Explore our latest INR tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (170)

By Topic:

About Us (11)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (30) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (75) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (7) BSD (1) BTC (6) BTN (1) BWP (1) BZD (1) CAD (52) CDF (1) CHF (33) CLP (4) CNY (23) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (16) DOP (1) DZD (1) EGP (2) ETB (1) EUR (125) FJD (6) FKP (1) GBP (81) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (24) HNL (1) HTG (1) HUF (8) IDR (8) ILS (6) INR (43) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (42) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (8) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (14) MYR (23) MZN (1) NAD (1) NGN (6) NOK (15) NPR (2) NZD (39) OMR (5) PEN (1) PGK (1) PHP (18) PKR (17) PLN (9) PYG (1) QAR (16) RON (2) RSD (1) RUB (11) RWF (1) SAR (10) SBD (4) SCR (1) SDG (1) SEK (15) SGD (40) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (17) TJS (1) TMT (1) TND (1) TOP (1) TRY (14) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (14) ZWL (1)

Global Central Banks Shift Policy: Key FX Impacts for August 2025 2025-08-28

Central banks are moving in different directions—Australia cuts, UK eases despite inflation, and the Fed faces political risks. Here’s what it means for exchange rates and transfer timing.

Trump Imposes Broad Tariff Hikes as Global Trade Tensions Escalate 2025-08-02

President Trump has raised U.S. tariffs to an average of 15.2%, targeting Canada, Asia, and Europe, as part of his push to reshape global trade. Markets and currencies reacted with caution amid rising uncertainty.

Dollar Surges, Rupee Stumbles: What's Driving FX Markets Now 2025-07-30

Global FX markets shifted in July as the USD gained on trade deals, the British pound climbed, and the Indian rupee weakened on tariff fears. Here’s what’s driving currencies now.

