Explore our latest Ofx tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (172)

By Topic:

About Us (12)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Locations (10)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (77) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (49) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (114) FJD (6) FKP (1) GBP (75) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (31) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (31) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (4) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (13) MYR (23) MZN (1) NAD (1) NGN (6) NOK (8) NPR (2) NZD (39) OIL (1) OMR (4) PEN (1) PGK (1) PHP (13) PKR (12) PLN (8) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (9) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (8) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (11) ZWL (1)

How to Choose the Best Money Transfer Provider

A comprehensive guide to choosing the best money transfer provider, covering key factors like fees, speed, exchange rates, and customer support, with comparisons of top providers.

Compare the Best Multi-Currency Accounts for Travel, Business & Transfers

We compare the features, exchange rates and security of the three best multi-currency accounts available today — the Wise Account, the WorldFirst World Account, and the OFX Global Currency Account.

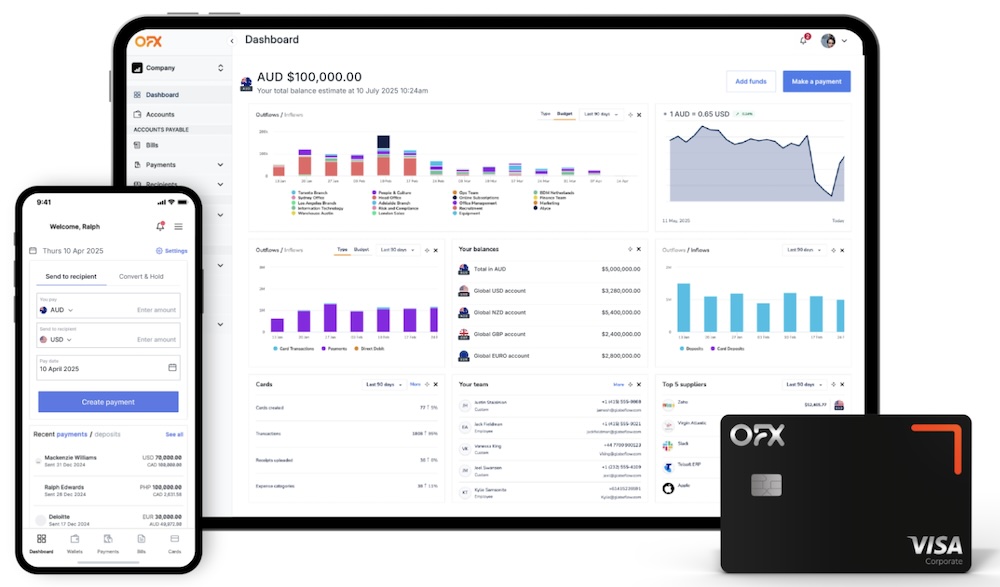

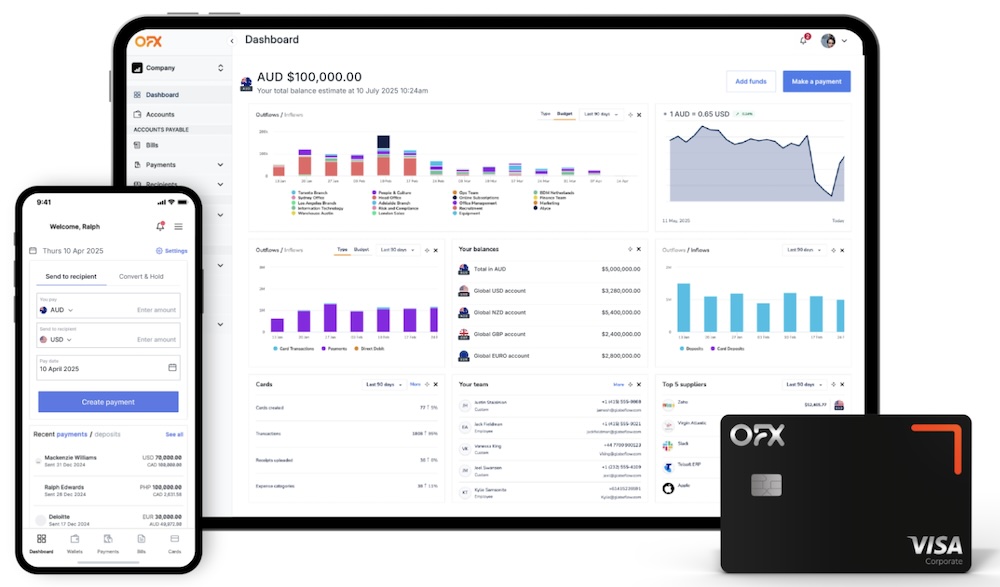

OFX 2.0 for Business: Global Accounts, Cards & Spend Control 2025-09-11

OFX has switched on “OFX 2.0” for businesses—adding global currency accounts, corporate cards and spend control, AP/batch tools, and accounting sync. Here’s how it reshapes FX from simple transfers to full finance ops.

OFX vs Wise: Which Money Transfer Service Is Best For You in 2026

Looking to transfer money internationally? We compare OFX and Wise side by side, covering costs, exchange rates, speed, and features to help you choose the best service for your needs in 2026.

Why Online Sellers Should Use an FX Specialist

If you’re selling online internationally, using an FX specialist can save you thousands. Better exchange rates, lower fees, and protection against currency swings can make a huge difference to your bottom line. Find out why smart online sellers are choosing FX specialists to manage their global payments — and how it could help you scale faster.

OFX Money Transfer Review: Fees, Rates & Features Explained (2025)

OFX is a reputable international money transfer service that caters to both individuals and businesses, offering a range of features designed to facilitate global transactions.

OFX ATO Tax Payments - Save on Australian Tax Transfers

OFX have made paying Australian Tax to the ATO from overseas easy while saving money on bank exchange rates and fees.

How can I prepare for life as an Expat?

Moving abroad? Here’s how to prepare emotionally, culturally, financially, and logistically for life as an expat. From building new friendships to managing finances, this guide covers everything you need to know.

Banks Charge Small Customers 25 Times More for FX, Research Shows

New research from the European Central Bank shows that banks charge smaller customers up to 25 times more for FX forward transactions and that those who fail to compare providers pay 14 times more for FX than those that do.

OFX Global Currency Account

The OFX Global Currency Account is perfect for sellers who need foreign bank accounts in GBP, EUR, USD, AUD, CAD and HKD.

Fintechs vs. Banks: Remittance War Rages On as FX Costs Slashed for Millions 2019-05-19

For many currency routes, FX costs have been slashed in recent years by a number of industry-disrupting fintechs, allowing such firms to slice great chunks from the banking sector’s lucrative remittance markets. Banks are fighting back, though, by developing low-cost, digital offerings of their own.

Remittances Reach All-Time High 2019-04-20

Remittances to low and middle-income countries reached a record high last year, the World Bank has said. Average transaction costs remain high, with an average of 7 percent paid to transfer $200 or equivalent.