Explore our latest CHF tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (172)

By Topic:

About Us (12)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Locations (10)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (77) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (49) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (114) FJD (6) FKP (1) GBP (75) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (31) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (31) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (4) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (13) MYR (23) MZN (1) NAD (1) NGN (6) NOK (8) NPR (2) NZD (39) OIL (1) OMR (4) PEN (1) PGK (1) PHP (13) PKR (12) PLN (8) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (9) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (8) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (11) ZWL (1)

Trump Imposes Broad Tariff Hikes as Global Trade Tensions Escalate 2025-08-02

President Trump has raised U.S. tariffs to an average of 15.2%, targeting Canada, Asia, and Europe, as part of his push to reshape global trade. Markets and currencies reacted with caution amid rising uncertainty.

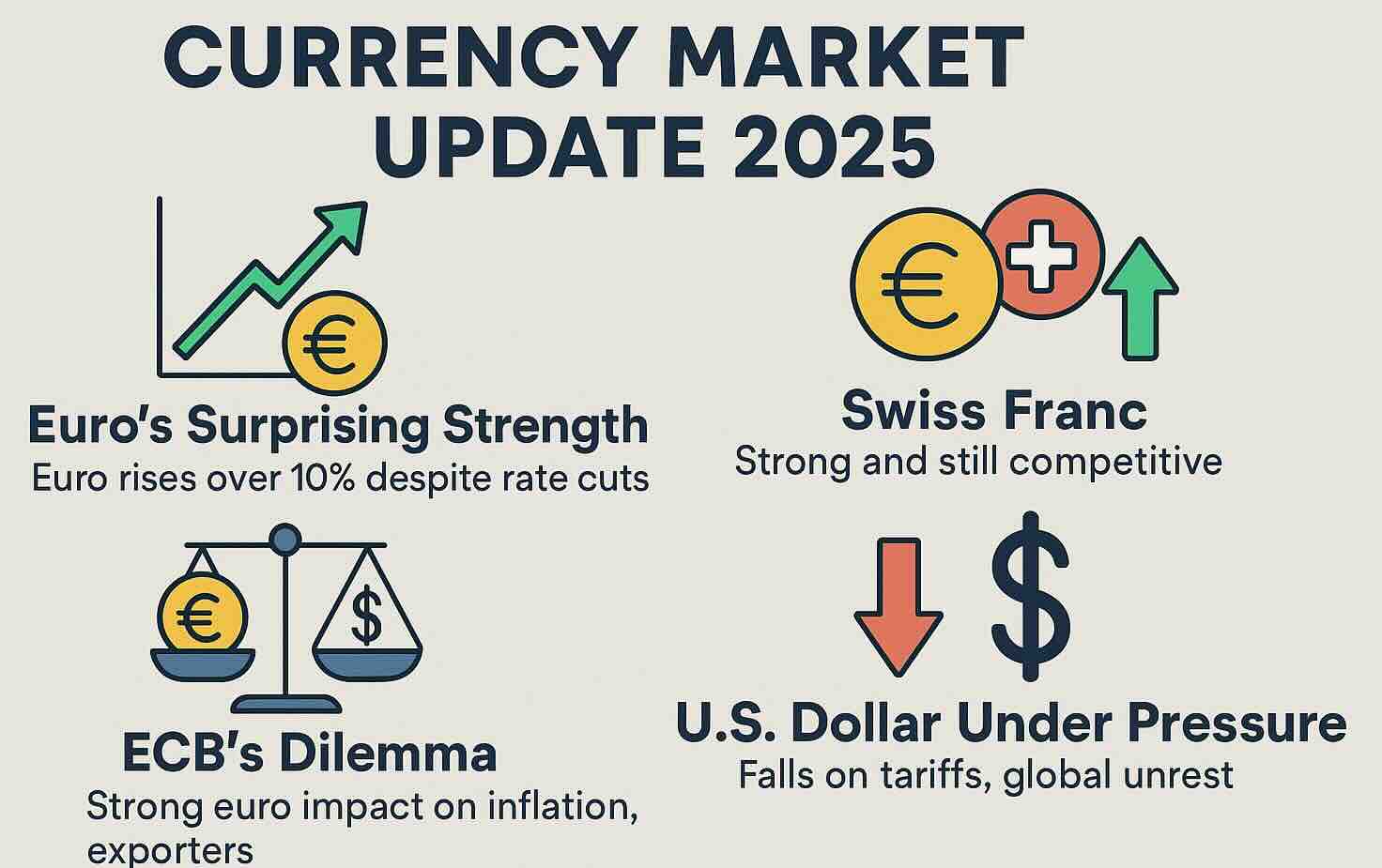

Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong 2025-06-03

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

The U.S. Dollar Is Losing Ground to the Euro — And the World Is Watching 2025-04-25

Deutsche Bank forecasts a significant weakening of the US dollar in the coming years, potentially reaching its lowest level against the euro in over a decade.

Swiss Franc Surges Amid U.S. Tariff Escalation 2025-04-11

The Swiss franc has experienced a significant surge, reaching a decade-high against the U.S. dollar, following President Donald Trump's announcement of increased tariffs on Chinese imports. This development has intensified market volatility and heightened demand for safe-haven assets.