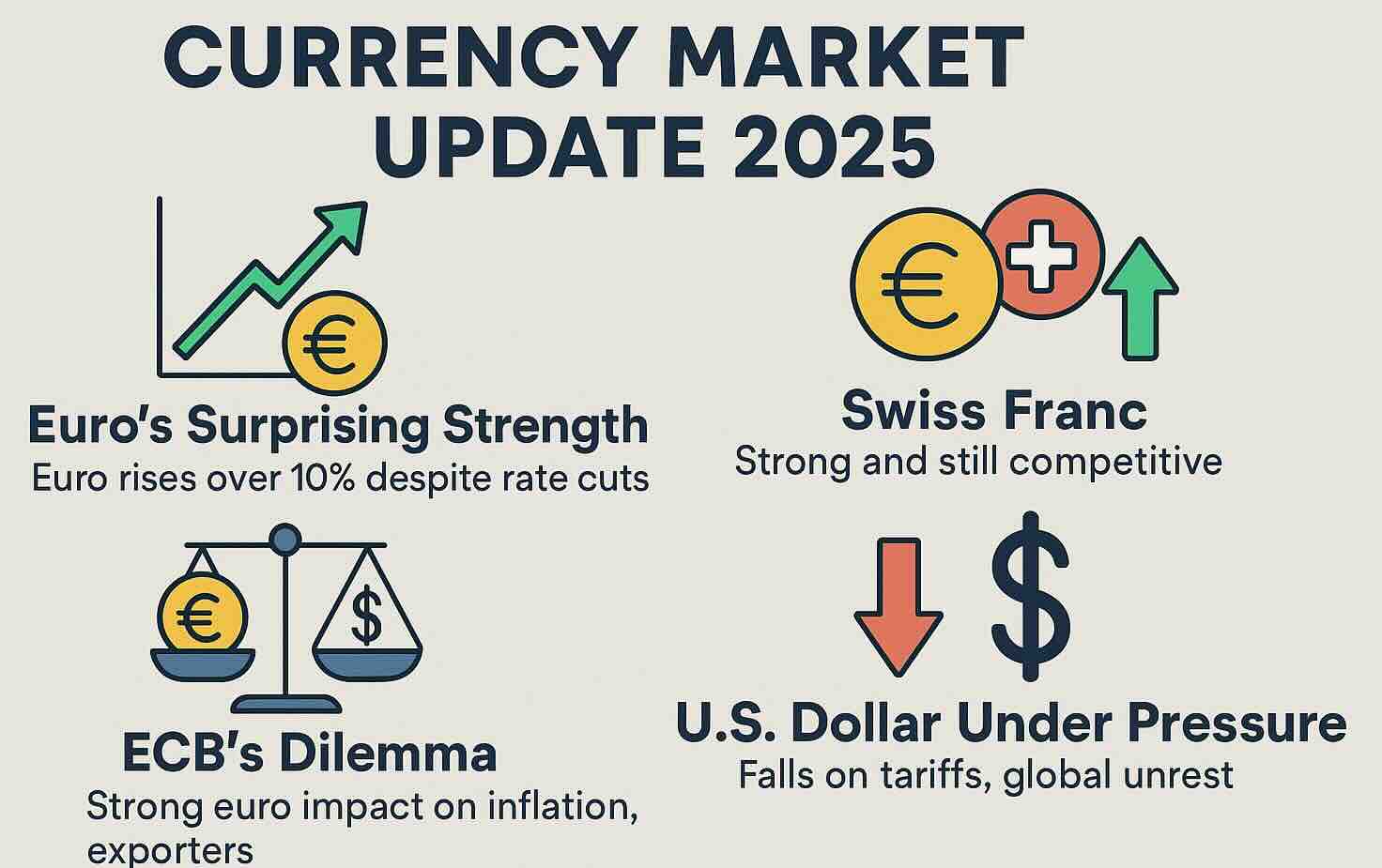

Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong 2025-06-03

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

Global Currency Markets React to U.S. Tariffs and Economic Policies 2025-03-27

Recent U.S. trade policies, including aggressive tariffs on auto imports, have introduced significant volatility in global currency markets, affecting major currencies such as the euro, British pound, and Japanese yen.

War and Inflation Powers US Dollar Strength 2022-05-10

During periods of rising inflation a stronger currency benefits a country's economics as this makes imports cheaper.

New Zealand Opening After Two Years - Aussies Welcomed First 2022-03-16

'Fortress New Zealand' opening after two long pandemic years - Aussies welcomed back first on April 12th and other nationalities on 1st of May.

India Country Guide (IN)

India is a vibrant, colourful, and fascinating country to explore but can be a little intimidating for first time visitors. There are many magical places to visit so try to make a point of staying at least two nights in any one place.

You ...

ZAR to INR Exchange Rate Forecast & Outlook

ZAR to INR Outlook In the near term, ZAR/INR is trading close to its 3-month high, supported by a widening rate differential.

USD to INR Exchange Rate Forecast & Outlook

USD to INR Outlook In the near term, USD/INR is trading close to recent highs but trading above the 90-day average.

TRY to INR Exchange Rate Forecast & Outlook

TRY to INR Outlook In the near term, TRY/INR is trading close to its 3-month average, holding near the middle of its recent range.

SGD to INR Exchange Rate Forecast & Outlook

SGD to INR Outlook In the near term, SGD/INR is trading close to its recent highs and above its 90-day average, with the pair consolidating within its recent range.

SEK to INR Exchange Rate Forecast & Outlook

SEK to INR Outlook In the near term, SEK/INR is trading close to its 90-day average, holding near the recent high at 10.01. The dominant driver remains...

SAR to INR Exchange Rate Forecast & Outlook

SAR to INR Outlook In the near term, SAR/INR is trading close to recent highs with the rate above its 90-day average, supported by the rate differential.

QAR to INR Exchange Rate Forecast & Outlook

QAR to INR Outlook In the near term, QAR/INR is trading close to the recent highs, supported by the rate differential that keeps the pair above its 90-day average.

PLN to INR Exchange Rate Forecast & Outlook

PLN to INR Outlook In the near term, PLN/INR is trading close to its 3-month average, holding near support around 25.01. The dominant driver from the...

PKR to INR Exchange Rate Forecast & Outlook

PKR to INR Outlook In the near term, PKR/INR is trading close to recent highs, holding near 0.3290, which is above the 90-day average and at the upper...

PHP to INR Exchange Rate Forecast & Outlook

PHP to INR Outlook In the near term, PHP/INR is trading close to the 90-day average and near recent highs.

NZD to INR Exchange Rate Forecast & Outlook

NZD to INR Outlook In the near term, NZD/INR is trading close to recent highs, supported by risk-off conditions and a risk sentiment focus.

