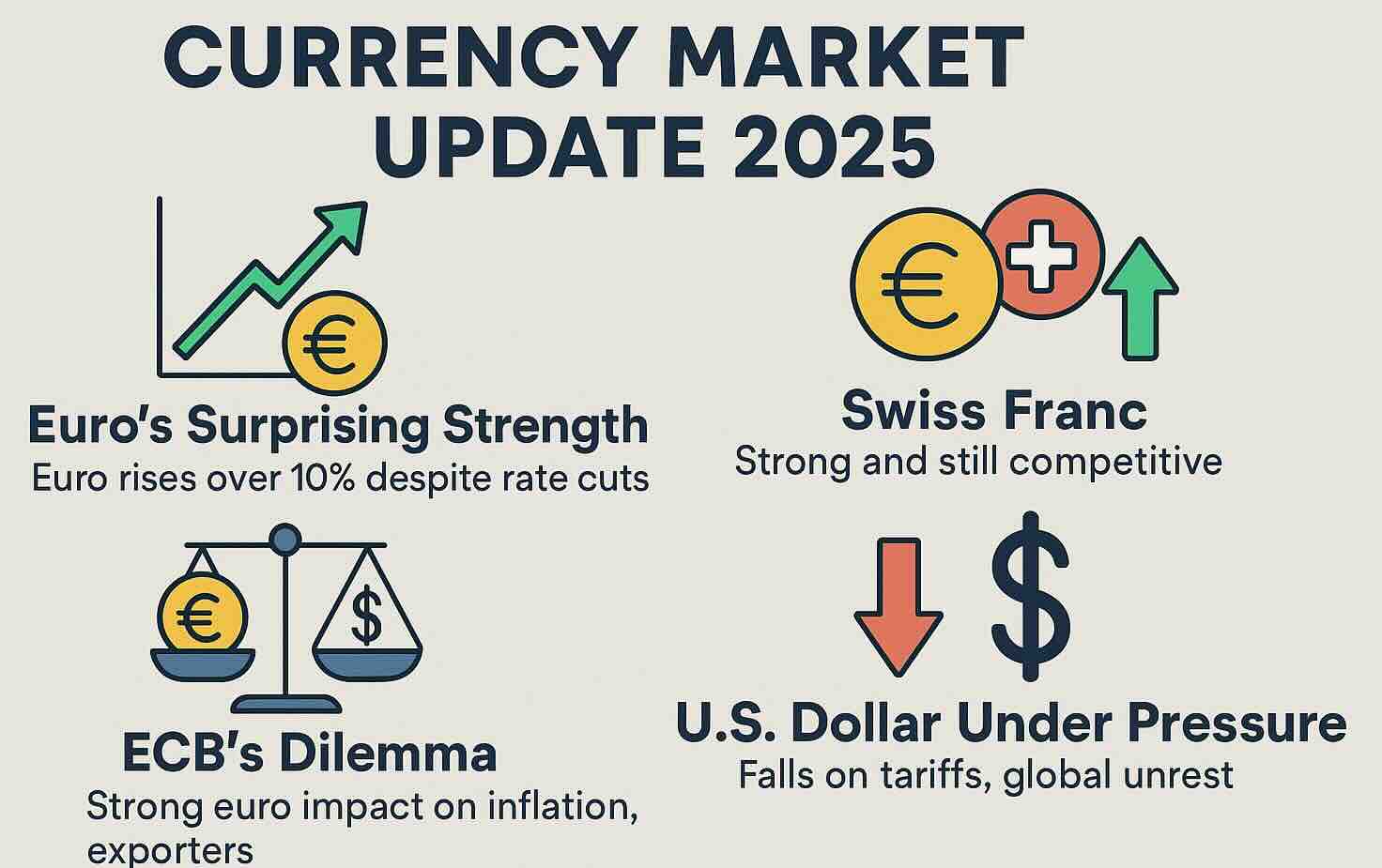

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

🇨🇭 Swiss Franc: Strong and Still Competitive

The Swiss franc remains the world’s strongest currency, yet Switzerland continues to thrive as an exporter. Despite a strong franc, Swiss companies succeed thanks to high-quality products, innovation, and a skilled workforce. Over half of Swiss exports are in high-tech sectors, and the economy remains resilient and productive. Switzerland shows that strong currencies don’t always hurt exports.

💶 Euro’s Surprising Strength

Despite cutting interest rates, the European Central Bank (ECB) has watched the euro climb over 10% against the U.S. dollar in just four months. Analysts expected a weaker euro—but global investors are shifting away from U.S. assets due to trade tensions and spending plans in Europe, especially Germany. This has pushed the euro to record highs on several measures.

📉 ECB’s Dilemma

The ECB is now in a tough spot: the strong euro helps reduce inflation but hurts exporters. ECB President Christine Lagarde wants to position the euro as a global reserve currency. However, upcoming forecasts may show inflation falling below the 2% target, adding pressure on the ECB to act—despite limited tools.

🇺🇸 U.S. Dollar Under Pressure

The U.S. dollar has fallen to a six-week low, hit by rising tariffs, global unrest, and investor doubts about U.S. policies. Trade tensions with China, wars in Ukraine and Gaza, and increased defense spending are driving global uncertainty. Oil prices are up, and gold has edged higher. The market is now watching for new U.S. data and central bank comments.

💰 Dollar and Carry Trades

As the dollar weakens, it’s becoming a popular “carry trade” currency—investors borrow in dollars to invest in higher-yield currencies like the Indian rupee, Brazilian real, and Turkish lira. April alone saw nearly $9 billion flow into emerging market bonds. If volatility stays low, this trend may continue.

🇮🇳 Indian Rupee Steady

The Indian rupee strengthened slightly, supported by dollar inflows and foreign bank activity. While regional markets declined, the rupee outperformed. Traders expect it to stay within the 85–86 per USD range. The Reserve Bank of India is expected to cut rates soon to support growth.

🇯🇵 Japanese Yen Outlook

The Japanese yen could strengthen if the Bank of Japan shifts from its long-standing easy money policy. As a safe-haven currency, the yen tends to rise during global uncertainty. Expect USD/JPY to trade between 125 and 140, depending on global risks and Japan’s economy.

🌍 Big Picture: What It Means

Currency markets in 2025 are being shaped by:

• Central bank rate cuts

• Trade tensions

• Geopolitical conflicts

• Shifting investor flows

Staying up-to-date is key—especially for anyone sending money abroad or managing international finances.

⸻

Disclaimer: Please note any provider recommendations, currency forecasts or any opinions of our authors should not be taken as a reference to buy or sell any financial product.