Explore our latest Foreign Currency Accounts tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (172)

By Topic:

About Us (12)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Locations (10)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (77) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (49) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (114) FJD (6) FKP (1) GBP (75) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (31) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (31) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (4) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (13) MYR (23) MZN (1) NAD (1) NGN (6) NOK (8) NPR (2) NZD (39) OIL (1) OMR (4) PEN (1) PGK (1) PHP (13) PKR (12) PLN (8) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (9) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (8) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (11) ZWL (1)

How to Choose the Best Money Transfer Provider

A comprehensive guide to choosing the best money transfer provider, covering key factors like fees, speed, exchange rates, and customer support, with comparisons of top providers.

Compare the Best Multi-Currency Accounts for Travel, Business & Transfers

We compare the features, exchange rates and security of the three best multi-currency accounts available today — the Wise Account, the WorldFirst World Account, and the OFX Global Currency Account.

How to Receive Freelance Payments from Abroad and Save on Exchange Rates

Freelancers working with overseas clients can lose hundreds to bank fees and bad FX rates. Here’s how to receive international payments safely, cheaply and quickly.

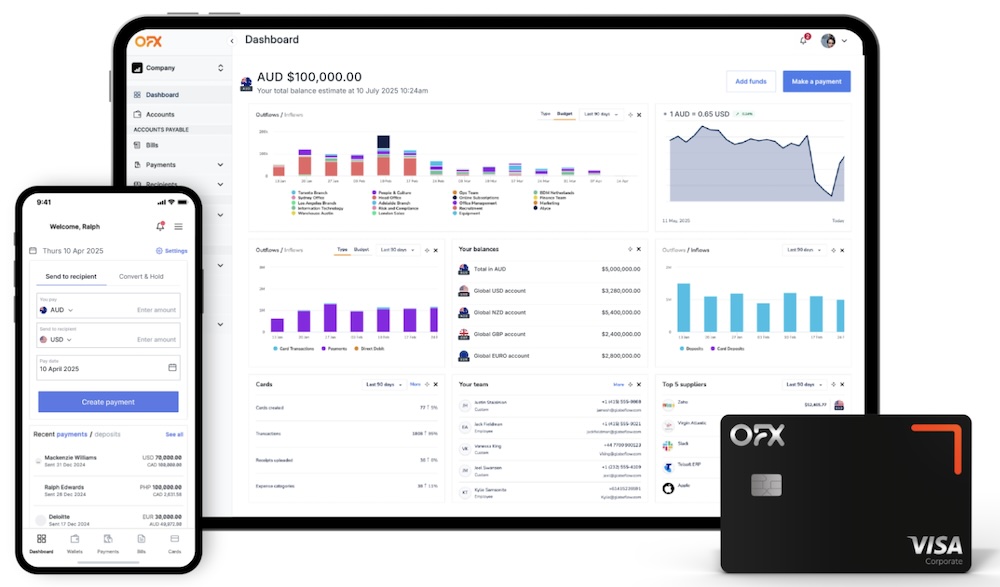

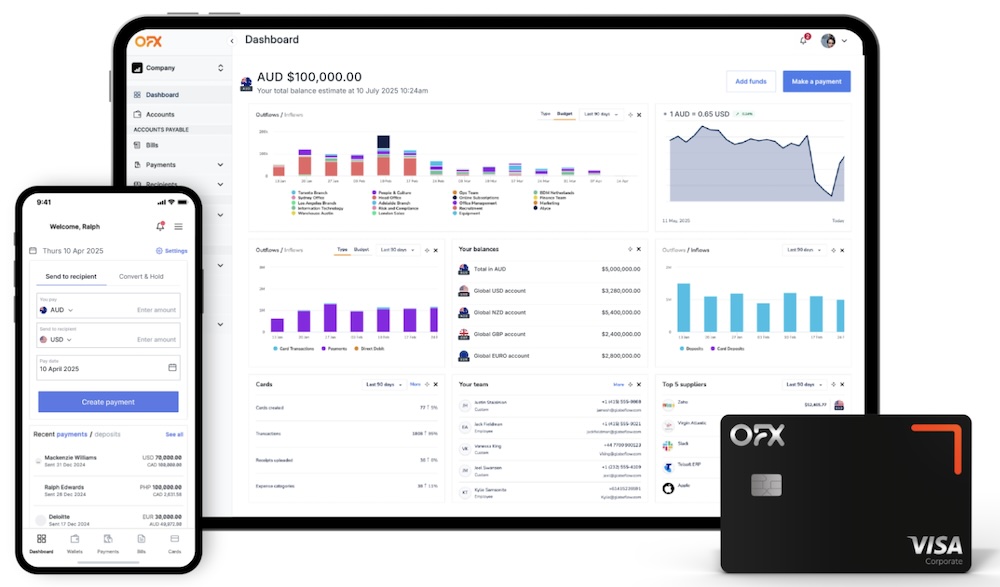

OFX 2.0 for Business: Global Accounts, Cards & Spend Control 2025-09-11

OFX has switched on “OFX 2.0” for businesses—adding global currency accounts, corporate cards and spend control, AP/batch tools, and accounting sync. Here’s how it reshapes FX from simple transfers to full finance ops.

OFX vs Wise: Which Money Transfer Service Is Best For You in 2026

Looking to transfer money internationally? We compare OFX and Wise side by side, covering costs, exchange rates, speed, and features to help you choose the best service for your needs in 2026.

Why Online Sellers Should Use an FX Specialist

If you’re selling online internationally, using an FX specialist can save you thousands. Better exchange rates, lower fees, and protection against currency swings can make a huge difference to your bottom line. Find out why smart online sellers are choosing FX specialists to manage their global payments — and how it could help you scale faster.

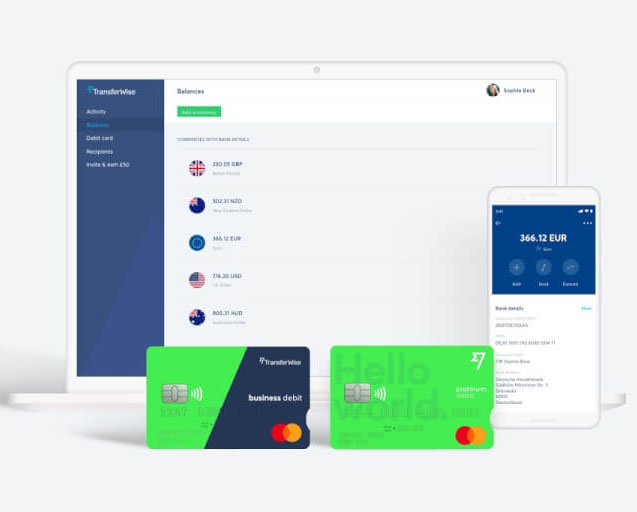

Wise Review: Is It the Best Way to Transfer Money Internationally?

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

WorldFirst World Account

WorldFirst World Account is a multi-currency business account that allows you to hold, send, and receive funds in over 40 currencies, making it ideal for global businesses and online market-place sellers.

Wise Account

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

OFX Global Currency Account

The OFX Global Currency Account is perfect for sellers who need foreign bank accounts in GBP, EUR, USD, AUD, CAD and HKD.

Foreign Currency Accounts - Best Expat Bank Accounts

In this guide we take a look at Foreign Currency Accounts, both the good and bad aspects and what to watch out for.