NOK to INR Exchange Rate Forecast & Outlook

NOK to INR Outlook In the near term, NOK/INR is trading close to its recent highs, supported by risk-off sentiment and Indian Rupee weakness.

MYR to INR Exchange Rate Forecast & Outlook

MYR to INR Outlook In the near term, MYR/INR is trading close to recent highs with the rate above its 90-day average.

KRW to INR Exchange Rate Forecast & Outlook

KRW to INR Outlook In the near term, KRW/INR is trading close to its 90-day average within a narrow range.

JPY to INR Exchange Rate Forecast & Outlook

JPY to INR Outlook In the near term, JPY/INR is trading close to its 90-day average and near recent highs.

INR to USD Exchange Rate Forecast & Outlook

INR to USD Outlook In the near term, INR/USD is trading close to its 90-day average and near recent lows.

INR to THB Exchange Rate Forecast & Outlook

INR to THB Outlook In the near term, INR/THB is trading close to its 3-month average and within a stable range.

INR to SGD Exchange Rate Forecast & Outlook

INR to SGD Outlook In the near term, INR/SGD is trading close to the 90-day average and near the recent lows.

INR to JPY Exchange Rate Forecast & Outlook

INR to JPY Outlook In the near term, INR/JPY is trading close to its 3-month average and within its recent range.

INR to HKD Exchange Rate Forecast & Outlook

INR to HKD Outlook In the near term, INR/HKD is holding near the 90-day average and trading close to the midpoint of its recent range.

INR to GBP Exchange Rate Forecast & Outlook

INR to GBP Outlook In the near term, INR/GBP is trading close to recent lows near 0.008109, trading below its 90-day average.

INR to EUR Exchange Rate Forecast & Outlook

INR to EUR Outlook In the near term, INR/EUR is consolidating within its recent range, supported by the policy outlook focus from the ECB and Fed.

INR to CNY Exchange Rate Forecast & Outlook

INR to CNY Outlook In the near term, INR/CNY is trading close to its recent lows within a 5% range.

INR to CAD Exchange Rate Forecast & Outlook

INR to CAD Outlook In the near term, INR/CAD is trading close to recent lows within its 3-month range, supported by the rate differential's influence.

INR to AUD Exchange Rate Forecast & Outlook

INR to AUD Outlook In the near term, INR/AUD is trading close to its recent lows and holding near the 90-day average, with risk sentiment remaining cautious.

INR to AED Exchange Rate Forecast & Outlook

INR to AED Outlook In the near term, INR/AED is trading close to its 90-day average and within the recent 3-month range.

HUF to INR Exchange Rate Forecast & Outlook

HUF to INR Outlook In the near term, HUF/INR is trading close to its recent lows within the 3-month range, pressured by the US interest rate differential.

HKD to INR Exchange Rate Forecast & Outlook

HKD to INR Outlook In the near term, HKD/INR is trading close to its recent highs within a very stable range and remains influenced by the rate differential.

GBP to INR Exchange Rate Forecast & Outlook

GBP to INR Outlook In the near term, GBP/INR is trading close to its 14-day high but remains near the 3-month average.

EUR to INR Exchange Rate Forecast & Outlook

EUR to INR Outlook In the near term, EUR/INR is trading close to the upper end of its recent range, supported by a risk-off environment and geopolitical tensions.

DKK to INR Exchange Rate Forecast & Outlook

DKK to INR Outlook In the near term, DKK/INR is trading close to recent highs, holding near its 90-day average.

CHF to INR Exchange Rate Forecast & Outlook

CHF to INR Outlook In the near term, CHF/INR is trading close to recent highs, holding near 118.4 and above its 90-day average.

CAD to INR Exchange Rate Forecast & Outlook

CAD to INR Outlook In the near term, CAD/INR is trading close to recent highs near 67.72, supported by risk-off sentiment and safe-haven flows.

AUD to INR Exchange Rate Forecast & Outlook

AUD to INR Outlook In the near term, AUD/INR is trading close to recent highs, supported by the rate differential but facing downside risk from global risk-off sentiment.

AED to INR Exchange Rate Forecast & Outlook

AED to INR Outlook In the near term, AED/INR is trading close to recent highs but remains supported by the stable policy environment in UAE.