Yuan's Volatility Surges Amid U.S. Tariff Escalation 2025-04-10

The Chinese yuan has weakened following the United States' decision to impose a 125% tariff on Chinese imports, prompting the People's Bank of China to intervene to stabilize the currency.

Currency Markets in Flux: Euro's Ascent Amidst Global Economic Shifts 2025-03-19

The global currency landscape is experiencing notable shifts as the euro strengthens against major currencies, influenced by economic policies, geopolitical events, and fluctuating oil prices.

US Dollar Hits 14-Month Low on Cooling US Inflation 2023-07-17

USD sinks as global currency markets react to slowing US inflation, prompting a surge in other major currencies and a potential end to the Federal Reserve's tightening cycle.

US Dollar Weakens on Regional Banks Fears and Tighter Credit 2023-05-05

The US dollar weakened due to fears surrounding regional banks, while the ECB offered a less hawkish than expected 25bp hike and the Swiss franc is in demand.

Fears of US Recession Shifts Currencies & Commodities 2022-06-23

As we approach mid-year a shift has taken place in currency markets with the narrative less about interest rates hikes and more risk-off worries about a possible coming recession.

War and Inflation Powers US Dollar Strength 2022-05-10

During periods of rising inflation a stronger currency benefits a country's economics as this makes imports cheaper.

Russian sanctions mount - US dollar gains 2022-02-28

Any curbs to Russian access to its foreign reserves could present a bigger blow to the Russian economy than the impact of a ban on Swift.

Geo-politics replaces COVID-19 Risk for Currency Markets 2022-02-24

Russia attacking Ukraine has sparked volatility and a flight to safe-haven currencies such as CHF.

Liechtenstein Country Guide (LI)

Clocking in at just 62 square miles, Liechtenstein is one of the smallest countries in Europe. It’s bordered by Switzerland to the west and south and Austria to the east and north. From its capital city Vaduz to the lovely mountain villages, her...

Switzerland Country Guide (CH)

Switzerland is a small, landlocked country located in Central Europe. It is known for its picturesque alpine landscapes, its renowned ski resorts, and its reputation as a global financial and banking center. Switzerland is also known for its high ...

CAD to CHF 2026 Forecasts

CAD/CHF Outlook: Bearish, as the rate is below its recent average and fluctuating within stable limits.

AUD to CHF 2026 Forecasts

AUD/CHF Outlook: Slightly positive, but likely to move sideways as the rate is above its recent average, yet there is no clear driver pushing it higher.

EUR to CHF 2026 Forecasts

EUR/CHF Outlook: Bearish, as the pair is below its recent average and near recent lows, facing pressure from key developments.

GBP to CHF 2026 Forecasts

GBP/CHF Outlook: Bearish, as the rate is below its recent average and near recent lows, weighed down by ongoing UK political uncertainty.

USD to CHF 2026 Forecasts

USD/CHF Outlook: Bearish, as the rate is below its recent average and has recently faced significant pressures.

CHF to ZAR 2026 Forecasts

CHF/ZAR Outlook: Bearish, as the rate is below its recent average and near recent lows, but may stabilize without strong catalysts.

CHF to TRY 2026 Forecasts

CHF/TRY Outlook: Slightly positive, but likely to move sideways, as the rate is above its recent average without a clear driver.

CHF to SGD 2026 Forecasts

CHF/SGD Outlook: Slightly positive, but likely to move sideways as the rate is above its 90-day average, but lacks a clear driver.

CHF to JPY 2026 Forecasts

CHF/JPY Outlook: Bullish, as the rate is above its recent average and near recent highs, supported by strong demand for CHF.

CHF to INR 2026 Forecasts

CHF/INR Outlook: Slightly positive, but likely to move sideways as the rate is above its recent average but lacks a clear supporting driver.

CHF to GBP 2026 Forecasts

CHF/GBP Outlook: Slightly positive, but likely to move sideways as the rate is just above its recent average and lacks a clear driver.

CHF to EUR 2026 Forecasts

CHF/EUR Outlook: Slightly positive, but likely to move sideways as the rate is above its recent average and trading range.

CHF to CNY 2026 Forecasts

CHF/CNY Outlook: Slightly positive, but likely to move sideways, as the rate is above its recent average without a clear driver to push it higher.

CHF to CAD 2026 Forecasts

CHF/CAD Outlook: Slightly positive, but likely to move sideways as the rate is above its 90-day average and near recent highs without a clear driver.

CHF to AUD 2026 Forecasts

CHF/AUD Outlook: Slightly weaker, but likely to move sideways, as the CHF is below its recent average and within its 3-month range.

CHF to AED 2026 Forecasts

CHF/AED Outlook: Slightly positive, but likely to move sideways, as the rate is above its recent average and near the mid-range.

CHF to USD 2026 Forecasts

CHF/USD Outlook: Slightly positive, but likely to move sideways as the rate is above its recent average, yet lacks a clear driver.

NZD to CHF 2026 Forecasts

NZD/CHF Outlook: Slightly positive, but likely to move sideways, as the rate is above its recent average but lacks a clear driver.

SGD to CHF 2026 Forecasts

SGD/CHF Outlook: The SGD/CHF outlook is slightly weaker, but likely to move sideways, as the rate is below its recent average and mid-range.